History of Financial Markets Unleashed: The Masses’ Irresistible Odyssey into Destiny’s Dance

Updated Dec 2023

If one studies the history of financial markets, one can clearly state that the masses learn nothing other than repeating the same mistake more efficiently. Trying to save them or make them see the light is futile, akin to catching a sharp falling dagger. A useless and painful experience.

Will history repeat itself?

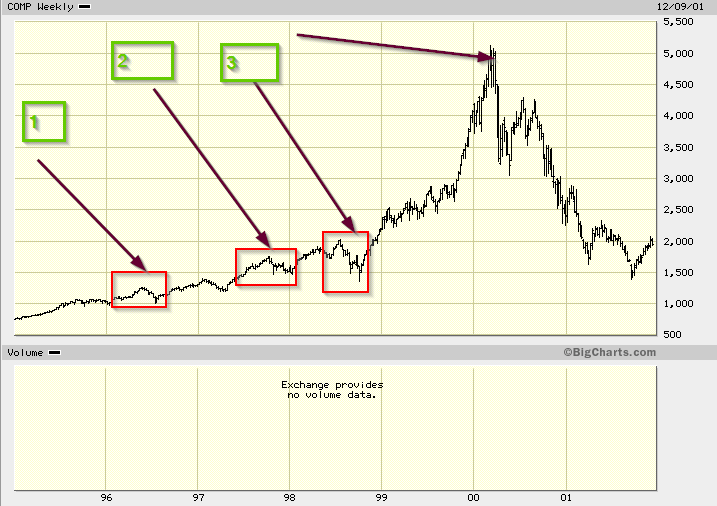

This is what took place during the dot.com bubble. During the ride up, there were many instances where it appeared that the end was nigh. Those that shorted early in the cycle lost everything and then some. Shorting the markets is a very high-risk venture; the following elements must line up when you do so. Bullish sentiment should be unusually high and remain at elevated levels for weeks on end. Everyone from your barber to your grandma should be talking about getting into the markets. Lastly, all the technical indicators should be trading in the insanely overbought ranges. One can consider shorting the markets if all the above factors line up.

The Cycles of Greed and Fear: Lessons from the History of Financial Markets

Back to the topic at hand, the above pattern could be in play for the stock market. We are either at point two (66% certainty) or Point 3 (36% certainty). It is more likely that we are at point two. The masses believed the dot.com boom was over on each pullback. The selloff during the middle of 98 was the sharpest, and it looked like the end was nigh, but it was the precursor to the most explosive part of the move.

As there is 10X more money in the markets now, the upward feeding frenzy will/should last at least 3X, if not 5X, longer. When point 3 is hit, this Bull market should have enough oomph for another 36 months. A mega top is not likely until 2025 to 2026 and could extend until 2028. There will be many substantial corrections along the way up. A mega-top will probably coincide with Dow 81 to 102K, and then a correction in the 60% to 84% ranges is likely. Until then, the data indicates that every strong pullback should be embraced like a long-lost love; the more it deviates from the mean, the better the opportunity.

The spread between Junk bonds and Investment-grade bonds is dropping fast, so investors are willing to risk more for less. Short-term, this is bullish for stocks. Overall, the bond market is projecting that rates will remain low for at least the next 12 to 18 months, with spikes in between.

