What Is Meant by Bull and Bear in The Stock Market: The Debate

Updated Nov 2023

We prefer to do so within a historical context when discussing concepts of this nature for two significant reasons. Firstly, by learning from history, we can avoid repeating past mistakes. Secondly, and more importantly, we can provide real-time illustrations of our actions, ensuring that we not only talk the talk but also walk the walk.

Novice traders often find themselves preoccupied with questions like “What is meant by bull and bear in the stock market?” But does it truly hold significance? Now that you understand the meaning, how will you leverage this knowledge? Wouldn’t it be more beneficial to inquire about the appropriate actions in bullish and bearish situations?

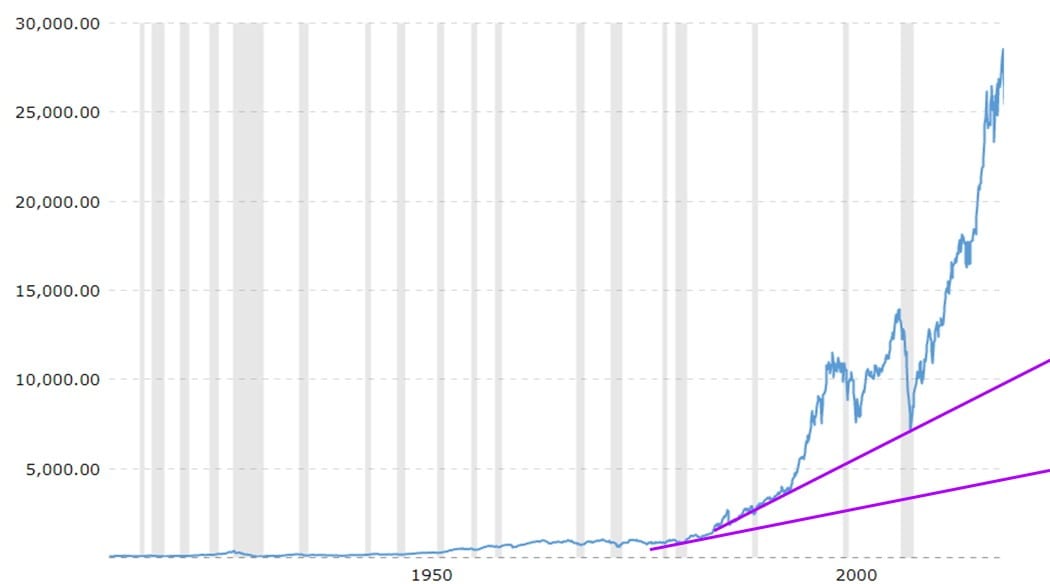

Upon examining any long-term chart, a striking observation emerges. The notion of being a bear in the stock market proves unsustainable in the long run. There is no evidence, whether from the living or the deceased, that being bearish yields long-term success. While generating sporadic profits through nimble trading may be possible, it requires considerable effort.

The remarkable aspect, however, is that every market crash appears insignificant when viewed on the chart—a mere blip. Conversely, seizing the opportunity to purchase stocks when fear is rampant after a market crash can lead to substantial gains.

In the long term, every bearish expert has been proven wrong as the market recovers its losses and surges to new heights. Consequently, bear market investing holds no value for the average investor. While it may be effective for agile individuals, why expend time and effort when focusing on long-term prospects can generate five to ten times greater returns? Additionally, engaging in top dividend plays can enhance one’s financial success by providing a healthy stream of dividends for life.

Let go of your entrenched perspectives and embrace the essence of reality.

We conducted an online search and found that a bear market is generally defined as a period of declining stock prices, typically accompanied by widespread pessimism and a negative economic outlook. However, it is important to note that there is no universally accepted definition for a bear market, and interpretations may vary.

In addition to the risks associated with adopting a bearish stance, there are also strategies like contrarian investing that aim to take advantage of market sentiment. Contrarian investors often look for opportunities to buy when fear levels have peaked, as this can indicate a potential market bottom. By considering mass psychology or mob psychology, investors can make informed decisions and potentially capitalize on market downturns.

It is crucial to understand that investing in the stock market involves inherent risks, and no strategy can guarantee success. Market conditions can change rapidly, and it is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Remember, embracing the essence of reality in the financial realm means acknowledging the dynamic nature of markets and being open to different perspectives and interpretations.

Exciting read: Economy: Exploring Different Economic Systems

Market Analysis: Comparing Current Trends to Historical Patterns

Today’s markets exhibit patterns that resemble those seen in 2003 and 2009. These patterns suggest a potential bottoming action rather than a topping action, as the needs have been largely disliked throughout this bull run. Initially, investors hesitated to allocate funds to this market, which could be seen as the first leg of the Bull Run that will eventually gain widespread acceptance.

At this stage, concerns about a bear market are unwarranted due to persistently negative market sentiment. Several positive factors contribute to this sentiment, including the significant tax cuts that provide momentum for the market to continue its upward trajectory. Additionally, although the Federal Reserve has chosen to raise rates, interest rates remain historically low and would need to rise significantly to impact the market.

