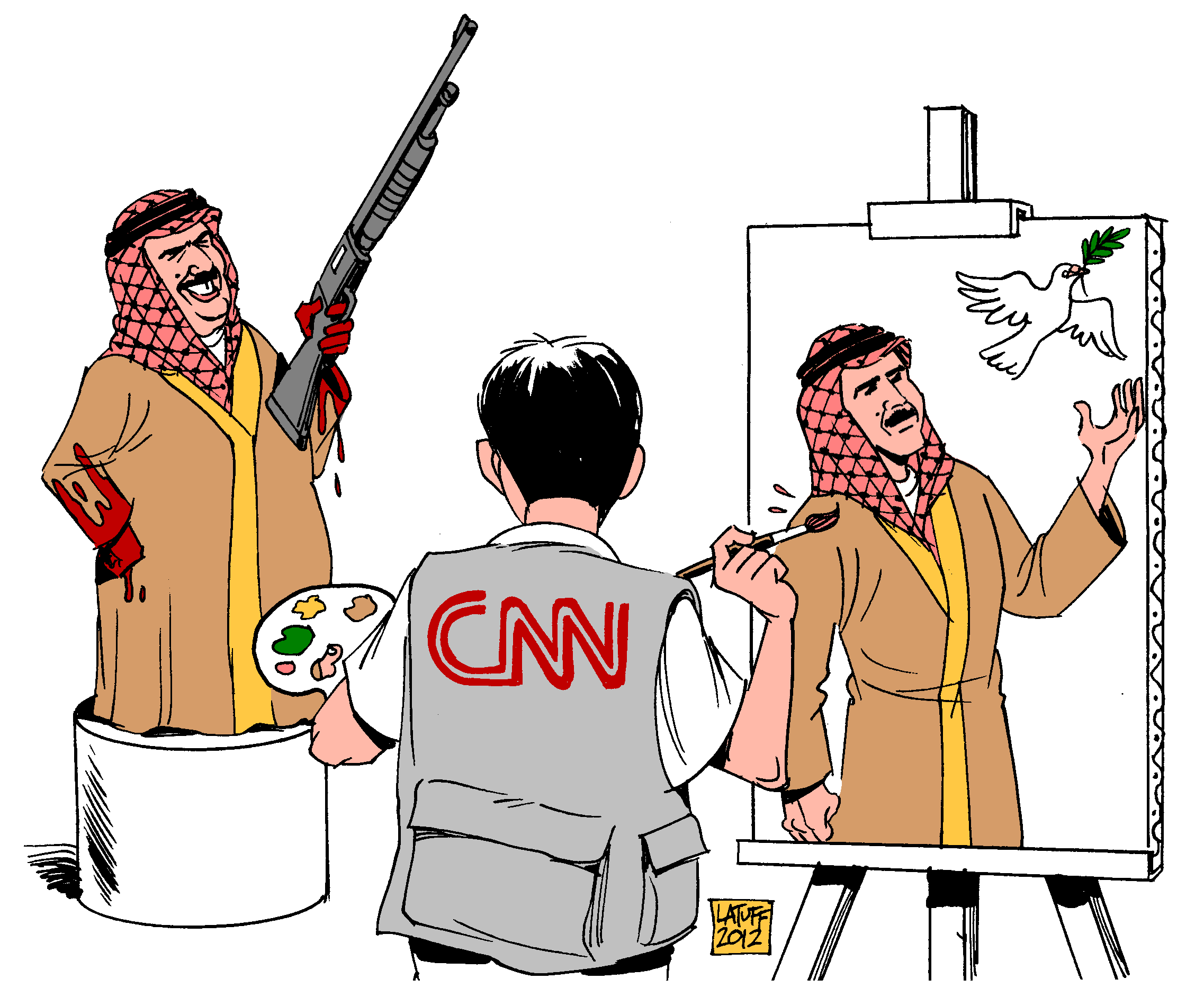

Mainstream Media Lies and In doing so alters Mass perceptions

The short answer comes down to noise. There is too much information out there already and 90% or more of it is garbage. We do not want to add to this noise factor. Don’t think the media is your friend; take any advice proffered with a shot whiskey and a barrel of salt. The media tends to make the most noise during times of turmoil, especially financial turmoil. Therefore it goes without saying that stock market crashes and any disaster type event should be viewed through an extremely contrarian (bullish) lens; the media like the masses are always on the wrong side of the markets. Historically no financial expert can prove that a stock market crash did not make for a splendid long term opportunity. Try as they might, they will fail in this endeavour.

