Investors are panicking again; they withdrew a whopping $20.7 billion from hedge funds in the month June. This is one of the largest outflows from the Market since 2009, and it could also reflect a new trend where investors are sick of paying Jackasses, oops we mean experts to do nothing but sit on their fat asses, lose money and then have to pay these leeches a huge fee. The current data seems to support this assertion

Net flows to hedge funds for the 2nd quarter were almost negative $11 billion and for the first half of 2016, net flows were negative $30 billion. Clearly, a trend is in place; not only are experts losing money in the markets, but the crowd is also negative on this market as they simply don’t understand the main driving force behind this market. They do not see against such a terrible backdrop off events how this market continues to trend higher.

The following facts are true

The economy is firing on two cylinders instead of four

Low unemployment figures mask the dark truth that there is a huge swath of the population that has given up on looking for a new job and so are no longer counted as part of the unemployed even though they are. Unofficially the unemployment rate is probably north of 18%.

The economic recovery is illusory in nature, and only hot money is supporting the markets; take away the money supply and the stock market bull will drop dead tomorrow. Corporate officers understand this so rather than looking for ways to create new business, they are looking for creative ways to create the illusion that earnings are improving. The trick, which is covered in the following article why this bull market will not hit a brick wall anytime soon is to borrow money on the cheap and use it to buy back shares thereby magically boost the EPS.

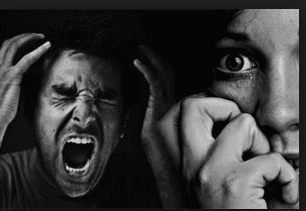

This bull should have dropped dead long ago, and that is what the masses have been waiting for all this time but to no avail. Mass Psychology states that is exactly why it will continue to kick them all in the head. No bull market has ever ended on a note of fear or anxiety, and this bull market is not going to be an exception.

The Fed is far stronger than all the jackasses from Wall Street and Main Street combined; fighting the Fed is the best way to bankruptcy. Those who have fought the Fed since 2008 have been bankrupted several times over.

Crowd Psychology reveals that the central bankers have no option but to inflate the money supply. The Fed has embraced to the Inflate to infinity paradigm; they will not stop till there is a major currency meltdown and waiting for such an event could prove to be an exercise in futility. It would be far better to keep an eye on the masses and see where they are heading as they will provide an early warning signal that the end is near. When the masses turn bullish and start to jump up and sing “Kumbaya my love”, the end will be nigh. At the moment the masses are still too anxious for this market to crash as illustrated by our proprietary “Anxiety Index”.

If the Fed stopped propping the markets, then this stock market bull would get a heart attack and die tomorrow, but this is not the case. The Fed is about to embrace negative rates, and that is going to be like dumping a tanker of gasoline on a raging fire. Don’t fight the trend for the trend is your friend while everything else is your foe.

Other Articles of Interest:

Most Unloved Stock Market Bull Destined To Roar Higher (Aug 5)

Student Debt Crisis Overblown & Due to Stupidity (Aug 4)

Despite Investor Angst Most hated stock market keeps trending higher (July 30)

False Information, Mass Psychology & this Hated Stock Market Bull (July 29)

Zero Percent Mortgage Debuts setting next stage for Stock Market Bull (July 27)

Long Term Stock Market Bears Always Lose (July 27)

Information overkill & trading markets utilising Mass Psychology (July 27)

Simple Common Sense Fix Ends Student Debt Problem (July 27)