Unlocking the Truth: Does Technical Analysis Truly Work

Updated Dec 2023

Technical Analysis does work to a degree. However, one can’t rely on technical analysis to provide the whole picture. Additionally, when using technical analysis, one needs to customise the settings and not rely on standard settings. Everyone uses the default setting, so by following the default setting, you are going to see what everyone else sees. If everyone knows something, it is no longer valid.

So far, the first part is coming to pass. Once the MACDs complete the bullish crossover (weekly charts), we expect a mini-feeding frenzy to pave the way for the next top. Novice traders are about to get clobbered; “the term he got beaten within an inch of his live” comes to mind. Market Update Nov 11, 2021

Next year, technical analysis will only work well if used with Mass Psychology. Those that fail to take this route are better off tossing skull bones or reading tea leaves. As for fundamentals, toilet paper will be much better; at least it’s good for one swipe.

Technical Analysis: An Effective Tool for Stock Market Analysis and Prediction

We expect the markets to mount a sharp rally to the year’s end, which could extend into January. While we expect the markets to top, don’t expect them to break down immediately. There will be several head fake moves before the market breakdown. The intensity is expected to be sharp, and the duration is short. However, after the primary selling wave, the markets are expected to tread water for some time before breaking out.

Still, many strong stocks will bottom and break out long before the market puts in a bottom. Even if the markets don’t surge to new highs next year, many stocks will. We mean this when we expect the market’s “disorderly” nature to worsen.

Does Technical Analysis Work? New thoughts

The analysis of financial markets using technical analysis involves examining historical price data to forecast future price movements. This methodology operates under the assumption that past price movements offer valuable insights into the market’s trajectory. Technical analysis employs various tools such as charts, statistical indicators, and other techniques to identify patterns and trends in the market.

Harnessing Mass Psychology in Conjunction with Technical Analysis

Mass psychology plays a pivotal role in financial markets as it influences the behaviour of market participants. Since the market comprises individuals subject to emotions, biases, and beliefs, these factors often drive market movements. Understanding the sentiments and actions of market participants can provide valuable indications regarding the market’s direction. By incorporating mass psychology into technical analysis, one can identify market trends and patterns that aid in predicting future price movements.

For instance, investors tend to be optimistic and confident during a bullish market, while a bearish market prompts fear and pessimism. Technical analysis can leverage these emotions to pinpoint market turning points and anticipate future price movements. Combining mass psychology and technical analysis enhances the accuracy of future price predictions.

The Synergy of Contrarian Investing and Technical Analysis

Contrarian investing is an approach that involves taking positions contrary to prevailing market sentiment. Investors often buy when others are selling and sell when others are buying. This strategy assumes that the market frequently overreacts to news and events, causing prices to deviate from their intrinsic values. Contrarian investors aim to capitalize on these market overreactions and profit by adopting positions against the prevailing sentiment.

Integrating contrarian investing with technical analysis offers valuable insights into market turning points. While technical analysis identifies trends and patterns in the market, contrarian investing provides an alternate perspective on market sentiment. For example, if the technical research indicates a bullish trend, contrarian investing can help identify when the trend is likely to reverse. By exploiting market overreactions, investors can profit from contrarian positions.

Combining Mass Psychology, Contrarian Investing, and Technical Analysis

The combination of mass psychology, contrarian investing, and technical analysis further enhances the accuracy of predicting future price movements in financial markets. By incorporating these approaches, investors can make profitable investments in the market.

Technical analysis is a powerful tool for traders and investors seeking a competitive advantage in the stock market. By acquiring knowledge and employing specialised analysis techniques, one can make informed trading decisions and potentially increase overall profitability.

Remember, successful implementation of technical analysis necessitates a blend of knowledge, experience, and discipline. Continual self-education, staying abreast of market trends, and adapting strategies as necessary are crucial. Integrating risk management techniques into trading plans is essential to safeguard capital and minimize potential losses.

Expanding Your Understanding of Technical Analysis

To deepen your understanding of technical analysis, consider utilizing online resources, attending educational webinars or seminars, and studying reputable books authored by experienced traders. Immersing oneself in the world of technical analysis equips individuals with the tools necessary to navigate the complexities of the stock market.

