Trading in the Zone: Mastering the Psychology of Trading

Dec 30, 2022

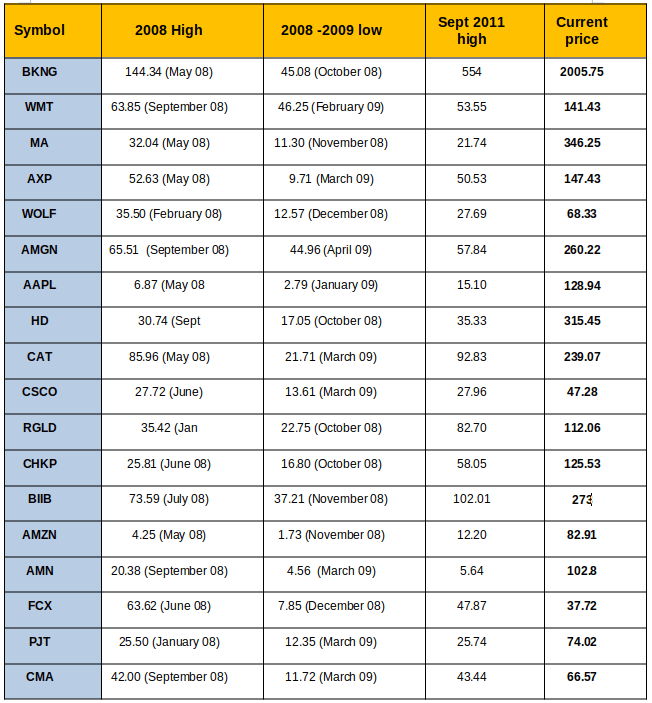

Irrefutable Evidence that Crashes Equate to Investment opportunity:

RGLD is a Gold stock. We purposely selected this stock to illustrate that even a sector-specific stock that one should generally only get into when the sector triggers a buy proves that crashes are buying opportunities.

Doing nothing but buying and holding these stocks would have yielded incredible gains. Notice how fast the profits started to surge after 2011. This is due to only one factor:

The Fed began to print more money. The recovery period between boom and bust is almost 5X faster than in 2009. If one had only used long-term charts (monthly charts) to buy and sell the above stocks, one would have fared even better. For example, one can utilise the monthly charts to jump in and out of the market while the trend remains positive.

One could have at least doubled the above returns using this simple strategy. Experienced traders could take things a step further. Use the weekly charts to jump in and out while the Monthly chart trades below the overbought zone. Essentially, one would sell when the stock was trading in the overbought ranges and re-purchase them when it moved into the oversold zone. Only traders with some knowledge of TA should attempt this.

Trading in the Zone: Cannonball Strategy

Applying the conservative cannonball strategy to several plays above would have yielded much higher returns than the buy-and-hold strategy. Cannonball strategy implies purchasing LEAPs when the stock is trading in the extremely oversold range and selling the position when the stock is sitting in the highly overbought zone.

The simple lesson we are trying to convey here is that if one does not panic and logic does not go out the window, one can bank outstanding gains over the long run. And history is on our side in this regard.

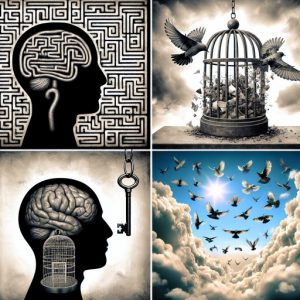

You won’t see the next opportunity if you give in to fear. This is particularly important now, for the top players are creating new narratives on the fly. What does this mean? They can prematurely create the illusion that the Bull market is dead forever. They have so much money that all of this is a game. Power is addictive, so they will keep doing this with more frequency. Hence those who don’t prepare themselves psychologically for this ploy could lose everything.

Trading in the Zone: Embrace Opportunities & Overcome Fear

The big players create every disaster or crash for only one reason: they delight in fleecing the masses. They want fear to take over so that you will gladly sell your top holdings for nothing; many will beg to bail out at or very close to the bottom. These players will then sit out of the markets for years while a new set of players are lured in. Finally, the old players (the ones that sold at or close to the bottom) will jump in (usually years later) and then the big boys will kill the new and old fish in one shot. Market Update September 11, 2022

This game has been repeated for generations; it will continue for one simple reason; the masses do not pass this valuable data to their offspring. Sadly, a new set of suckers are born every year.

The bottom line; things always look rough in the short term, but the rewards that await the Astute Players are massive. 2023 might start rough, but it will provide Tactical Investors with many fantastic opportunities. Putting this conservative cannonball strategy to use should amplify the gains.