Reality Check: Decoding Market Signals Beyond Fear

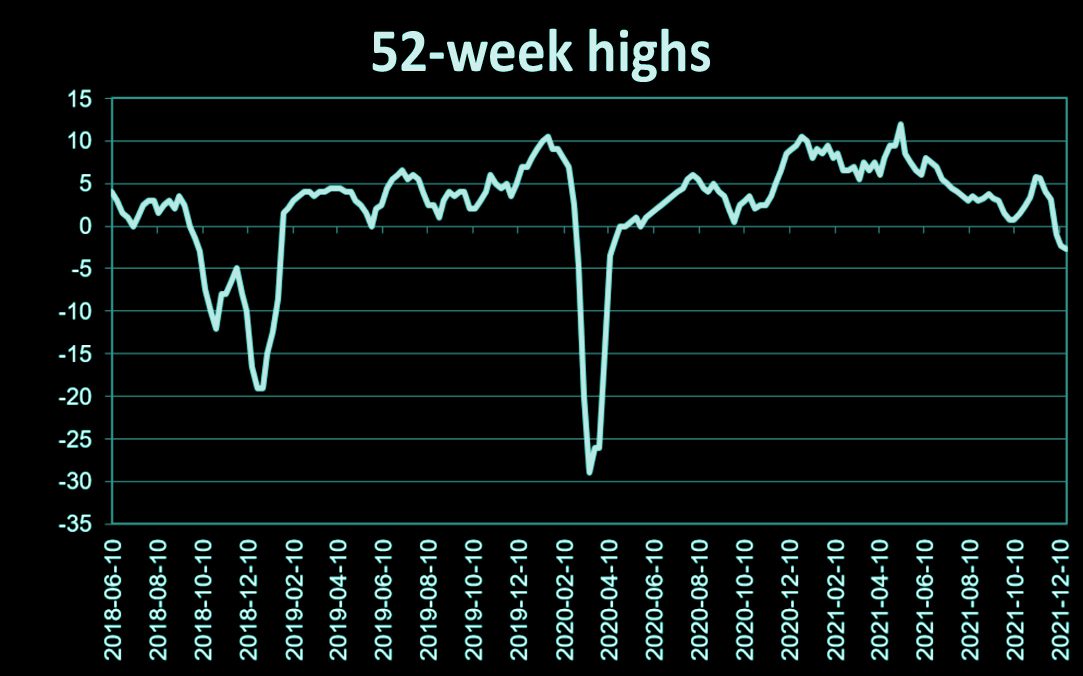

Observe the chart above closely – it reveals an intriguing trend. Typically, when an index hits new highs alongside a record low in the number of 52-week highs, it’s seen as a negative inter-market divergence. While this holds some truth, our ongoing observation suggests a different narrative. Often, it indicates that major players prompt weaker investors to unload top stocks without dragging the indices down.

This tactic sustains the illusion of normalcy while underlying issues persist. A more noteworthy observation is that, as the S&P 500 reached new highs last week, over 330 NYSE companies hit new 52-week lows – double the number reaching new highs on the same day. This rare occurrence has only happened three times, all in December 1999, as highlighted by Chief Investment Officer Ramsey of the Leuthold Group.

What followed is etched in financial history: the dot-com bubble burst. But before the burst, there was a spectacular final frenzy. Bullish sentiment soared, indices reached insanely oversold ranges, and even Grandma became a stock expert rivalling the best traders at Goldman Sachs.”

Today (Dec 27th), there were 96 highs on the Nasdaq and 111 new lows. While on the NYSE, there were 134 new highs with 43 new lows. So, the SP500 is more robust now, but the Nasdaq appears to be building momentum for a strong finish. Markets usually crash when speculation runs rife, and Nasdaq’s code name is a Speculator’s delight. We monitor the Nasdaq closely as it is likely to provide the first signal of a market top. Market Update Dec 27th, 2021

Financial History: Learn, Anticipate, Seize Opportunities

These developments give further credence to the strong correction of next year’s hypothesis. It also adds weight to the silent correction hypothesis. Finally, it also supports the argument that the big players have so much money that they take delight in changing the narrative and the outcome. We stated that the markets would most likely experience two corrections next year.

One would be mild, and one would be wild. It is hard to determine in advance which one will come to pass first, for there are no free forces in the market. We must base most of our analysis on what the crowd is doing, pattern changes and technical analysis. We can confidently state that the sharp correction will provide Tactical Investors with another enormous buying opportunity. That is provided you don’t freeze. Many new subscribers and those who subscribe to our free newsletter now talk about how easy it was to buy stocks in 2020 and make money. Yet over 90% of them panicked and did not buy. Hindsight makes even a jackass appear to be a genius. Another opportunity will be provided, and let’s see if they act when opportunity knocks or if they allow fear to knock them out.

Strategic Maneuvers: Navigating Market Dynamics and the Fed’s Playbook

One possible deviation could be that the big players change the narrative slightly. Here, the indices experience a milder correction (milder, not mild) while specific sectors get smashed. Bitcoin and several components of the overall Hi-tech industry come to mind. In this scenario, everything is achieved in one shot while maintaining the illusion that things are not bad. A crash leads to a stampede, but if you crash a bunch of sectors, the cows continue munching on the grass as they assume the overall situation is under control. The action will be wild enough to give the Fed an excuse to, at most, raise rates 3 to 4 times (if that much) and then reverse course very rapidly. Most likely, they will raise rates once and then backpedal.

The Fed counts on the fact that the masses will not study the history of the financial market. If they did, they would realise that the Fed’s only function is facilitating boom and bust cycles. The Fed is hell-bent on keeping this market alive at this game stage. They should have allowed natural market forces to rule back in 2009, but they stepped in to reduce the damage. And during the COVID crash, they went ballistic. So what the history of financial markets teaches us is that the Fed has now decided to follow this slogan: inflate or die trying to. Hence, there is only one option/solution; every crash has to be viewed through a bullish prism. The stronger the deviation from the main trend line, the better the opportunity.

