Unlocking Long Term Opportunities: A Vision for Sustainable Growth

Updated Feb 14, 2024

Navigating the labyrinth of investing, particularly in the stock market, necessitates a deep understanding of mass psychology, a contrarian perspective, and the strategic acumen of a chess grandmaster. As an entity with a wealth of 200 years of experience in stock investing, I’ve learned that market crashes and euphoria are two sides of the same coin: both present unique opportunities for the astute investor.

Market crashes, often viewed with trepidation, are, in fact, golden opportunities for buying. When fear grips the market, stock prices plummet, creating a disparity between the intrinsic value of a company and its market price. This disparity is a gateway to long-term opportunities. It’s akin to a clearance sale in the stock market, where solid companies are available at discounted prices. Unswayed by the mass hysteria, a contrarian investor sees these crashes as an opportunity to invest in robust businesses with the potential for sustainable growth.

Conversely, periods of market euphoria often signal a time to take profits. When optimism is at its peak, stock prices tend to become inflated, surpassing the intrinsic value of the companies. This scenario resembles a chess game where a strategic retreat can be as vital as an aggressive advance. Recognising this inflated value as temporary, the seasoned investor may opt to sell, capitalizing on the high prices before the inevitable correction.

However, unlocking these long-term opportunities requires more than just understanding market sentiment. It necessitates a vision for sustainable growth that focuses on companies with sound business models, strong leadership, and a proven track record. Investing is not a game of chance; it’s a game of skill, patience, and strategy. Like chess, each move in investing should be calculated, deliberate, and aimed towards achieving a long-term objective.

Investing is not about outsmarting the market; it’s about understanding its rhythm, recognising the opportunities it presents, and making strategic moves that align with a vision for sustainable growth. It’s about playing the long game, where the rewards of patience and strategy far outweigh the fleeting thrill of short-term gains.

Strategic Synergy: Unveiling Long-Term Opportunities in Chess and Investing

Chess and investing share a profound connection, requiring strategic foresight, patience, and an understanding of complex systems. In chess, as in investing, each move is a calculated decision made with an eye towards future implications.

Chess strategy is a purposeful attempt to gain an advantage over your opponent, involving long-term goals related to king safety, pawn structure, space, and piece activity. Similarly, investing involves long-term strategies to gain an advantage in the market. It’s about understanding the intrinsic value of assets, recognizing market trends, and making informed decisions based on these factors.

One of the most challenging things in chess and investing is knowing exactly when to act and stay put, and follow the strategy. In chess, there are only several moments in a game where a position is critical, and one has to decide whether to change the pawn structure, make a dynamic trade or sacrifice for an attack. Similarly, in investing, knowing when to buy, sell, or hold requires a deep understanding of market dynamics and the ability to make critical decisions under pressure.

In both chess and investing, the value of a piece or an asset is not absolute but relative. It’s based on its potential moves, its current position, and its perceived value to another player or investor. The best players and investors occasionally make bold moves, but their strategies are always rooted in a robust decision-making framework.

Just as chess players manage their resources and adapt their plans based on the changing dynamics of the game, successful investors manage their portfolios to tap into the best opportunities in the market under all conditions. They don’t just react to market and economic events but proactively arrange their portfolios to weather market volatility and capitalize on emerging opportunities.

Chess and investing are about playing the long game, where strategic planning, patience, and adaptability are crucial to success. They both require the ability to think several moves ahead, anticipate changes and make decisions that align with long-term objectives.

Now, let’s continue the discussions against a historical backdrop.