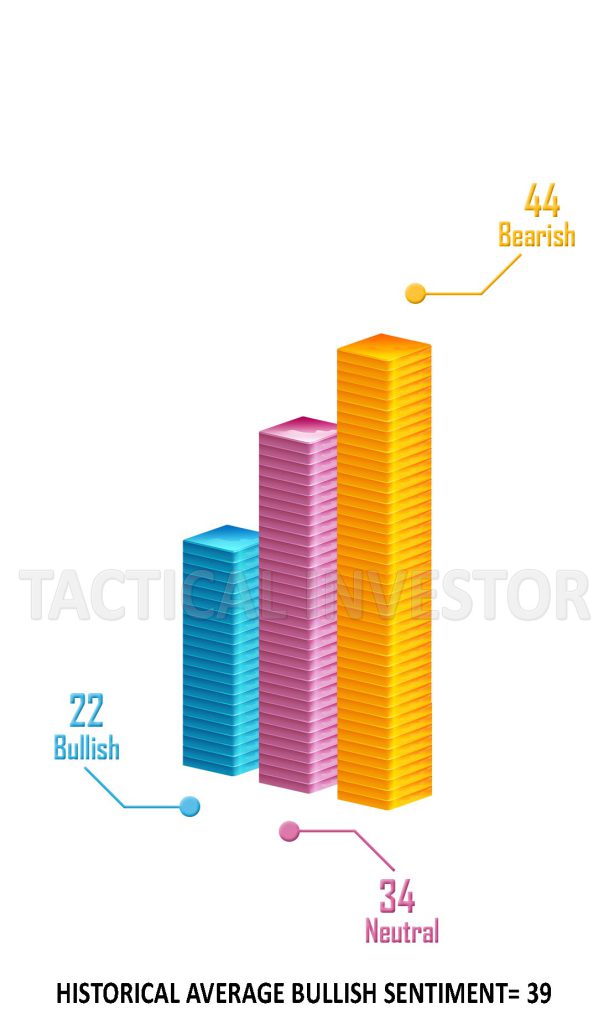

Stay in the zone by paying attention to Sentiment

Making money trading in the zone involves mastering the psychological aspects of trading, such as emotional control, discipline, and risk management. One effective way to stay in the zone and make profitable trades is to use technical analysis, which involves studying charts and market data to identify patterns and trends. It is also essential to have a solid trading plan that includes entry and exit points, stop-loss orders, and position sizing.

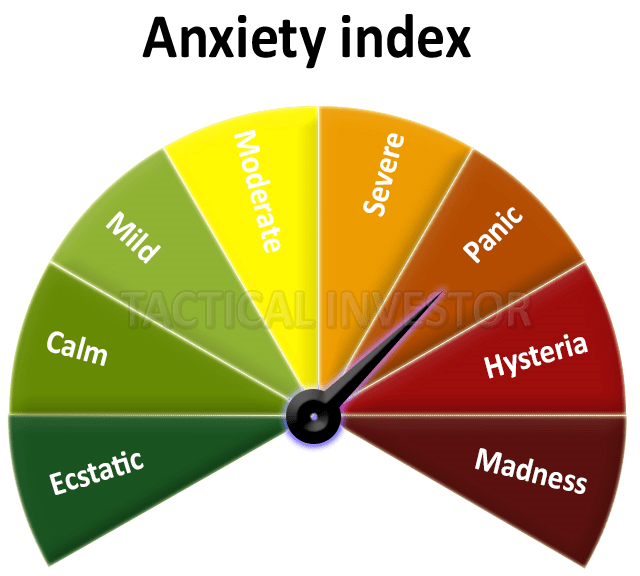

In times of market uncertainty and panic, staying focused and making rational decisions can be challenging. However, experienced traders understand that opportunities often arise during times of turmoil. As the needle in the Anxiety Index moves deeper into the panic zone, it is crucial to remain vigilant and patient, waiting for the right signals to appear.

The recent signal indicating a potential Father of all buys (FOAB) is a rare opportunity that could signal the start of a new decade-long bull market. By staying in the zone and keeping emotions in check, traders can take advantage of these opportunities and profit from market movements. Remember, mastering trading in the zone is a process that requires practice, discipline, and patience.

Other Articles of Interest

Stock Market Tips For Beginners: Surfing the Trends for Success

Panic Selling Mastery: Buying the Fear & Selling the Joy

Catch the Wave: Decoding Trading Cycles with the Esoteric Edge

Are Economic Indicators Finally In Sync With the Stock Market

Perception Manipulation: Mastering the Market with Strategic Insight

Market Uncertainty: A Challenge for Investors

Stock market basics for beginners: Adapt or Die

Richard Russell’s Dow Theory: Is It Still Valid?

DJU Index: To Buy or Flee? Unraveling the Market Mystery

Stock Market Psychology 101: Learn, Thrive, and Profit

In 1929 the Stock Market Crashed Because of Greed

Unshackling Minds: The Journey to Remove Brainwashing

Mob Psychology: Breaking Free to Secure Financial Success

Unveiling the VIX Fear Indicator: A Case Study in Market Volatility