Nov 28, 2022

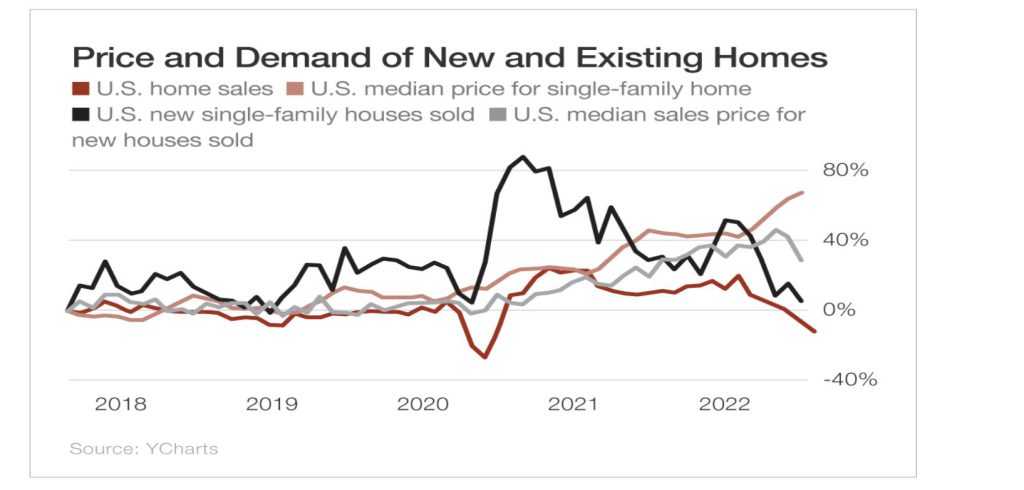

One can see that while the median price has been rising, new existing home sales have been in a general decline for several months. In simple terms, it comes down to affordability; there is a limit to how much disposable income the average American has to allocate towards their monthly payments.

In some instances, monthly payments have increased 50% for a similar-priced house purchased

roughly 8 to 12 months ago. Housing is another leading economic indicator. For most Americans, homes represent their most significant investment, and housing wealth accounts for approximately half of their total household net worth. When housing prices fall, Americans spend less because they feel poorer. As housing prices fall, Tax revenues drop, homebuilders cut back on building projects, construction workers get fired, and unemployment levels rise.

A new survey from consultancy PwC released this month showed 50% of companies are planning

to reduce overall headcount. Additionally, 46% of companies said they are dropping or reducing

signing bonuses, while 44% are rescinding offers

Not too long ago, wage inflation was a big issue, and at that time, in the Market Update service and in our private forums, we stated that soon the opposite would occur. It is now coming to pass. Shortly a plethora of articles will emerge saying how the average American will probably have to work until he dies as opposed to retiring at a certain age.

When things appear dire, that is when contrarian investors should raise their heads and start looking for deals. Experts are notorious for making the loudest noise at or close to market bottoms. While we expect existing home sales to decline and price to fall, the market will bottom once the Fed deflects. The Fed will take a knee as both the stock market and the economy are hooked on easy money. Risk takers can start looking for bargains as it is now a buyers’ market. Don’t be in a rush to buy; the idea is to look for the best possible deal.

Other Articles of Interest

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Unraveling the Enigma: The Dark Allure of Mob Mentality

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Unmasking Deceit: Examples of Yellow Journalism

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Investment Journal: Charting the Course Toward Financial Triumph

Trading Success: From Riches to Rags and the Rise to Wealth Mogul

Dow theory Forecasts: Alternative could be better