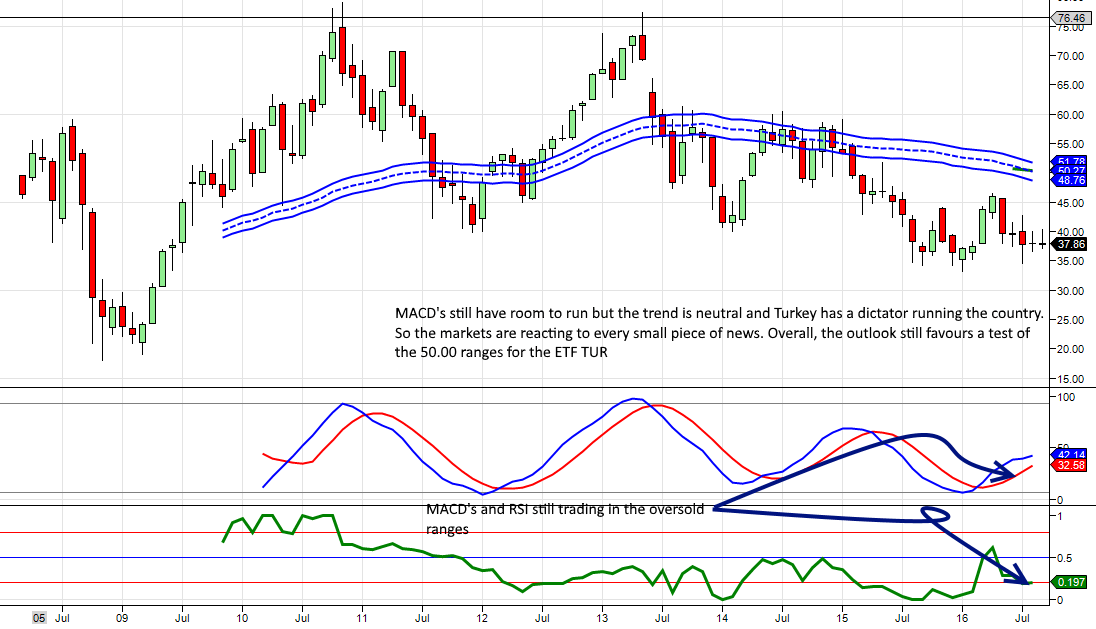

We will examine markets that are already in a bullish phase (Dow, SPX, etc.) and markets that are close to putting a bottom and turning around. Our analysis will be based on the slow-moving monthly chart (each bar on the graph represents a month’s worth of data), and as a result of, we will not update the charts on a weekly basis unless the outlook changes significantly. The most significant gains come from entering a market at the onset of a new trend change. As we progress, we will put fewer notes below each chart; look at older updates if you need clarification. The principle is relatively simple. Reading one or two of the older updates listed below should suffice.

Individuals willing to take on a small amount of risk can put the following strategy into play. When both the Custom MACDs and Custom RSI are trading in the extremely oversold ranges, you could open up positions in the strongest stocks in the overall Market or in stores from the Top 10 sectors. 75% of the time, the stocks in the corresponding industry tend to experience decent moves when both MACDs and RSI are trading in the oversold ranges.

