Gold Price Analysis & US Superpower Status

Updated March 2023

The average life span of a superpower is 250 years, and the U.S. has been in this position for 240 years, so it is running out of time. Russia is using the strong dollar to buy up cheap, valuable Gold. When the western media states that Russia’s reserves are falling, they are disingenuous. What is taking place, among many things, is that the reserves are in dollars, and Russia is simply getting rid of their worthless dollars and replacing them with Gold.

IMF data (International Monetary Fund) shows that Russia and China have been among Gold’s most significant net buyers for eight years. Last year, countries purchased nearly 590 tonnes of Gold, accounting for 14% of annual global gold bullion demand. Innovative nations like Russia and China use these low prices to load up on Gold and divest from the dollar. They understand that this economic illusion can last for only so long before reality strikes.

The chart below illustrates how Russia’s reserves of Gold have soared over the years. The Dollar will be toppled eventually, and the end will not be pretty.

Source: http://www.tradingeconomics.com

The number of bilateral deals bypassing the dollar continues to soar. With the opening of the AIB (Asian infrastructure bank) and with the Yuan being accepted into the world reserve currency club, the path for the dollar is downhill.

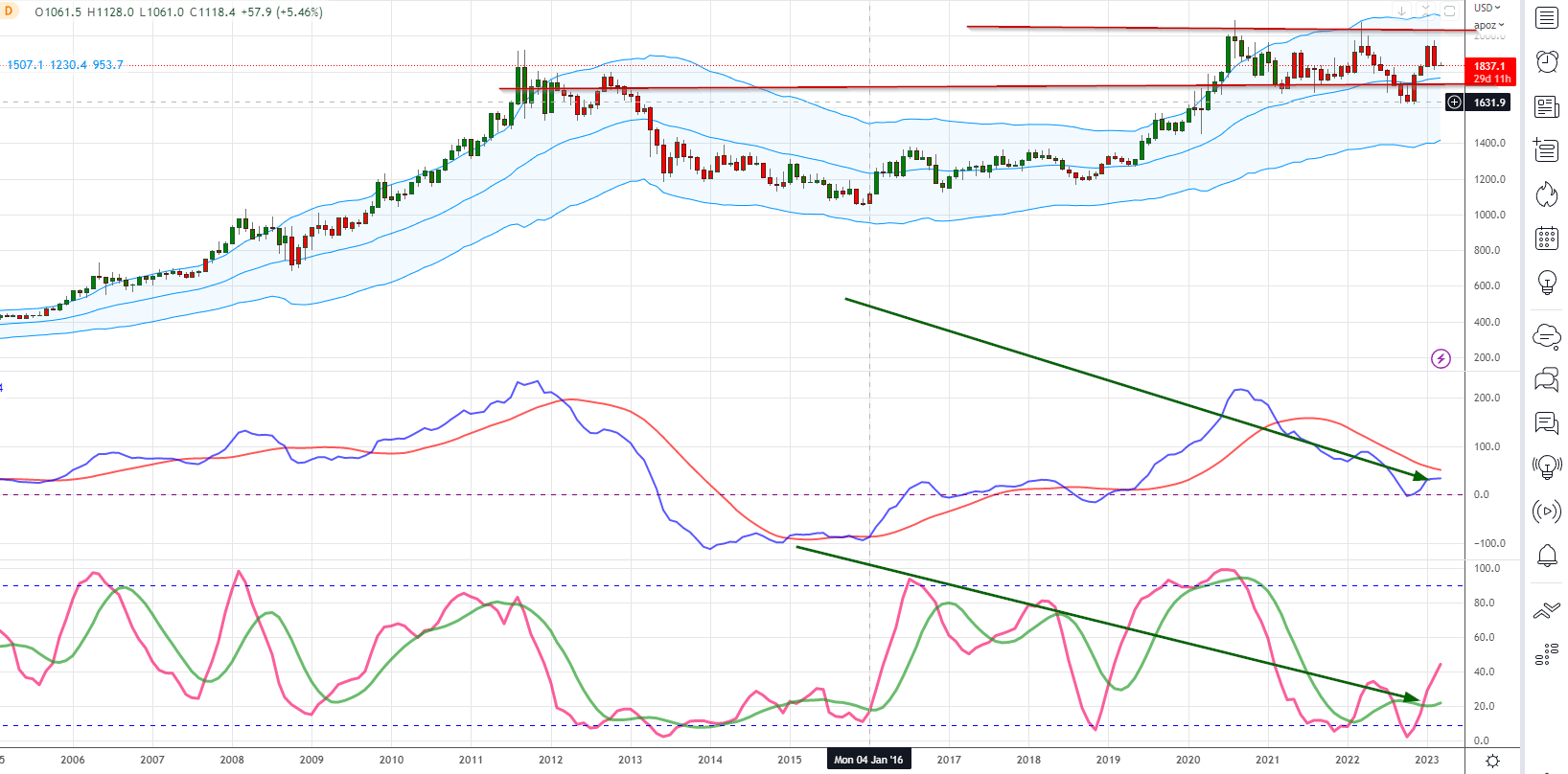

Gold Price Analysis 2023

Gold is gaining momentum and poised to trade higher, while the dollar is nearing a multi-year peak. While the dollar may test the highs of 2022 and even reach the 114 range, it is likely to decline for years to come. In contrast, we anticipate gold will trade in the range of $2,500 to $2,900, with a possible overshoot to $3,600 before a multi-month top takes hold.

Investors should consider using sharp pullbacks to deploy new capital into long positions, with a focus on blue-chip gold stocks and bullion. By doing so, they can benefit from the potential upside in gold while hedging against the volatility of the market

Other Related Articles:

Saving for retirement: Invest in stocks & retire rich (March 9)

China powering ahead with supply-side reforms (March 8)

Stock Bull Market over; Mob Psychology disagrees (March 2)

Beliefs Dangerous to long-term financial success (March 1)

Can China attract Foreign Talent via Issuing extra Green Cards (Feb 29)

The future looks bleak, I gotta wear shades.

my comment..”average length of life of a superpower”…hey …you dont have 100 infallible accuracy…there has never been a superpower with as many great inventions and influence FOR GOOD…as the USA…so i say..ITS LASTING as long as the Earth will last…chill..