In conclusion, technical analysis is valuable for traders and investors seeking a competitive edge in the stock market. By analyzing historical price and volume data, identifying patterns and trends, and applying technical indicators, individuals can make more informed trading decisions and potentially achieve greater success in their financial endeavours. However, it is important to note that mastering technical analysis requires time, practice, and a commitment to continual learning.

The Power of Technical Analysis in Today’s Financial Markets

Market forces are changing rapidly, and we closely monitor the psychology behind the markets. Hence, we might issue a general sell signal. Before we continue, remember Tactical Investors never panic. Such a sell signal is not be construed as a signal to panic. It simply implies that not all stocks might trade to the suggested exit points on time, and the better option would be to seek the best possible price on most of our holdings—an example of a general sell signal.

Close the following positions when the Dow trades in the 34 to 35k range. At that point, individuals would start to enter GTC orders slowly (remember, slow but sure as we never panic). The idea would be to aim for the best possible exit price. On the same token, we might also issue a general buy. For example, deploy 1/3rd into the following companies when the Dow trades in the 29 to 30k ranges. We could also mix match by issuing specific exit points on particular stocks while lumping a group of others into the general sell category.

Our strategy will be based on what the markets are doing. Once again, remember, we never panic. A Tactical Investor is the last to leave the room and the first to enter. We stroll in and out, leaving the running to the fools.

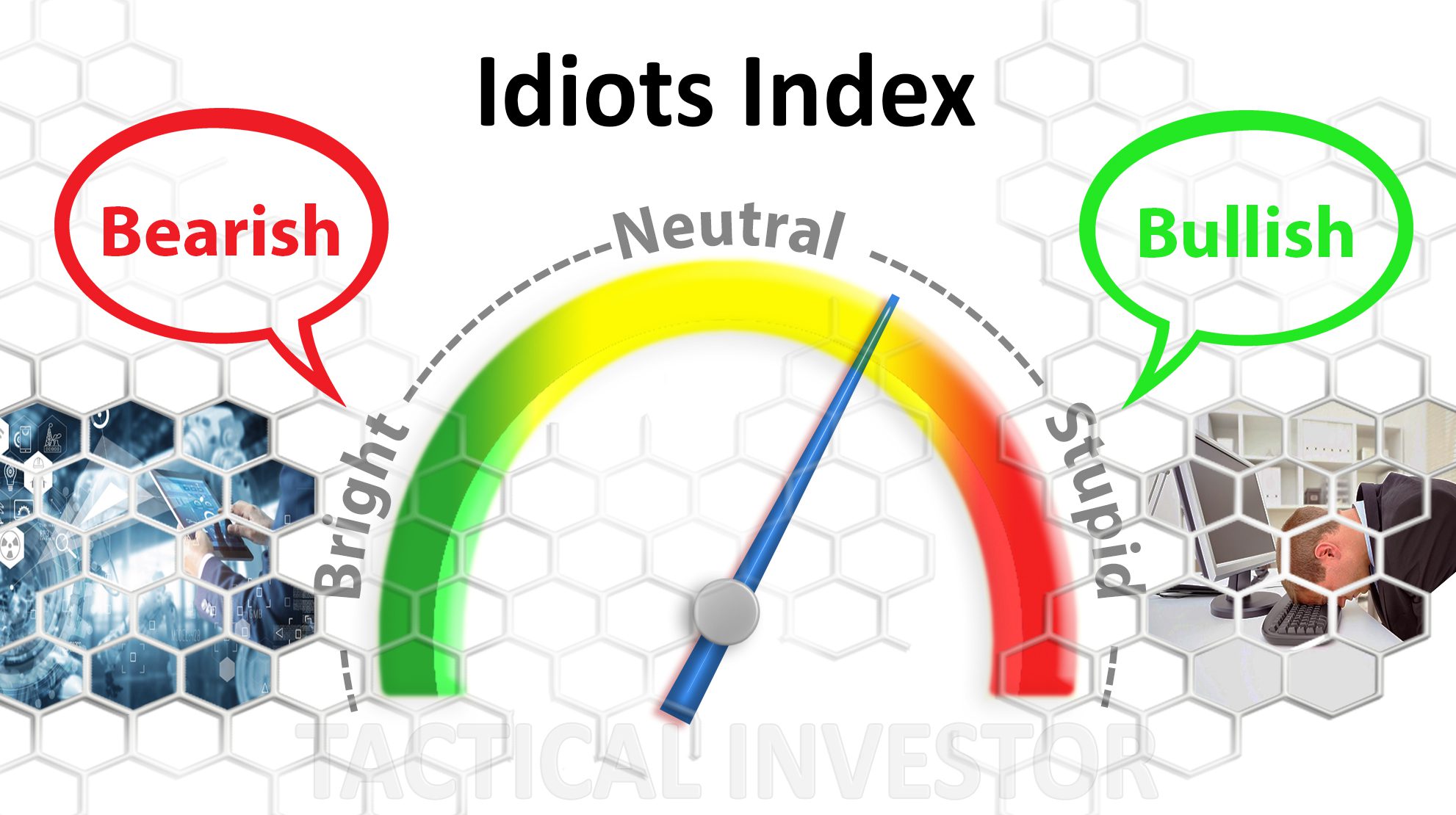

The idiot’s index is moving to the Neutral zone, indicating that intelligent individuals (but dumb investors) are becoming more confident. This suggests market action will be volatile as competent individuals generally make for the worst investors.

Published on February 14, 2022, and regularly updated with the latest information as of Dec 2023, this comprehensive guide provides up-to-date insights into the world of technical analysis.

Articles That Challenge Conventional Wisdom

Vulgar Words: A Psychological Perspective

Strategic Asset Allocation: Enhancing Portfolio Performance

Many Americans $400 Away From Hardship

LongNet: Empowering Transformers with 1,000,000,000 Tokens

Economic Illusions: Smoke and Mirrors?

AI in Agriculture: Amazing Advances For Artificial Intelligence

Market Sentiment Analysis: Americans’ Fear of Investing

Perma Bull Chronicles: Navigating Market Optimism and Trends

Mainstream Media: Don’t Bother Unless You Enjoy Losing

Decoding Stock Market Forecast: Absence of Crash Explained

Market Panic: Crowd Dumps Baby With The Bathwater

The renaissance of Australian gold miners

Examining 400 Billion Corporate Tax Forgiveness

Resilient Bullish Trend: Navigating the Realm of Bullish Stocks

Resilience and Recovery: Your Guide After the Stock Market Crash

Research suggesting technical analysis works

The effectiveness of technical analysis is a subject of debate in the finance industry, and some studies support and refute its efficacy. However, here are some examples of research that suggest technical analysis can be practical:

- A study by Brock, Lakonishok, and LeBaron in 1992 found that technical trading rules could generate profits in foreign exchange markets over a short-term period. Source: Brock, W., Lakonishok, J., & LeBaron, B. (1992). Simple technical trading rules and the stochastic properties of stock returns. Journal of Finance, 47(5), 1731-1764.

- A 2019 study by Neaime and Gaysset found that technical analysis can be useful in predicting stock returns in Middle Eastern markets. Source: Neaime, S., & Gaysset, I. (2019). Technical analysis and stock return predictability: Evidence from Middle Eastern stock markets. The Quarterly Review of Economics and Finance, 71, 50-65.

- A study by Sullivan in 1999 found that technical analysis can be an effective tool for stock selection and market timing. Source: Sullivan, R. (1999). The effectiveness of technical analysis: A review. The Financial Review, 34(2), 43-63.

- A 2017 study by Kocenda and Kozubek found that technical analysis can effectively predict stock returns in emerging markets. Source: Kocenda, E., & Kozubek, P. (2017). Expecting stock returns: A regime-switching combination approach and economic links. Journal of Forecasting, 36(4), 441-460.

- A study by Lo, Mamaysky, and Wang in 2000 found that technical analysis could be used to enhance portfolio returns. Source: Lo, A. W., Mamaysky, H., & Wang, J. (2000). Foundations of technical analysis: Computational algorithms, statistical inference, and practical implementation. Journal of Finance, 55(4), 1705-1765.