Flow of Funds: Contrarian Opportunities & BTC Market Analysis

Updated Dec 2022

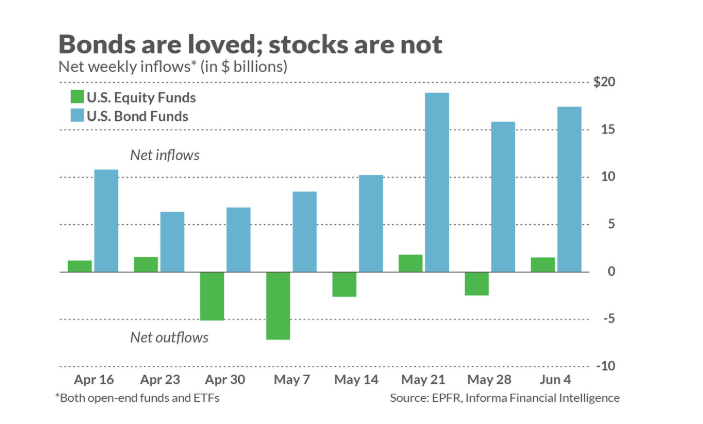

So, one would think this massive rally was being funded by investors selling bonds and redeploying this money into the stock market. But that’s not the case, according to EPFR data over the past eight weeks. The flow of funds indicates that money is pouring into bonds instead of stocks. US Equity funds have experienced outflows of 11 billion dollars, while bond-based funds have experienced net inflows north of 95 billion dollars.

This is a fantastic development from a contrarian perspective, for it indicates that the crowd is still incredibly nervous, and this data is backed by the Anxiety index and the consistent bearish sentiment readings that have refused to drop despite this massive rally. Hence, the game plan; view all panic-based selling as a huge opportunity to open positions in top stocks at a discount.

Random thoughts on BTC and The flow of funds

After the MACDs experience a bullish crossover, the bitcoin market is likely to take off, and GBTC could surge to the 17.40 to 18.00 ranges with an overshoot as high as 21.00. Until then, the market is expected to remain volatile. Regarding Bitcoin, that could translate to a move as high as 14,400 with a possible overshoot of 15,500 ranges. If this comes to pass, it will prove that the Hard money and Gold bug community is dying and that the idea of Gold going through the roof is another myth. It does make sense to put some of your money into precious metals, but no more than 15% of one’s funds should be allocated to bullion; the ideal figure would be 10%.

Flow of funds Article summary

Following the flow of funds can be a helpful strategy for investing in the market because it helps investors identify the direction and momentum of capital movement. By tracking where the money is going, investors can gain insights into market sentiment and recognise emerging trends relevant to their investment decisions.

For example, suppose a significant amount of capital flows into a particular sector or industry. In that case, it may indicate growing investor confidence in that area. Conversely, investors may lose faith in that area if capital flows out of a specific stock or sector.

By following the flow of funds, investors can also identify opportunities to invest in areas experiencing significant capital inflows. This can help investors identify stocks or sectors likely to outperform the broader market.

Furthermore, tracking the flow of funds can also help investors to manage their risk exposure. By identifying areas where capital flows out of the market, investors can adjust their portfolio allocations and reduce their exposure to potentially risky areas.

In summary, following the flow of funds is a valuable strategy for investors who want to gain insights into market sentiment, identify emerging trends, and manage their risk exposure.

Other Articles of Interest

US bank stocks and Psychological Ploys in the stock market

US jobless claims No Longer Connected To Stock Market

Easy Money Environment Fosters Price manipulation

How to Become A Better Trader?

Market Timing Strategies: All fluff or?

Define Fiat Money: The USD Is A Great Example

Deflation Economics: The Art of Twisting Data

BTC vs Gold: The Clear Winner Is …