History Repeats: The Masses as Cannon Fodder in Financial Follies

The Impact of COVID-19 on Financial Markets

The COVID-19 pandemic wrought havoc on global financial markets, showcasing the undeniable influence of mass psychology. As fear and uncertainty gripped most investors, a frenzied sell-off ensued in the throes of the crisis, causing a sharp decline in stock markets worldwide.

However, a swift and bold response from central banks and governments, spearheaded by the Federal Reserve, reversed the tide. Aggressive measures, including interest rate cuts and fiscal stimulus, spurred a rapid market recovery despite ongoing pandemic challenges. Yet, many individual investors failed to capitalize on this upswing, paralyzed by lingering fear that prevented them from re-entering the market.

Amidst the chaos, the pandemic accelerated existing financial market trends, notably the surge in digital technologies. Tech stocks soared, attracting investors and fueling concerns about an impending bubble. This phenomenon exemplifies the impact of mass psychology, where the majority blindly follows trends, often resulting in overvaluation.

The pandemic’s aftermath underscored the need to factor in non-financial risks, such as health and environmental concerns, in investment decisions. While this shift is positive, it introduces another facet of mass psychology – the herd mentality. Investors may inadvertently overlook the nuances in their pursuit of trends, succumbing to collective decision-making without a complete understanding.

Recognizing these patterns of mass psychology is paramount for investors seeking an edge. Understanding the propensity of the masses to react to fear, blindly trail trends, and succumb to herd mentality allows investors to sidestep these pitfalls. Instead of being swept along by the crowd, informed decisions based on thorough research and individual risk tolerance can position investors favourably, even amid uncertainty and market volatility. The key lies in transcending the tendencies of the masses to secure a strategic advantage in the financial landscape.

The Prolonged Correction Saga of 2022

In the annals of finance, the year 2022 it has etched its mark with a protracted and gradual correction in the financial markets. Many tech stocks experienced a downward spiral during this time, coinciding with the Federal Reserve’s decision to elevate interest rates. The Fed’s move was a calculated response to mounting inflation pressures, fueled in part by supply chain disruptions and heightened demand as economies rebounded from the pandemic.

Unlike the abrupt crashes of the past, this correction unfolded with a measured descent in stock prices. This deliberate pace afforded investors the luxury of time to recalibrate their portfolios and rethink their strategies. However, the flip side was an uptick in market uncertainty and volatility.

Amid this correction, a discernible shift occurred, with investors veering away from growth stocks, particularly in the tech sector, toward more defensive sectors and value stocks. Concerns about overvaluation in the tech realm and the potential impact of escalating interest rates on growth stocks were driving this strategic shift.

Amidst the challenges, the correction also unfurled opportunities for astute investors. Those who could pinpoint undervalued stocks and sectors reaped the benefits of the subsequent market rebound. This underscores the pivotal role of active management and a steadfast long-term perspective in shaping effective investment strategies.

In conclusion, the tapestry of financial market history imparts a vital lesson – while markets may exhibit short-term volatility and capriciousness, they possess an inherent tendency to recuperate over the long haul. Thus, adopting a panoramic long-term viewpoint, coupled with a judiciously diversified portfolio, serves as a compass for investors to navigate the choppy waters, capitalizing on emerging opportunities amidst the undulating challenges.

Other Articles of Interest

Contrarianism: Capitalizing on Dissent in the Market Maze

Copper ETF: The Great Investment Debate – Buy-In or Miss Out?

Palladium Price Trends: Unveiling the Allure of a Shining Investment

What is a Bullish Market: Debunking the Illusion of Stock Market Crashes

Profit Surge Unleashed: Mastering the Craft of Selling Puts for Income

Mastering Stock Market Psychology: Neutralizing Emotions & Biases

The Uptrend Alchemy: Transmuting Market Insights into Wealth

Take Control of Your Future: The Empowering Investing for Dummies PDF Handbook

How Did Many Banks Fail Consumers in the Stock Market Crash of 1929?

Factors Behind the Stock Market Crash and the Great Depression

US Rising Food Prices: Analyzing FOMO and Other Market Dynamics

Mastering Elegance in Economics: How to Define Financial Freedom in 5 Years

Market Timing Indicator: Genuine Gauge or Just Empty Hype?

Navigating the Palladium Market

Breaking Free: How Avoiding Debt Can Lead to Financial Freedom and Hope

Mass Psychology & Financial Success: An Overlooked Connection