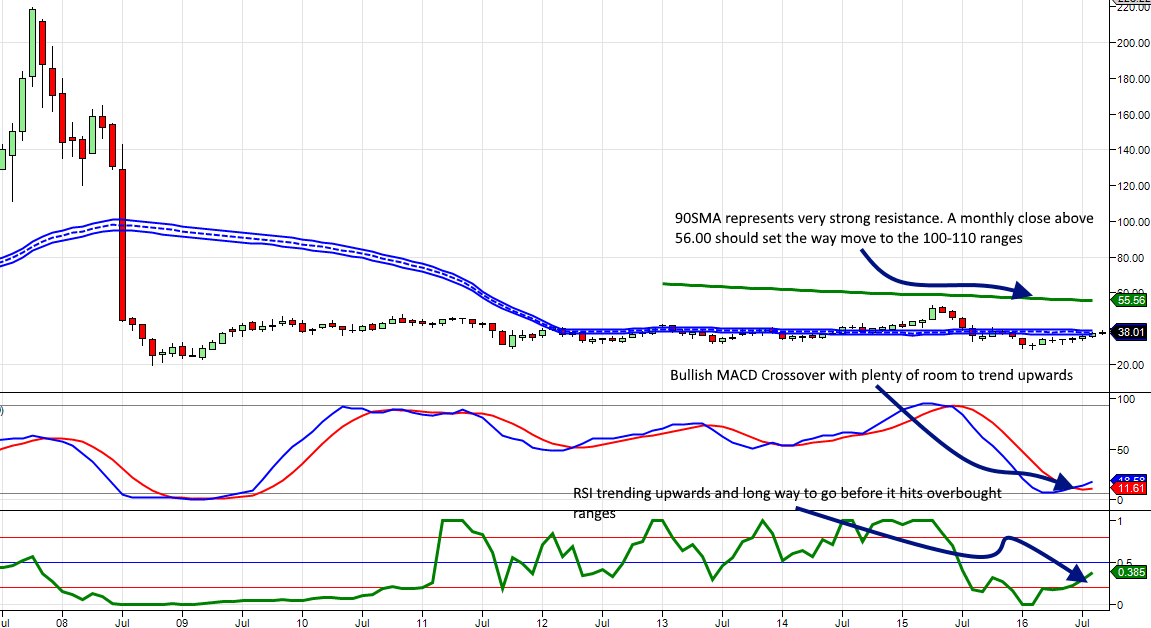

Navigating Market Trends: Unveiling Long-Term Opportunities for China

Looking at the chart below, you will understand why there is no need to panic if there is no update every two weeks. These are slow-moving monthly charts; when a trend changes, it is infrequent to reverse course immediately. If there is a trend change, we will notify everyone immediately. Traders willing to act on their own should use strong pullbacks

to build positions in stocks such as BABA, BIDU, QIHU, NTES, TCEHY, CHL, etc

Our long-term outlook on China remains bullish, and because of the MACD crossover, we increased the number of plays in which we would like to establish a position.

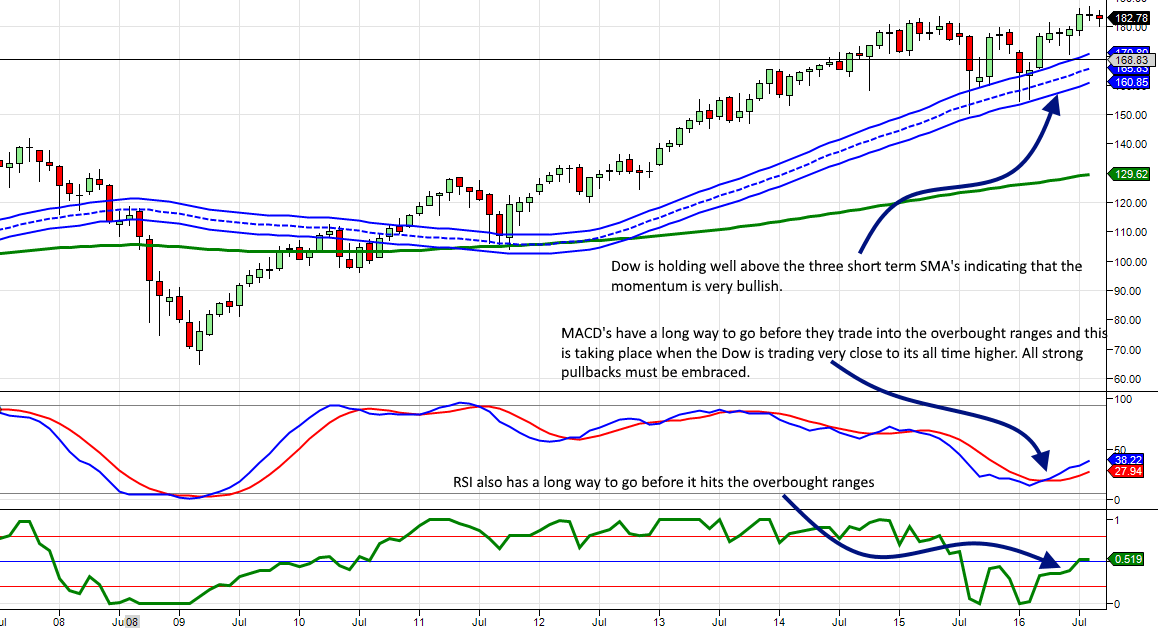

Exploring Long-Term Opportunities in Dow

The Dow has rallied sharply, yet our indicators are still trading in the oversold ranges on the monthly charts. In simple language, all sharp corrections should be viewed as manna from heaven.

Suppose some miracle tests the 90SMA; back the truck up and load it to the max. This does not occur too often, especially when the trend is up. Bullish sentiment remains below the 38% range and has not come close to testing the 50% range. No market breaks down till the masses are on board.

