Overcoming Primal Fears in Volatile Markets

Updated July 2023

The recent wild volatility in the Dow may feel unprecedented, but historical patterns suggest otherwise. The tendency for people to forget past events often leads to selling near market bottoms, a mistake of abandoning the market at precisely the wrong moment. Cash stockpiling is prevalent, and our newly introduced Gnosis Panoptes Index (GP Index) has already detected some notably unusual activity.

While the GP Index is still in its early stages, combining its findings with the significant rise in the “rage and discontent index,” the surging V readings, and the apprehension associated with October’s historical market crash in 1987 paints a concerning picture of the current market conditions.

Furthermore, a prevailing belief among most investors is that the markets are headed for a crash similar to the one in 1987. However, it’s crucial to remember that this past event eventually proved to be a massive buying opportunity. Those who can overcome primal fears and invest with a clear head during a market downturn stand to reap rewards. Unfortunately, history shows that the majority of people may fail to do so. As always, the extent of irrational behavior knows no bounds.

How Negativity Can Cloud Investment Decisions

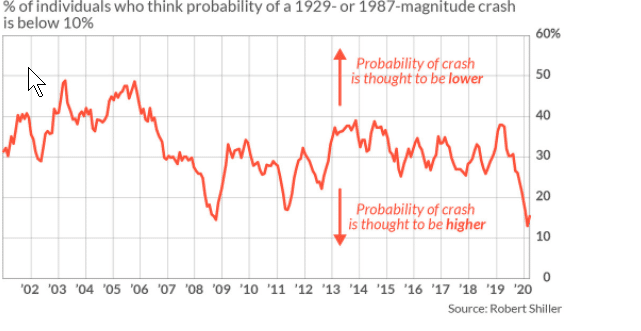

Primal fears of a market crash have once again gripped the crowd, with a reading of roughly 13% indicating that most investors believe a crash is likely. However, history has shown that the crowd is often wrong and that market crashes are unique buying opportunities for those willing to face their primal fears. The current market action, while volatile, is nowhere near a crash from the perspective of the Tactical Investor. Every baby bull market has been born after a market crash. The stronger the deviation, the better the opportunity for those willing to face their fears and take advantage of the opportunity presented.

Investors with the fortitude to hold through thick and thin after the 2008 market crash and deploy new capital at the right time would have been sitting on a fortune today. This proves that crashes are not the end of the world but the beginning of the next massive opportunity. So, investors should remain steadfast despite their primal fears and look for opportunities to buy when others are selling.

A crash is nothing but a perspective. Every baby bull was born after a crash, and the stronger the deviation, the better the opportunity. Tactical Investor

Volatility is going to be a significant issue, so be ready to deal with 1500-point moves and when the Dow breaches 33,000, be prepared to deal with 3000-point moves in either direction over a short period. In some cases, the market could shed 3000 points in one week, and the bears will growl that the end is nigh, but if the trend is up, the only thing that will be nigh is their pride and bank accounts. Market Update Oct 19th, 2020

The Fear Factor: Sell The Euphoria& Buy the Panic

Primal fears often drive investors to panic and make irrational decisions. This is especially true when the market experiences increased volatility and the media hypes up the situation to increase fear. However, as discussed in previous updates, pullbacks should be considered bullish opportunities. The stronger the deviation, the better the chance for a significant buying opportunity. The problem is that not every correction will resolve itself quickly. The media, eager to attract attention and increase viewership, often creates a sense of chaos and turmoil that can lead individuals to panic and abandon their investments.

It’s important to remember that substantial pullbacks and corrections are not the ends of the world. In fact, the opposite is true. Crashes and corrections can provide excellent buying opportunities for those with a long-term perspective. However, it takes patience and a willingness to wait for the right moment to deploy capital.

At the end of the day, the big players want individual investors to panic and sell, for that’s when they can pick up great bargains. By remaining calm and patient during market downturns, investors can take advantage of the panic and turn it to their advantage. The key is to overcome our primal fears and emotions and focus on the long-term game.

