Bitcoin Market Crashing: Is this the end of Bitcoin

For greed all nature is too little. Seneca

Whenever the masses fully embrace a market, trouble is usually close at hand, and that’s what occurred with Bitcoin; the masses were completely enamoured with Bitcoin. The masses were euphoric and expected bitcoin to soar to the next galaxy. Wild targets of $100,000 were being issued that sounded more like the ravings of a lunatic than of an expert. In an article published on the 4th of December 2017, we made the following comments:

Conversely, Bitcoin is now in the feeding frenzy stage, so this market is ripe for a correction. Tactical Investor

Mass Psychology and the Pitfalls of the Bitcoin Craze

Bitcoin’s popularity has spurred a proliferation of cryptocurrencies, making it challenging to distinguish between legitimate investment opportunities and dubious schemes. With so many cryptocurrencies available, issuing one’s own cryptocurrency has become a popular way to try and score big in the market.

However, investors must exercise caution and conduct thorough research before investing in any cryptocurrency. The sheer number of cryptocurrencies available means that many are likely to be scams or poorly designed, leading to significant losses for investors.

Additionally, mass psychology can play a significant role in the cryptocurrency market’s ups and downs. When the masses are euphoric, it often indicates that the market is due for a downturn. As seen with Bitcoin, the market can quickly turn against investors who buy into the hype without fully understanding the risks.

The Dubious Trend of Companies Changing Their Names to Boost Stock Prices

The recent trend of companies changing their names to include “blockchain” and enjoying immediate stock price surges is concerning. Long Island Ice Tea, a beverage company with no viable blockchain product, saw a 200% increase in its stock price after announcing a name change to Long Block Chain Corp.

Other companies like Riot Block Chain, LongFin, and Kodak have also employed similar tactics with success. This trend could potentially encourage even non-relevant companies to jump on the bandwagon, leading to further stock price manipulation.

Investors must exercise caution when considering investments in companies that have changed their names to include blockchain without any actual blockchain product. Such decisions are often driven by hype and speculation rather than a sound understanding of the technology’s potential.

Investors should conduct thorough research on the companies business models, financials, and blockchain expertise before investing. Blindly following hype and trends could lead to significant losses in the long run.

Charlie Lee’s Litecoin Sell-Off Raises Conflict of Interest Concerns

Charlie Lee, the creator of Litecoin, recently sold his entire stake in the cryptocurrency just before Bitcoin’s crash. Lee claimed that the sell-off was to avoid conflicts of interest, but the timing of the sale raises questions about his motives. http://bit.ly/2leWumd

It is worth noting that people have taken out mortgages or cash advances on their credit cards to invest in Bitcoin, a highly volatile and unpredictable market. Such risky investment strategies are ill-advised, as they can result in significant financial losses.

Investors should exercise caution when investing in cryptocurrencies and avoid taking on excessive debt to fund their investments. Investing within one’s means and conducting thorough research before investing can help avoid costly mistakes.

The last Psychological Straw?

When two experts, James Altucher and John MacAfee stated that Bitcoin was destined to soar to $1 million, it was almost a given that the outlook would change for the worse. We sent out the following warning to our subscribers:

Bitcoin is now in a full-blown mania stage; people are taking mortgages to speculate on bitcoin. Insane price targets of $1 million are being tossed into the air, and the masses are lapping it. That is how the market works, it gives and gives but then it strikes and takes everything back ten times faster. Market Update Dec 17, 2017

Bitcoin futures; the perfect vehicle to manipulate Bitcoin

Bitcoin futures provide an excellent venue for the big sharks to swallow up the silly sardines hoping to strike it rich. The big players can now manipulate the Bitcoin market via the futures market. They can use Fiat money (worthless paper) to push it up or down, much the same way they did and are still doing with the precious metals markets. This illustrates the lie behind the “Bitcoin is different nonsense”; Bitcoin is nothing but digital fiat; in some ways, it’s worse as anyone can issue their own cryptocurrency.

So what’s the outlook for Bitcoin?

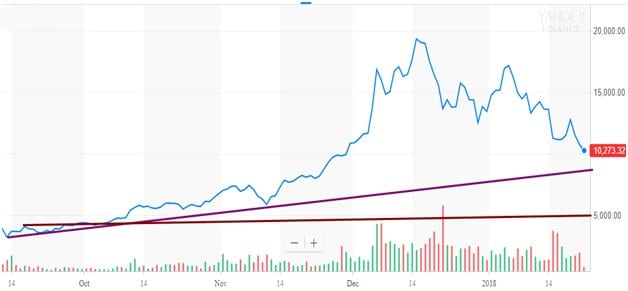

Courtesy of https://finance.yahoo.com

Navigating the Turbulent Waters of the Bitcoin Market:

Bitcoin is a volatile market that can rapidly shift from an excellent investment to a painful experience. Understanding the trend of lower highs that started in December 2017 is crucial in predicting the market’s future. Our conservative estimate puts Bitcoin’s range at $8,800-$9,200, but we cannot rule out the possibility of it dropping to $5,000-$5,600 before stabilizing. Panic can distort reality, and investors tend to sell at or close to the bottom.

Despite the turbulence, Bitcoin will trend upwards again, although it does not necessarily have to surge to new highs. The market’s bottom is close when experts stop issuing optimistic targets and begin criticizing it. Compared to the wild bubble-like action of the Bitcoin/blockchain sector, the equities markets appear timider. We will explore this further in a follow-up article.

Insights, Strategies, and Warnings for Investor

Investing in Bitcoin Investment Trust (GBTC) is a relatively safer option for those who want to invest in the Bitcoin market. Wait until sentiment turns negative or Bitcoin trades at least in the $8,000 range before investing, and do not invest more than you can afford to lose.

Lastly, the outlook for Gold is more positive than that for Bitcoin at present. Investors should take a cautious and measured approach to investing in Bitcoin while keeping an eye on the market’s developments.

Ability will never catch up with the demand for it.

Malcolm S. Forbes

Other Articles of Interest

Stock Market Insanity Trend is Gathering Momentum (Jan 10)

Is value investing Dead (Jan 9)

Irrational markets and Foolish Investor: perfect recipe for disaster (Jan 5)

Stock market Crash Myths and Realities (Jan 3)

Bull-Bear Markets & Arrogance (Jan 1)