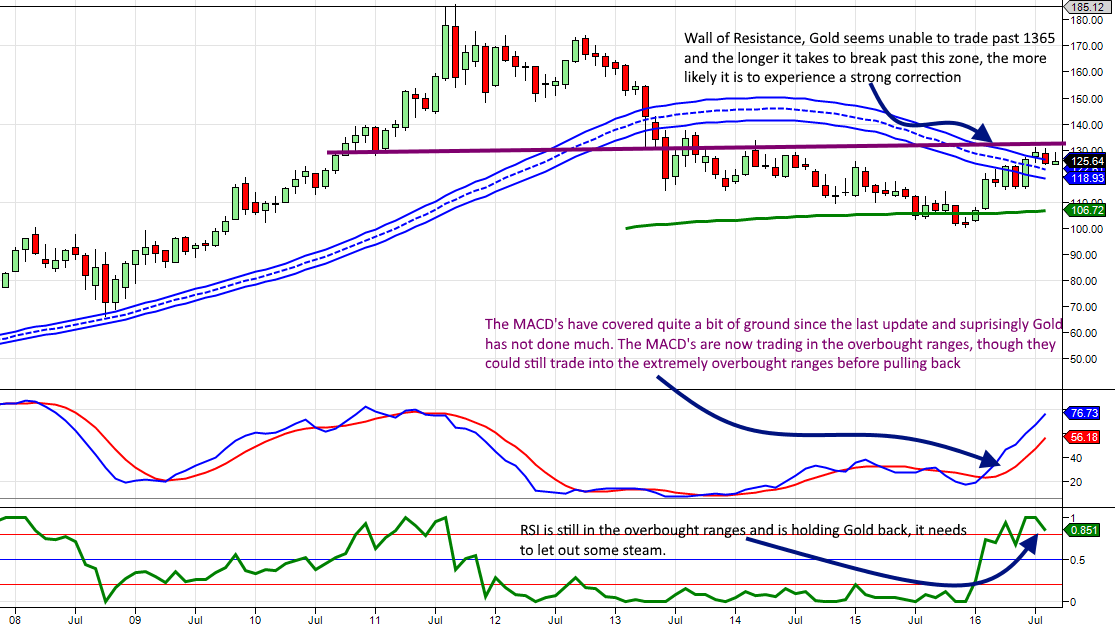

Gold Rush: Exploring Long-Term Opportunities in the Precious Metal Market

While one can state that the move in gold bullion is typical, one cannot say the same for gold and silver stocks. They experienced powerful upward moves. Something seems to be a bit off here because they have experienced such strong moves, but Gold Bullion has not even made it past $1400. The current prices are more reflective of Gold trading north of 1650. July 15, 2016

More and more, it appears that Gold rallied on fears stemming from Brexit. Gold stocks, in general, have not been doing much and many are showing early signs of topping out.

Gold did something somewhat unexpected. It rallied in the face of a rising dollar. This could be construed as a long-term signal that Gold is decoupling from the dollar and trading upwards on its own merits. The biggest surprise has come from Gold stocks; they have mounted ferocious rallies, but for some reason, Gold bullion is not trading at levels that would justify such prices. July 15, 2016

Gold stopped trading in tandem with the dollar, and even on days when it shows signs of weakness, the reaction from the gold market is muted. This is why we used the word “so what” when we stated that you should not worry that you missed the first leg of this bull market, as there are many other markets out there. China and Russia for example, look much more attractive than Gold. Oil also, for the time being, looks far more appealing than Gold.

If Gold does not break past 1365 soon and stay above this level every week, then it’s almost guaranteed that the downward move will be pretty intense when it pulls back again. It could end up trading to or below $1000.00. Another surprising development is that the trend shows no signs of turning bullish or strengthing since the last update.