Crucially, our trend indicator still indicates a positive trend, necessitating the embrace of every pullback, regardless of intensity.

In conclusion, it is essential to note that both bears and bulls tend to overstay their welcome. If the markets are indeed approaching the top, it may be prudent to allocate a small portion of funds to purchase puts. However, the primary focus should be on compiling a list of high-quality stocks to invest in when the markets begin to decline.

Remember, emotions play a significant role in triggering both bull and bear markets. The masses often overstay their welcome in both scenarios. It is crucial to avoid letting emotions dictate investment decisions.

Using this definition, we can make the following assertion:

The Trend is your friend in Both Bull & Bear Markets.

Bull and bear markets are based on trends; if you can determine the trend you won’t overstay your welcome in either scenario. The masses are notorious for letting their emotions do the talking, so they always buy at the top and sell at the bottom.

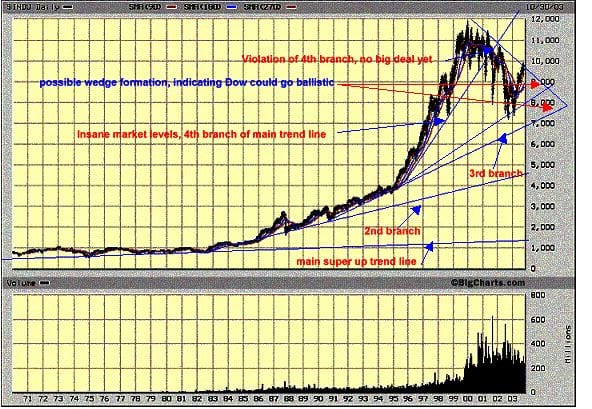

Looking at the trend, we see the super primary direction of the Dow is still intact. In fact–get ready to hold your breath–we would have to break below the 1500 level to say the super long-term uptrend is over.

Any stock usually has three stages: the super primary trend and 1-3 more branches before it corrects. At this point, it can fall back to the main trend line and then slowly return to its old former highs and even surpass them or completely vanish from the face of the earth. Looking at the Dow, you will notice that it has had four branches in total, which is rather extreme.

Overextended markets experience substantial corrections that are often mistaken for bear markets.

The market overextended itself to the maximum point, and it’s only logical that it should regress to the mean. Since the upward move was so outrageous, the downward move should be equally outrageous.

So far, we have just fallen below the 4th branch, which is understandable and expected, considering that the market has reached unprecedented levels. However, let’s examine the chart. We couldn’t even break below or touch the 3rd uptrend line. This indicates that the market still has a lot of momentum, and its current actions have only begun to address a small portion of its extreme elements. The Nasdaq experienced a more significant correction, and the explanation for this is straightforward. The Nasdaq went from where one speculates to where individuals started to speculate as if they were under the influence of a potent hallucinogenic drug.

The stronger the pullback, the better the opportunity

Take a long-term look. This pullback has been relatively mild and, in reality, nothing to worry about. The new thrill-seeking investors, who were so busy getting high every day as they saw their portfolios soar in value every week, got smashed with a super dose of reality when the market decided it was time to take a breather and rid itself of some excesses. And since the NASDAQ was where speculation was the most rampant, it follows that it should also be where the correction would be the strongest and the fastest.

We have not even touched 7,000 nor breached it. Had we done so, this would have indicated further weakness. If we had violated it, we would have to break below 5,000 to invalidate the second main super uptrend line.

So, where do we stand now? If you look closely, it sounds like we are in the process of completing a wedge formation, which will be very bullish if we break out of it. Also, we are slowly making higher lows, which is another bullish indicator. Another significant bullish indicator is that for over six months now, the number of new highs has seriously outpaced the number of new lows. This shows that the internals of the markets are improving and getting stronger.

When priced in Gold, the Dow is just trending sideways

What is fascinating is that Gold is also putting in a beautiful wedge formation when priced in South African Rands, which adds further credibility to the theory that the Dow is doing nothing but adjusting to the high level of currency inflation.

So, in the short term, Gold and the Equity markets can keep chugging up. However, Gold will be the final Victor since its major uptrend has just begun.

I believe with the above data, one can draw the following conclusions:

A pullback to the 8,800 to 9,000 area would be very healthy for this market. However, it is not necessary. Pulling back to even 9,400 to 9,500 will serve the minimum criteria to provide the ingredients required to start the next phase of this rally. So far, there is nothing incredibly spectacular about this rally when one looks at it regarding a stronger currency.

In summary, most of the move was due to a currency adjustment: the US dollar getting hammered to death, and the markets adjusted to reflect this inflationary process. (You can’t expect the need to stay at the same level if several hundred more million or billion dollars are chasing the same number of stocks.)

Dow Targets

If the Dow can hold in the 8,800 to 9,000, the outcome looks interesting. Esoteric cycle analysis (our proprietary indicator at the Tactical Investor) suggests the following targets if we can hold the above ranges:

1st target will be a break of the Dow over the 10,000 range

2nd target 10,500

3rd target 11,400

Extreme target 11,7000

Then we start the process that I call the crash and burn as the market corrects and returns to an average level. But before it does, an insane amount of pain has to be felt. So when all is said and done, this market could end up in the 1,500 to 4,000 point range.

As we live in unpredictable times, owning gold and silver bullion would be prudent.

As John Maynard Keynes puts it, “Markets can remain irrational longer than you can remain solvent.”

And if you are nervous about the markets, then listen to Mark Twain:

“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” Mark Twain 1835-1910

If you claim to be a contrarian, then at the very least, you can take the time to look at what I have to say. Understand that I am not pushing these opinions down your throat but only providing other possible scenarios from the ones most of you have been given to date. Don’t shoot the messenger because he delivers a message that does not fit your pre-built expectations scenario.

What is meant by bull and bear in the stock market: Concluding thoughts

In conclusion, understanding “what is meant by bull and bear in the stock market” is crucial for investors. Recognising these terms allows one to navigate market trends and make informed decisions. The text highlights the importance of examining long-term charts and debunking misconceptions surrounding bear markets.

It emphasises the significance of trends, encouraging investors to avoid emotional responses and instead focus on the reality of market conditions. The article also underscores the need to adapt entrenched views and stay aware of the ever-changing dynamics in the financial arena. By grasping the concepts of bull and bear markets, investors can better position themselves to seize opportunities and manage risks effectively.

Initially published in 2004 and continuously updated over the years, the most recent update was completed in July 2023.

FAQ On What is meant by bull and bear in the stock market

Q: what is meant by bull and bear in the stock market?

A: The terms “bull” and “bear” in the stock market are metaphorical representations of different market conditions. The term “bull” derives from how a bull attacks its opponents by thrusting its horns upward, symbolizing upward price movement and a positive outlook. In contrast, the term “bear” reflects how a bear swipes its paws downward, representing a downward price movement and a negative outlook.

Q: How do bull and bear markets affect investors?

A: Bull markets are generally favourable for investors. Stock prices tend to rise during a bull market, and there is optimism and confidence. This can lead to increased investment activity and potential profit opportunities. Investors may experience gains in their portfolios and see their investments grow.

On the other hand, bear markets pose challenges for investors. During a bear market, stock prices decline, and there is a prevailing sense of pessimism and uncertainty. Investors may witness losses in their investments and may be inclined to sell their holdings to limit further losses. It can be challenging for investors, requiring caution, strategic decision-making, and a long-term perspective.

Q: How can investors navigate bull and bear markets effectively?

A: Navigating both bull and bear markets requires a balanced approach and an understanding of market dynamics. In a bull market, investors must stay disciplined, avoid getting caught up in excessive optimism, and carefully assess investment opportunities. Diversification and proper risk management strategies can help protect investments during market downturns.

During a bear market, investors need to remain calm and avoid making hasty decisions based on fear or panic. Taking a long-term perspective, identifying potential value investments, and conducting thorough research can help investors identify buying opportunities during market downturns.

Q: Are there any strategies to consider during bull and bear markets?

A: Yes, there are several strategies that investors can consider during different market conditions. In a bull market, investors may focus on growth stocks, ride the upward momentum, and consider taking profits at appropriate times. Monitoring market trends, staying informed about economic indicators, and making informed investment decisions are essential.

During a bear market, investors may shift their focus towards defensive stocks, which tend to be less affected by economic downturns. They may also consider value investing, looking for undervalued companies with solid fundamentals. Implementing a systematic investment approach, such as dollar-cost averaging, can also help navigate market volatility.

Ultimately, understanding the characteristics of bull and bear markets, staying informed, and adopting a disciplined investment strategy can assist investors in making informed decisions and potentially capitalizing on market opportunities.

Other Articles of Interest

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

I’m Never Going to Be Financially Secure, So Why Try?

Why market crashes are buying opportunities

A Clear Illustration of the Mass Mindset In Action

Inductive Versus Deductive reasoning

Comic Strip Illustrating Mass Mindset

Mass Psychology or Contrarian Investing

Interesting, and agreeing with most of your comments. Let “the trend be your friend” has been great advice to traders. From a longer term perspective, “Don’t Fight The Fed’ has been ignored by many “old guys”, like me who could never guess that a rational Fed would keep rates near zero for this length of time.

The economy actually bottomed the summer of 2009 but “planned” (in my view) irresponsible lack of sound fiscal policy put “it all” on the Fed who has been the best friend Obama’s political career ever had.

Presently, there are Trillions of dollar value invested in “negative return investment!” It’s a “no brainer” to buy a vault and load it with cash & gold for a better return.

In that regard,the Chinese are actually purchasing the largest “gold vault” in history from Barclay’s, other than the pyramids.

The torch is being passed to the next world Empire.

China strategy to dominate the gold market.

http://read.bi/22fecnI