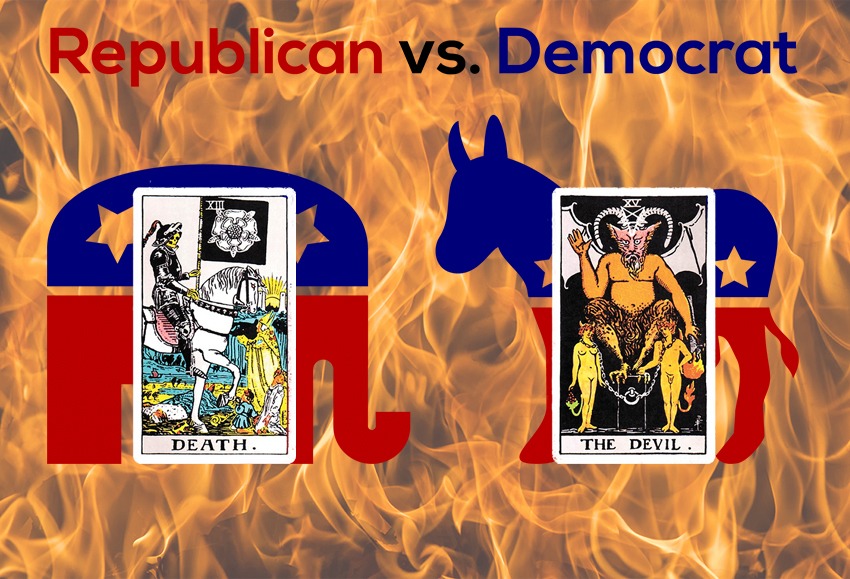

Democrat vs Republican: The Two Sides of the Same Coin

With the Democrats, the priority is to help the people at any cost by injecting as much money into the markets as possible. The Republicans, on the other hand, use a different approach to funnelling money into the markets. But the truth is, they are both cut from the same cloth. In the grand scheme of things, the argument of Democrat vs Republican is moot, as they are just two sides of the same coin.

The Impact of Fiat and the Unhinged Fed

The Federal Reserve has been given free rein to push the printing press into hyperdrive, creating massive amounts of Fiat. It’s crucial to recognize that Fiat is the primary threat to freedom in modern times. All the other issues that people argue about are just symptoms of the disease. The US National Debt is projected to reach a staggering $100 trillion, which could be catastrophic for Americans and others in the West. As the average person becomes increasingly dependent on psychotropic drugs and augmented reality technologies, the control exerted by the top players will only intensify.

The Power of Observation in a Controlled Narrative

The big players are masters at controlling the narrative. They have complete control over the Fear cycle and will soon exert control over the Pleasure cycle. However, those who can observe the situation from a distance, without falling prey to panic or emotional turmoil, stand to make out like bandits. The big players often provide clues and loopholes, but only those willing to look and observe can benefit from this information. Ultimately, the little pots of honey the big players miss can add to a significant windfall for the astute observer.

Fear alters the brains chemistry:

A recent Stanford University School of Medicine study has shed light on the impact of chronic stress and anxiety on the brain’s ability to regulate negative emotions. Published in Biological Psychiatry on April 21, this study marks the first time brain scans have been used to investigate the impact of anxiety and chronic stress on emotion-regulation circuits in children aged 10 or 11.

The Role of Brain Regions in Emotion Regulation

The study used MRI to analyze brain signals between two regions: amygdalae, which process fear, and the dorsolateral prefrontal cortex, linked to decision-making and emotion regulation. The results showed a strong signal from amygdalae to the prefrontal cortex in more anxious children, indicating a hijacked circuit and common marker for anxiety and stress.

Implications for Mood-Regulation Disorders in Children

The study’s findings have significant implications for mood-regulation disorders such as anxiety and depression, which are more deeply entrenched during the developmental stage of 10 to 11 years. The results underscore the importance of identifying and addressing chronic stress and anxiety in children, particularly concerning the brain’s ability to regulate negative emotions. http://stan.md/3bmNszb

It is worth noting that these children are the decision-makers of tomorrow, and the effects of the COVID pandemic and resulting hysteria could have far-reaching implications for them in the coming years. With Pavlovian-type training yielding optimal outcomes when subjects are young, the experiment’s global nature implies that its effects will be widespread. It remains to be seen what the long-term impact will be on the children’s psychological development and their decision-making abilities.

Cannabis helps one cope with anxiety.

Previous research has suggested that blocking the FAAH enzyme could decrease fear and anxiety by increasing endocannabinoid,. This is consistent with the reduced anxiety some experience after smoking marijuana.

In 2009, Hariri’s lab found that a common variant in the human FAAH gene leads to decreased enzyme function with impacts on the brain’s circuitry for processing fear and anxiety.

In the new study, Andrew Holmes’ group at the National Institute on Alcoholism and Alcohol Abuse tested the effects of a drug that blocks FAAH activity in fear-prone mice that had also been trained to be fearful through experiences in which they were delivered foot shocks.

Moving away from the Democrat vs Republican debate

The Tactical Investor Alternative Dow Theory suggests that the Dow utilities can indicate market trends. Despite some of our indicators showing a pullback, with some reaching extremely oversold levels, the utilities are still exhibiting an upward trend. This indicates that while the markets may experience a mild correction, some sectors may undergo significant downturns. It is important to remember that this market is not traditional anymore. Although our alternative Dow theory has been successful since 2006, there may be a divergence in 2021, and we are closely monitoring this and other developments. On a positive note, if the IDU closes above 83.00 monthly, it will signal that the Dow is likely to test 36K to 38K ranges with the possibility of overshooting to the 40,5000 to 42,000 range. Please visit this link for further information on the Tactical Investor Alternative Dow Theory.http://bit.ly/3oxWa1d

Other Articles of Interest

Mastering the Art of Retirement: How to Start Saving for Retirement at 45 with Grace and Style

Investor Sentiment in the Stock Market: Maximizing Its Use

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Financial Freedom Reverse Mortgage: A Sophisticated Strategy for a Comfortable Retirement

Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

Maximizing Gains: Mastering Market Sentiment Indicators

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams

Sophisticated Strategies for US Dollar Index Investing: Elevate Your Forex Game

How much has the stock market dropped in 2023?

Visionary Views: How to Achieve Financial Freedom Before 40