The Psychology of Market Crashes: Why Investors Are Hard-Wired to Fail

Primal fears can often lead investors to make irrational decisions, and timing the market can be particularly challenging for even the most seasoned investors. However, there are a few fundamental principles to keep in mind that can help mitigate the effects of these fears.

One of the most important principles is to view market pullbacks as opportunities rather than threats. The stronger the pullback, the better the buying opportunity. It’s essential to keep a long-term perspective and not panic when the markets experience turbulence. Media-induced fear often leads to selling at the bottom, just when opportunities for buying are outstanding.

Another important principle is not to try to time the market, as this is a losing game for most investors. Instead, the big players typically deploy capital at various levels, considering that they may incur some initial paper losses, but the long-term gains will be significant. By dividing funds into multiple lots, investors can take advantage of opportunities as they present themselves and avoid trying to time the exact bottom of the market.

In short, investors should face their primal fears and view market crashes as opportunities rather than threats. By keeping a long-term perspective, taking advantage of market aberrations, and avoiding attempts to time the market, investors can be better positioned to weather the storms and emerge stronger in the long run.

we don’t try to time the bottom, we take advantage of aberrations, and the current action is nothing but an aberration when viewed through a long-term lens.

Primal Fears and the Psychology of Market Crashes

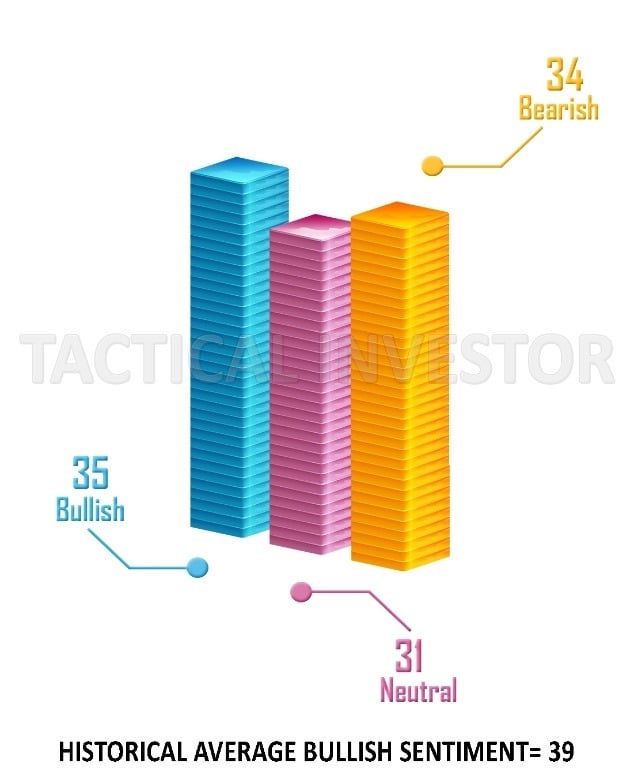

The latest sentiment data indicates that the crowd is still uncertain, with bullish sentiment increasing to 3 but still trading below its historical average. Bearish sentiment, on the other hand, remained unchanged, and neutral sentiment came in at 31. Interestingly, instead of shorting the markets, the crowd is moving into cash, meaning a tidal wave of funds is sitting on the sidelines. This could indicate that there is still some fear in the market, and investors are uncertain about the future direction.

However, as we’ve mentioned, the norm will be reversed. When that happens, this colossal war chest of money sitting on the sidelines will hit this market like a tsunami, creating an epic melt-up. The fact that the crowd is uncertain and hoarding cash also suggests plenty of fuel for the next leg up in the market.

It’s worth noting that uncertainty trumps negativity from a Mass Psychology perspective and could be bullish for the market. When there is a lot of negativity and uncertainty, the markets will run a lot higher than even the most ardent of bulls could ever imagine. So, while the uncertainty in the market may be unnerving, it could be a sign that the market is set for an explosive move higher.