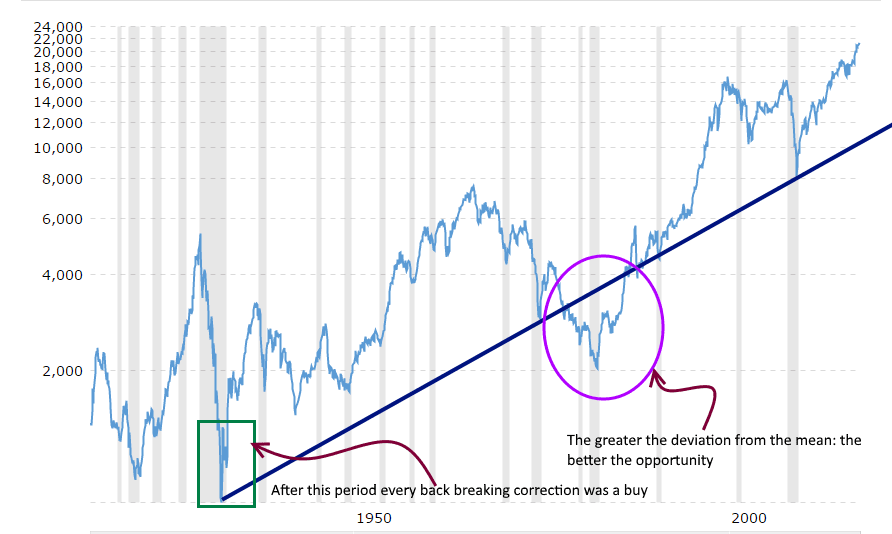

The above chart proves that stock market crashes equate to long term opportunity. We focus on the trend and Mass Psychology unless there is a significant change in these readings or a sudden black swan type event, we do not see any point in repeating our stance or reviewing external data that is meaningless and at most makes for good gossip. For example, this is why experts who have been focussing on the fundamentals cannot understand why this market continues to surge higher and have taken a beating.

Follow the Trend and ignore the Noise

Fundamentals were hardly useful in the past, as you are examining old data and the data is provided in a standard format, so everyone that has access to it generally arrives at the same conclusion. Now, with EPS and other data being manipulated, the little value that fundamentals once offered is entirely negated. We list some critical data because some subscribers still value this type of data.

This is also why hedge funds and many other firms that manage money are fairings so badly; in fact, they always performed badly, and the management was the only one that was getting rich, but that is a story for another day.

Doug Dillard followed the path that once almost guaranteed entrance into the 1 Percent: Good college (Georgetown), investment bank (Morgan Stanley), MBA (Harvard). Then a hedge fund. A decade out of business school, he was heading Standard Pacific Capital, a multibillion-dollar San Francisco firm that traded global stocks. It did well by its clients, making money in 2008 as markets plummeted.

Investment Returns not so great anymore

But Dillard’s returns—like most other hedge fund managers’—failed to keep pace in the post-Great Recession bull market. Investors exited. In February, when assets slid below $500 million, Dillard pulled the plug. “It has recently become clear to both of us that sometimes there is a logical conclusion to even a good thing,” he and his partner, Raj Venkatesan, wrote to clients. They aren’t the only ones thinking their good thing might be gone. On April 26, Third Point manager Dan Loeb, one of the hedge fund elite, wrote to investors that the industry is “in the first innings of a washout.” At the annual Berkshire Hathaway shareholder meeting at the end of April, Warren Buffett told investors to keep money away from hedge funds because of their high fees and lousy return Ful Story

Hedgefund days are numbered; like the media, they are all talk and no action

The day’s of hedge funds are numbered; the truth is that 90% of the managers know next to nothing. Money managers ( and other financial experts) are no different from the average Joe; they place too much value on useless information. The money management sector is going to go through a complete crash and burn cycle as the trend has changed; a significant portion of investors do not trust them anymore.

For the world’s top hedge fund managers, 2015 was a fantastic year, with an astounding amount of money made. Institutional Investor’s Alpha magazine released its annual review of how the top managers fared last year, and the tally for the group of 25 came in at nearly $13 billion, up 10 percent over 2014. In any year, that figure would likely grab headlines, but considering that it was the worst year for funds since 2011—with Atlantic Investment Management founder Alexander Roepers telling the Wall Street Journal “Everything went wrong”—those totals seem particularly enormous. Full Story

If faired so poorly in 2015, then 2016 is going to be even worse, and 2017 could be a killer (as in Kaput) for many of the large funds. Most money managers are too brash, know next to nothing and follow each other. That is why so many funds are bailing out of NFLX and AAPL now when they should have bailed out a long time ago; now it is time to buy. Thus just like the masses they sell when it is time to buy and buy when its time to sell.

More examples of what we term “Noise Events.”

The market is crashing or correcting in Aug 2016;

We did not react to this stuff on a daily or even weekly basis. We were ready for the correction (to us it was a correction, to others may be a crash) and so we greeted it with joy. Had we started to focus on the noise the media was broadcasting or the negative aspects of the pullback, we would have just added to the chaos. Instead, we chose not to be part of this nonsense, and the markets recouped as expected.

The market is crashing or correcting in Jan and Feb of 2016;

We sent out a few extra interim updates, just to let our subscribers know that there was nothing to panic about. However, we refused to be dragged into the panic that was gripping the markets and by avoiding that nonsense, we were able to focus on what was going on and not on some nonsensical story the bears were trying to sell the public.

Brexit: This event was so insignificant to us that we did not think it even warranted an interim update. Moreover, if you look back after the initial panic, the world moved on as it always does.

Bank of England is lowering rates; almost two weeks later after the event, we decided to explore it from a different angle.

Japan New QE program;

another non-event for us as we know the trend no matter what the expert’s state, interest rates will continue to trend lower.

We could list countless more events and in each, the outcome is the same; those that panicked lost, those that remained to calm gained and this is particularly the case if the trend is up. If the Dow were to shed 1500 points tomorrow, it would be a non-event for us as long as the trend remained bullish. If the trend changed and the Dow only dropped 100 points it would be a monumental development for us in comparison. It takes time to get used to this type of thinking at that is because the vast majority have unwittingly been brainwashed.

As long as Fiat money exists, any panic event should be viewed as a buying opportunity.

Think of us as information gatekeepers; we are trying to help filter the data you have to deal with as opposed to adding to the noise. There is just too much noise in this world today. In fact, there is so much noise that it is very hard to get a bearing on what is going on if you allow all that noise in. You need to look at everything with a disinterested gaze to spot the main pattern. If you are drawn in by an event, you are no longer thinking logically; your emotions are doing the thinking for you.

Other Suggestions

Subscribe to our free newsletter to keep abreast of the latest developments; we cover everything from the financial markets to the World’s food supplies. Mass Psychology knows no limits, utilised correctly it can spot trends in any market, and we can show how to protect yourself and benefit from these new trends. The world is changing it’s a dog eat dog world, but you do not need to descend into the pits of filth; you have the choice to distance yourself from this sub-human behaviour and empower yourself both mentally and financially; the decision lies within your palms

Other Articles Of Interest:

Masses hoarding cash & ignoring the Stock Market (Aug 30)

Maestro Greenspan Thinks Rates will Rise Rapidly; dream on (Aug 30)

Crowd Psychology states Uranium Bear Market over (Aug 29)

Economic & psychological warfare Big Money’s favourite Weapon (Aug 24)

What’s making this stock Market bull So resilient? (Aug 22)

Violence Stupidity & religious intolerance will continue to soar (Aug 22)

Mass Media Turns Bullish: Stock Market Correction likely (Aug 19)

Crowd Control market Manipulation & Pensioners forced to Speculate (Aug 18)

China Following America’s lead: Exports Bad Debt Globally (Aug 13)