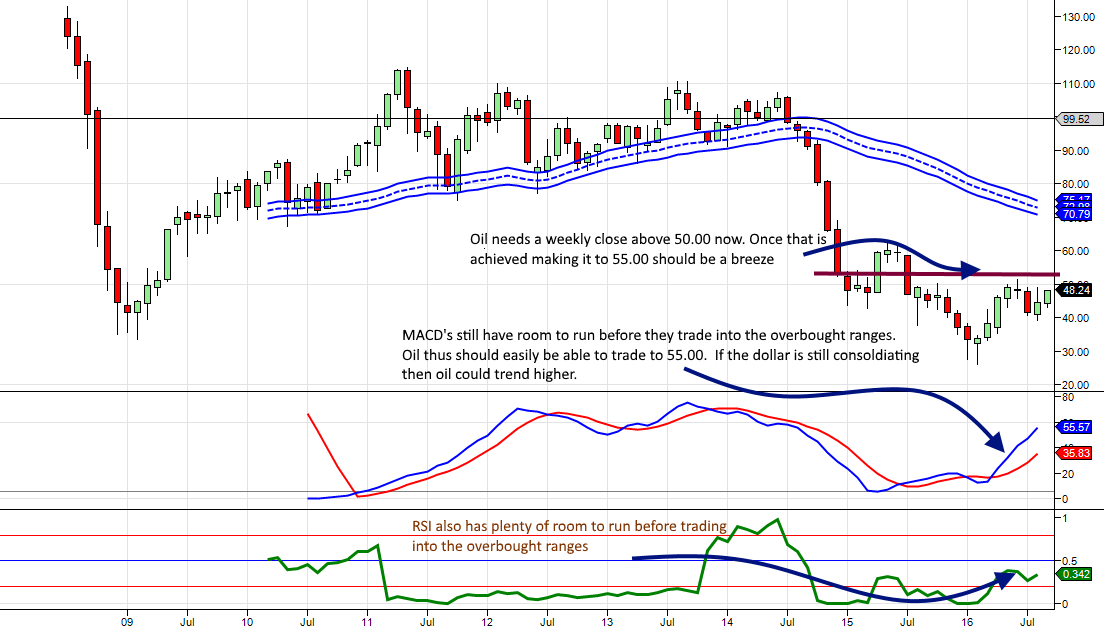

Unlocking Profit Potential: Mastering the Art of Oil Trading

Oil continues to follow the projected path with perfection and no interruption; contrast the action in oil to that of Gold. The trend quickly moved from neutral to positive, which is interesting. However, the score is not very high; normally, the trend swings into the extreme bullish zone. We have a mildly bullish trend. This suggests that we should wait for the indicators in the weekly chart to move into the oversold ranges again, or oil has to let some steam and shed at least $10.00. Update May 17th, 2016

The trend has strengthened, and we might get the $10.00 pullback we sought. On that note, the stock PZE and a few others are showing signs of strength during this pullback, so we will reevaluate our decision to close the position. Update July 15, 2016

Oil let out steam and shed over 10 dollars before a bottom took hold. Oil continues to trade toward the projected path we laid out months ago.

Oil is still expected to trade in the 55.00 range, and depending on what the dollar is doing, it could trade at 65.00. However, our focus will now be on the 55.00-58.00 range. At that point, we will most likely close any long positions we have in oil stocks.

Additional opportunities

Turkey’s trend is still neutral but has shown no signs of strengthening for the last few weeks. Conversely, it also has shown no signs of weakening.

Those who followed our suggestions are still in the black, as the average entry price for TUR should have been 38.00 or better. TKC has still not put in a bottom if you got in at 9.00 or better; a suggested stop would be in the 6.80-7.00 range. TKC is a riskier option in comparison to the ETF TUR.

Tasty Treats

How To Get Financial Freedom: Escape the Herd for Lasting Success

Legalized Food Poisoning: America’s Toxic Diet by Design

“””Investing for dummies”””: Follow The Trend

Executive Compensation Driving Share Buybacks

Illusions of Economic Recovery: Negative Interest Rate Controversy

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Inside the Market Psychology Cycle: Unveiling Trends and Tactics

South China Sea Showdown: Intensifying Heat on the Horizon

Will the Stock Market Crash: Analyzing Possibilities and Implications

China Quantitative Easing: Battling Economic Slowdown

What is Data Manipulation: The Dark Side?

Corruption in China: Government’s Aggressive Crackdown on Wrongdoings

These Are The Things That Scare Americans The Most

Exotic Art: The Fusion of Art and AI Brilliance

Market Timing Strategies: Debunking Flawless Predictions

How to boost your immune system: Simple Ideas