Trend-Focused Dow Outlook: Price Targets Irrelevant

Updated March 2023

Let’s take a historical dive and examine what was expressed in 2017 when this article was initially published. Since then, it has been updated multiple times, and today we will provide the 2023 outlook, making the text sound more modern.

The Dow appears to have broken through the top of the Channel formation, falling in the 20,800-21,000 ranges. If it closes above 21,300 on a monthly basis, then despite the markets being overbought, the Dow could surge past 22K before running into a strong zone of resistance. Market Update June 18, 2017

Given the resiliency of this market, the Dow could very easily trade to 22K before it trades to 19K. The masses must show some enthusiasm; if they don’t and the market pulls back strongly, it must be viewed as a screaming buy. For now, the masses seem to be locked in the pessimistic mode. Market Update July 6, 2017

Dow Outlook: What’s Next

We have had the opportunity to field test the Tactical Investor Alternative Dow theory in real-time for over 15 years, and it has proven to be highly effective. According to this theory, the markets will not break out to new highs unless a positive divergence signal is triggered or the Dow utilities trade into the extremely oversold range. As a result, exercising patience is crucial.

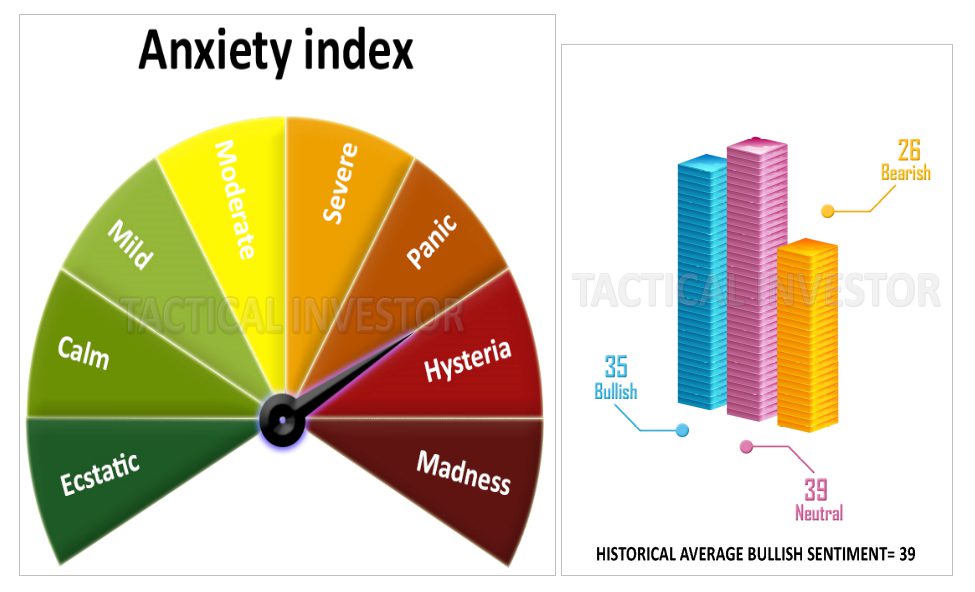

Assessing the trend requires monitoring market movements to determine overall market health. While the Dow provides insight, relying solely on the Dow Jones price target is insufficient. We need a broader range of factors for informed decisions.

Considering the State of the Masses

The masses’ state is a significant consideration, as their behaviour impacts market movements. In addition to the masses’ behaviour, we must assess various factors to determine the market’s health.

Interest rates are crucial in market decisions, significantly impacting market movements. For instance, aggressive rate hikes by the Fed lead to little to no new highs for markets. We expect a recession until the Fed stops, despite indications that they might slow down.

Navigating the Markets in Uncertain Times

The Dow has been volatile in an uncertain environment, with a slow, prolonged correction in 2022. This is why exercising patience, and discipline is vital in investment decisions. Focusing solely on the Dow Jones price target isn’t sufficient; multiple factors must be considered to make informed decisions.

While not a popular view, an objective and informed analysis is vital. The Dow outlook/price targets is just one aspect of market analysis, and multiple factors must be considered to make informed decisions. Doing so, we can navigate the markets better and make sound investment decisions.

Conclusion

The Dow outlook is essential in market analysis as its one of the most widely followed indices, but it shouldn’t be the sole focus in investment decisions. We must consider multiple factors, such as trends, the state of the masses, and interest rates, for informed decisions. Patience and discipline are critical in navigating the markets, and a broader range of factors are necessary for informed decisions.

Other Articles of Interest

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?