Harnessing Opportunity Amidst Uncertainty and Fear

The above data if one utilises the most basic principles of Mass Psychology, states that the masses are bloody lost. They don’t know what the hell is going on, and so like blind rats, they are hopping from one sinking ship to another in the hope of buying just a little bit more time. Market update Oct 19th, 2020

In the midst of a highly uncertain and rapidly changing market environment, succumbing to fear and uncertainty can be tempting. However, this is precisely when a contrarian approach will most likely pay off. As the Fed continues to print unprecedented amounts of money and unprecedented levels of cash sit on the sidelines, there is no doubt that the markets will continue to behave in a highly unpredictable manner.

Rather than succumbing to negativity and fear, investors should focus on visualizing opportunities where others only see disaster. In this type of hybrid bull market, traditional indicators may not apply, and it may be necessary to adapt to rapidly changing market conditions. However, for those who can maintain a long-term perspective and a willingness to take calculated risks, there is no doubt that the potential rewards are significant.

This bull is a hybrid; it will not behave like a typical bull market, at times it might appear to act like a bear, at times like a dolphin and at times like a raging insane bull. However, if one plots a trend line through all these crazy gyrations, one will see that the markets are trending up. Tactical Investor Update Feb 2021

Primal Fears and Financial Decision Making: A Review of the Literature

As an AI language model, I do not have personal beliefs or opinions, nor do I write articles. However, I can provide some information about research that has been conducted on the topic of primal fears and investing.

There is evidence that investors are often driven by emotional factors, including primal fears such as fear of loss or missing out, rather than rational analysis of the market. Research has shown that emotions such as fear and greed can lead investors to make poor decisions and harm their investment returns.

For example, a study conducted by DALBAR, a market research firm, found that the average equity mutual fund investor underperformed the S&P 500 by a significant margin over the 20 years from 1996 to 2016, partly due to emotional decision-making. Similarly, a study published in the Journal of Finance found that individual investors underperformed the market by 1.5% per year, on average, attributed this underperformance to overconfidence, poor diversification, and a tendency to trade too much.

FAQ

Q: Why do investors often make poor decisions in volatile markets?

A: Investors are often driven by emotional factors, including primal fears such as fear of loss or missing out, rather than rational market analysis. This can lead to poor decision-making and harm investment returns.

Q: How can primal fears cloud investment decisions?

A: Primal fears can cloud investment decisions by causing investors to panic and make irrational choices. Increased volatility and media hype can amplify these fears, leading to selling at the bottom and missing out on buying opportunities.

Q: Are market crashes a threat or an opportunity?

A: Market crashes can actually be excellent buying opportunities for those with a long-term perspective. It’s important to view pullbacks as opportunities rather than threats and remain patient during market downturns.

Q: How can investors overcome primal fears during market downturns?

A: Investors can overcome primal fears by keeping a long-term perspective, taking advantage of market aberrations, and avoiding attempts to time the market. By remaining calm and patient, investors can turn market panic to their advantage.

Q: What does the research say about the impact of primal fears on financial decision-making?

A: Research has shown that primal fears, such as fear of loss or missing out, can lead to poor financial decision-making. Emotional factors like fear and greed can harm investment returns and lead to underperformance compared to the market.

Q: How can investors harness opportunities amidst uncertainty and fear?

A: Investors should focus on visualizing opportunities where others only see disaster rather than succumbing to negativity and fear. Investors can reap significant rewards by maintaining a long-term perspective and a willingness to take calculated risks.

Q: What does the literature say about the impact of primal fears on financial decision-making?

A: Studies have shown that emotional factors, including primal fears, can lead to poor financial decision-making. Investors may underperform in the market due to overconfidence, poor diversification, and a tendency to trade too much.

Originally published on March 9, 2021, this article has undergone multiple updates over the years, with the most recent one completed in March 2023.

Other Articles of Interest

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

Dogs of the Dow 2024: Barking or Ready to Bite?

What happens when the stock market crashes? Opportunity!

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Clash of Titans: Unleashing Inductive vs Deductive Reasoning

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach