Hyperinflation definition

Updated Dec 2022

The penguins masquerading as experts on Hyperinflation are full of it, for they fail to understand a specific factor, the “velocity of money”. Next time they start with their load of bull, ask them if they even know what the velocity of money represents.

So, what is Hyperinflation: According to Investopedia, Hyperinflation is defined as:

Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy. While inflation measures the pace of rising prices for goods and services, Hyperinflation is rapidly rising inflation, typically measuring more than 50% per month.

Hyperinflation is not in play. It also depends on the angle or period one plucks the data from to determine if inflation is a real threat.

The true definition of inflation is an increase in the money supply. It has now been bastardised as an increase in the price of goods. Price surges are a symptom of the disease and not the condition. Let’s look at many historical charts in line with this distorted view of inflation.

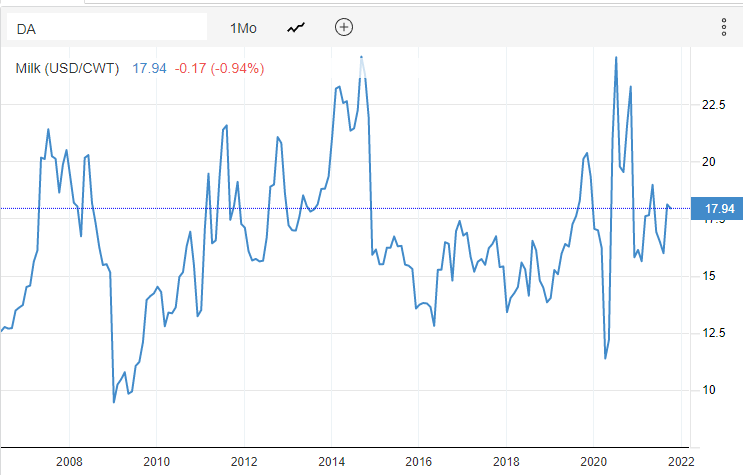

Historical Price of Milk

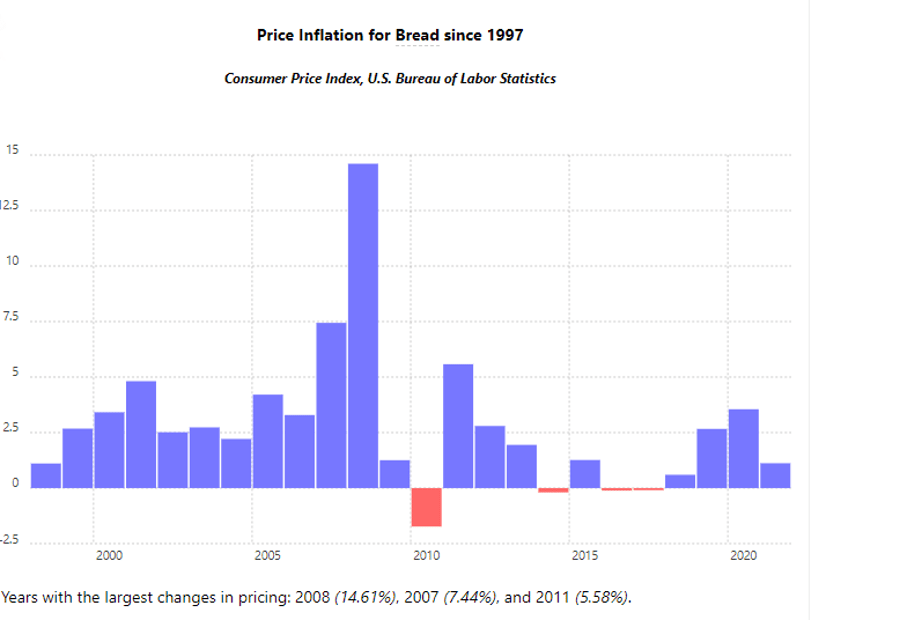

Historical Price of Bread

Source: https://www.in2013dollars.com/Bread/price-inflation

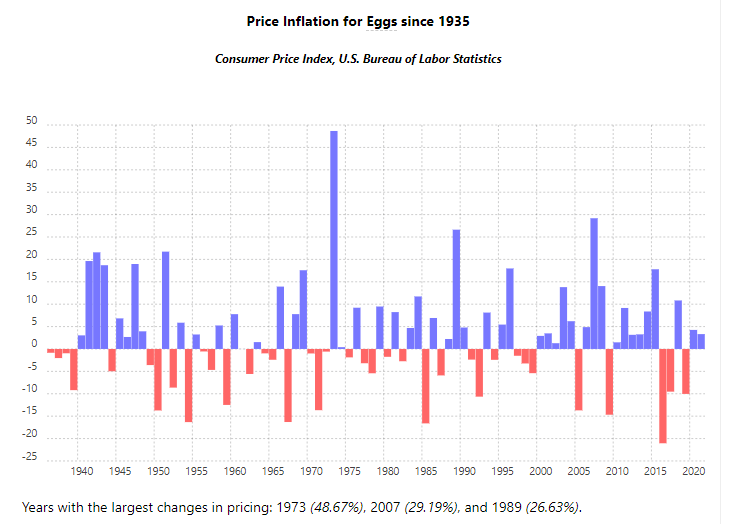

Historical price of eggs

Source: https://www.in2013dollars.com/Eggs/price-inflation

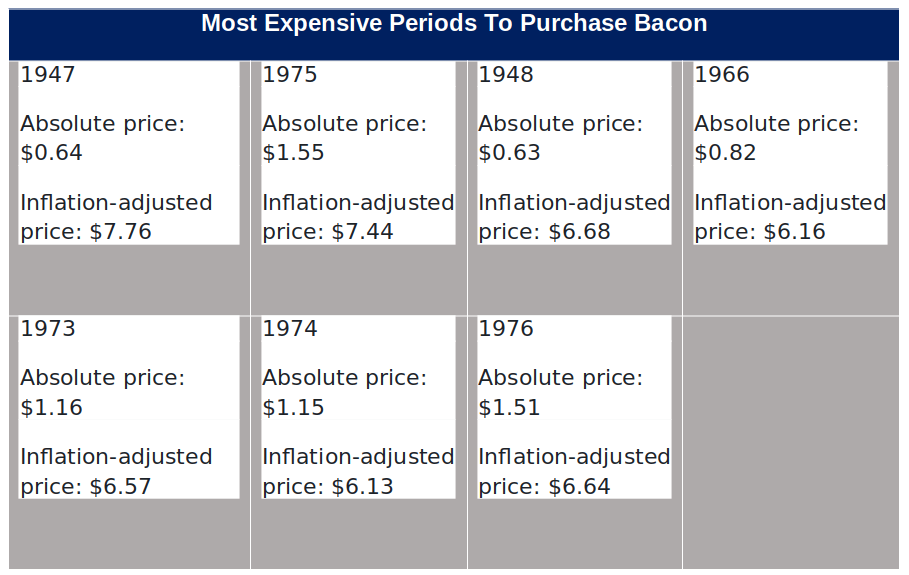

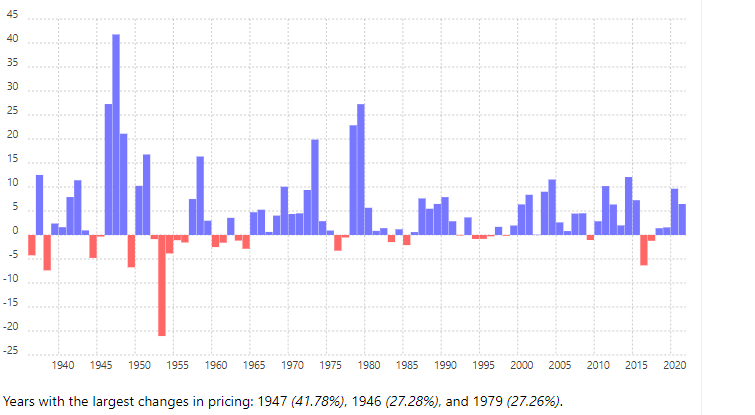

Historical Price of Bacon

It looks like the price of Bacon is trending upward. However, when one digs deeper, this is what one finds.

Source https://www.southernliving.com/meat/bacon/bacon-history-pork-belly-prices

The current average price for a pound of Bacon is 5.82. The above table indicates that Bacon was far more expensive in 1947 than it is today

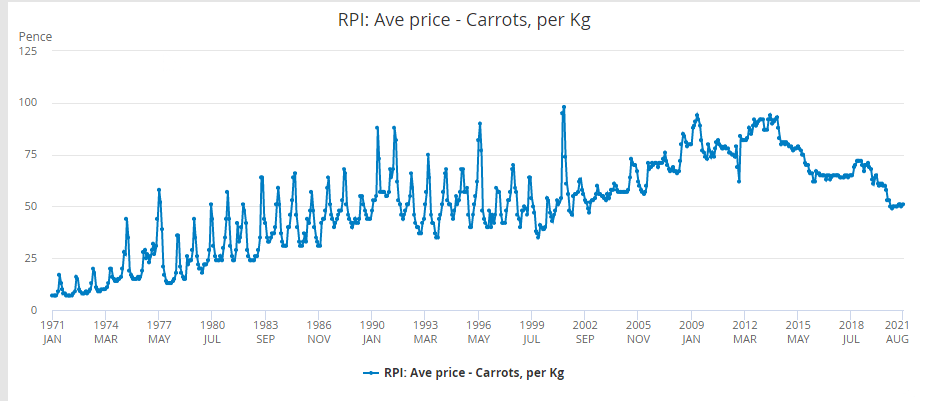

Historical Price of Carrots

Source: https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/czne/mm23

Yes, the above chart is based on the prices of carrots in the UK, but it matters not, for the trend is roughly the same in the USA.

Historical Price of Beef and Veal

Source: https://www.in2013dollars.com/

Source: https://www.bls.gov/

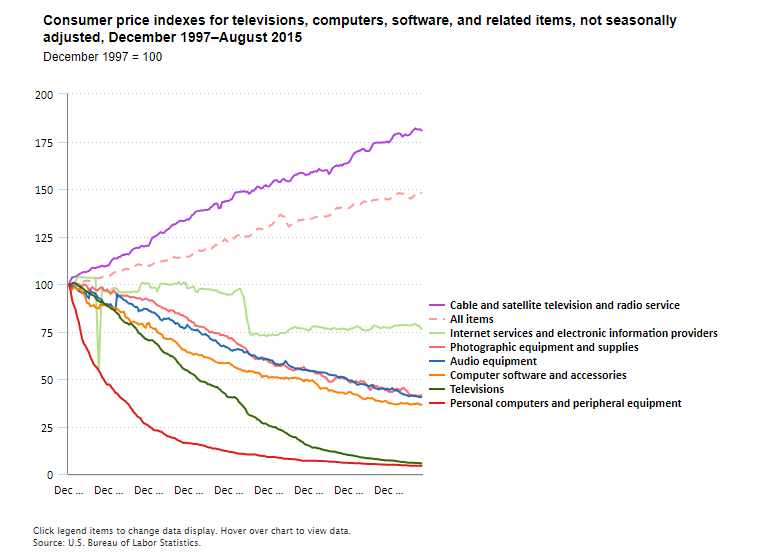

Suppose you remove the price of cable and satellite television (another manipulated market). In that case, the cost of everything else in the above chart has been trending downwards.

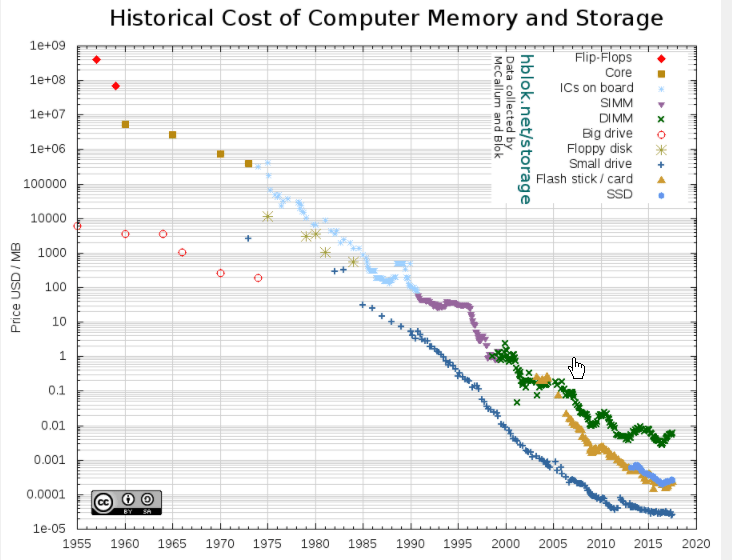

Source: https://hblok.net/blog/posts/2017/12/17/historical-cost-of-computer-memory-and-storage-4/

We could go on and but we will stop with this chart. Over the past two months, we provided further evidence that the hyperinflation story is the work of an empty mind. This article summarises the other factors that we have discussed in previous updates. https://bit.ly/3aIst8l

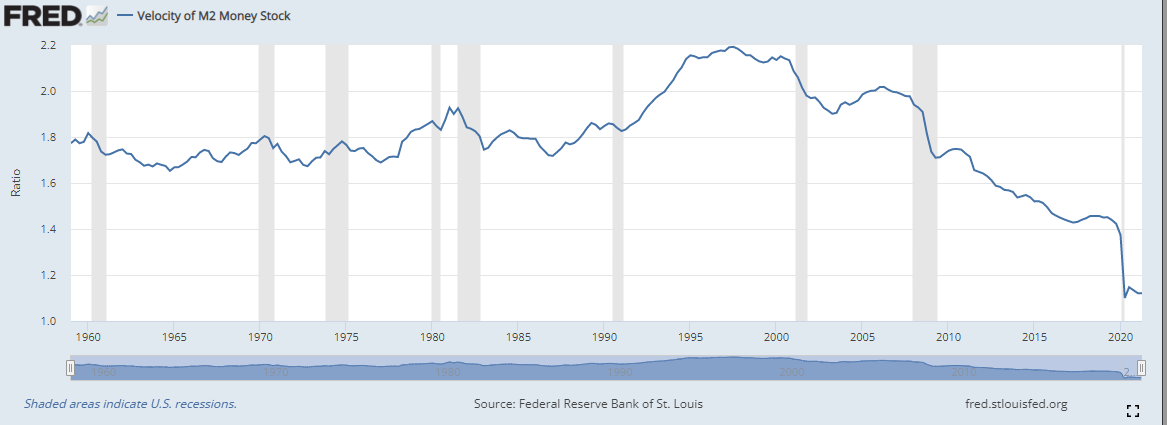

The velocity of M2 Money Stock

All that matters, in the end, is the velocity of money; currently, it is at a multi-year low. This suggests that all the price spikes we are witnessing are man-made. Housing prices are rising because of supply and demand. The demand is outstripping the supply. Oil and natural gas prices spiked because the hardcore brain-dead greenies decided to exclude natural gas and nuclear from their all-green mantra.

The current supply chain bottleneck is also man-made. A subscriber submitted an excellent article that provides an in-depth look into this misdeed. The report is posted under the news section towards the end of this update. In almost every instance, the price surge had nothing to do with inflation. Manipulation instead of inflation, in most cases, is what’s taking place.

Given the decline in the velocity of money, the worst-case scenario is that we will witness momentary price spikes in different assets from time to time before they revert to the mean. Most so-called inflation experts don’t even know what the velocity of money means or how crucial it is to determining long-term inflation trends. Hence most of these inflation experts are nothing but glorified jackasses.

References on the Definition of Hyperinflation

These articles discuss the implications of hyperinflation:

- “Hyperinflation Definition and Causes” by Investopedia: https://www.investopedia.com/terms/h/hyperinflation.asp

- “What is Hyperinflation?” by The Balance: https://www.thebalance.com/what-is-hyperinflation-3306127

- “Hyperinflation Explained” by Forbes: https://www.forbes.com/advisor/investing/hyperinflation-explained/

- “Understanding Hyperinflation” by the International Monetary Fund (IMF): https://www.imf.org/external/pubs/ft/fandd/basics/hyper.htm

- “The Dangers of Hyperinflation” by The Balance: https://www.thebalance.com/hyperinflation-causes-effects-examples-3306128

Other Articles of Interest

IBM Stock Price Prediction: Time to Buy or Fly?

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Clash of Titans: Unleashing Inductive vs Deductive Reasoning

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory