Stock Market Bubble: Opportunity and the Misconception of Crashes

Updated Dec 2023

Introduction:

Stock market bubbles have been a recurring phenomenon throughout history, capturing the attention of investors and economists alike. While these bubbles are often associated with economic downturns and market crashes, it is important to recognize that they also present opportunities for astute investors. This essay will explore the notion that stock market bubbles can be seen as periods of opportunity and examine how many bubbles are mistakenly interpreted as crashes due to the euphoria and overconfidence of the masses. To illustrate this, we will analyze the crashes of 1987, 2008, and the 2020 COVID-induced market decline.

Opportunity in Stock Market Bubbles:

Stock market bubbles create an environment of heightened optimism and speculative behaviour. During the bubble phase, market participants strongly believe in perpetual market growth, leading to inflated asset prices. This exuberance attracts more investors, driving prices even higher. While it is crucial to acknowledge that bubbles eventually burst, leading to market corrections, it is equally important to recognize that the bubble phase offers unique profit opportunities.

1. The 1987 Crash:

The 1987 stock market crash, also known as “Black Monday,” is a prime example of a bubble-like scenario. Before the crash, the stock market experienced an unprecedented rise, fueled by the proliferation of computerized trading strategies. However, the market became overbought, with prices detached from underlying fundamentals. The crash was inevitable, but for those who recognized the bubble and positioned themselves accordingly, it presented an opportunity to profit from the subsequent decline and subsequent recovery.

2. The 2008 Crash:

The 2008 financial crisis is often associated with the bursting of the housing bubble and subsequent market crash. The period leading up to the crash saw a surge in housing prices and the proliferation of risky mortgage-backed securities. As more investors jumped on the bandwagon, the bubble grew larger. However, the crash phase could be seen miles away for those who paid attention to the signs of an overheated market. Savvy investors who recognized the bubble had the opportunity to protect their investments or even profit from short-selling strategies.

3. The 2020 COVID Crash:

The COVID-19 pandemic led to a significant market decline in early 2020. While the initial trigger was a global health crisis, it is important to recognize that the market had already reached bubble-like levels prior to the outbreak. The prolonged period of optimism and overconfidence had created an environment ripe for correction. Investors who were cautious and recognized the unsustainable market conditions had an opportunity to protect their portfolios or strategically enter the market at lower prices during the crash phase.

The Masses and Misconceptions:

One common characteristic of stock market bubbles is the euphoria and overconfidence exhibited by the masses. This enthusiasm often leads to misconceptions, with many mistaking the bubble phase for a permanent surge, resulting in the misconception of crashes when they are, in fact, market corrections. The masses’ belief that the market will continue to rise indefinitely blinds them to the signs of an impending crash. This sentiment creates an opportunity for savvy investors who can identify the overbought conditions and strategically position themselves to profit during the subsequent correction.

Let’s examine historical stock market bubbles to demonstrate how they lead to monumental opportunities. Those who fail to learn from history are doomed to repeat it.

Stock Market Bubble Not In Sight As Trend Is UP

Buffett’s latest views on corrections and the coronavirus

‘It wasn’t October 1987, but it was an imitation… [and the financial crisis] was much more scary, by far, than anything that happened [on Monday].’

“If you stick around long enough, you’ll see everything in markets,” he said from his Omaha headquarters. “And it may have taken me to 89 years of age to throw this one into the experience, but the markets, if you have to be open second by second, react to news in a big-time way.

The astute investor now has a front-row seat to witness in real-time that the best time to buy stocks is when the masses are in disarray. They are now throwing the bathwater out with the baby, grandpa, grandma, and the family pet. It is in such moments that astute investors find real bargains. One needs to be patient for these opportunities and, more importantly, act when they present themselves. As usual, the crowd will panic and fee for the hills, when less than two weeks ago, they were begging for a chance to get into the very stocks they are now running from.

Nothing changes, and that is why the masses are destined to lose. The storyline is the same if you examine every single bubble in history.

Stock Market Bubble Not In The Offings Yet

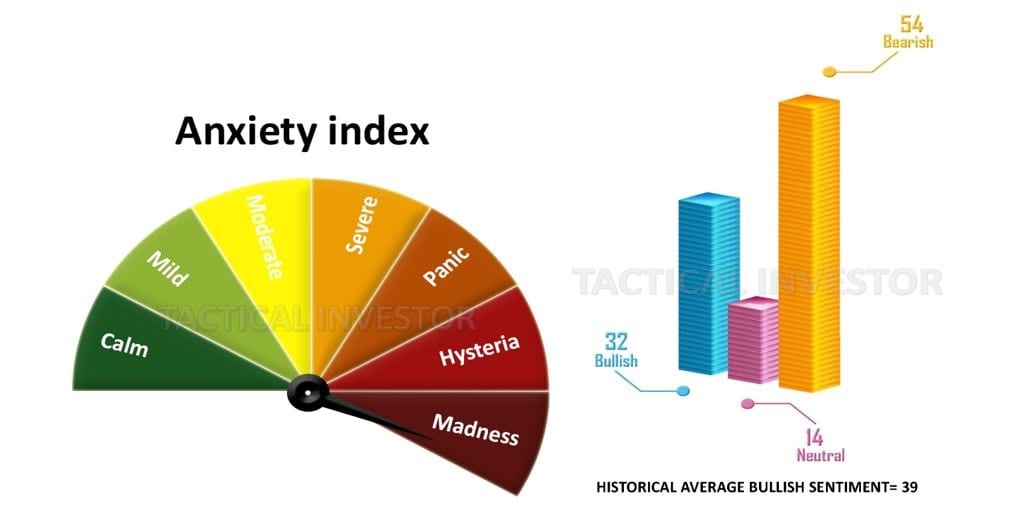

These readings were tabulated before yesterday’s pullback (July 31st), so a few more days of selling, could propel bearish readings. It is incredibly surprising that at this very late stage of the game, to see such a small number of individuals in the bullish camp. Once again, we have to reiterate no matter how strongly you might feel that this market should crash and burn, don’t act on those sentiments. No market in history has ever crashed until the masses have embraced it, and we don’t think this Bull market is not going to change that equation. Market Update July 31, 2019

Just one week later, the outlook has shifted, demonstrating how easily the masses can change their stance. It will require considerable effort for them to embrace this bull market wholeheartedly. However, this fickleness among the masses brings excellent news, as it suggests that this bull market has the potential to surge even higher than we initially anticipated.

Conclusion

If the market experiences a pullback, it should be seen as a bonus. This is why we also adopt the belief that in an upward trend, stronger deviations from the trend present better opportunities. Considerable pullbacks should be regarded as early Christmas bonuses, indicating that the trend remains firmly upward. Sharp pullbacks can be utilized to initiate new positions or add to existing ones.. Market Update July 24, 2019

If the pullback from yesterday starts to gain momentum, it should be welcomed as it will likely present a buying opportunity. The optimal time to make purchases is when the trend is upward and uncertainty begins to arise, and vice versa. When one feels confident that everything is going well and the markets are bound to continue rising, it is more probable that the opposite outcome will occur.s. Market Update July 31, 2019

Hindsight is fantastic, for it gives you all sorts of wonderful ideas that most fail to ever put into action when presented with the same situation again.

Random Notes: Buffett’s View on Stock Market Bubbles

“You, as shareholders of Berkshire, unless you own your shares on borrowed money or are going to sell them in a very short period of time, are better off if stocks get cheaper, because it means that we can be doing more intelligent things on your behalf than would be the case otherwise,”

“The real question is: ‘Has the 10-year or 20-year outlook for American businesses changed in the last 24 or 48 hours?’” the billionaire investor said on CNBC.

“You’ll notice many of the businesses we partially own, American Express AXP, +0.86% , Coca-Cola KO, those are businesses and you don’t buy or sell your business based on today’s headlines. If it gives you a chance to buy something you like and you can buy it even cheaper then it’s your good luck,” the chairman and CEO of Berkshire Hathaway BRK.B, added.

In his annual investor letter over the weekend, Buffett said equities would outperform bonds for years due to low tax rates.

“If something close to current rates should prevail over the coming decades and if corporate tax rates also remain near the low-level businesses now enjoy, it is almost certain that equities will over time perform far better than long-term, fixed-rate debt instruments,” he said. Full Story

Stock Market Bubble Outlook Update July 2020

At 26% of the S&P 500, tech’s footprint is almost double that of the next most significant industry, health care.

“Relative valuations matter, and tech is extremely stretched relative to other sectors,” said Dennis DeBusschere, head of portfolio strategy at Evercore ISI. “It’s tough to expect the market to hold up when tech is getting pummeled.”

“There are more pockets of the tech sector that are priced for perfection if not sainthood,” said David Sowerby, a portfolio manager at Ancora Advisors. “The bar has gotten meaningfully higher.”

Simply beating estimates is not enough to sustain the momentum. Earlier this week, Microsoft reported earnings that exceeded analyst forecasts, and its stock sank 4.4%. Such a pattern has played out across the industry. Among tech firms that reported, all exceeded profit forecasts, but their shares fell an average 1.1% on the first day, the second-worst reaction among the 11 main industries, data compiled by Bloomberg show.

“People have taken a ruler, and with tech companies, growth companies, they put the ruler down and drew a straight line up. We think that’s wrong,” Wells Fargo & Co.’s strategist Chris Harvey said in an interview on Bloomberg Television. “We want people to start taking profits from your uber-caps and from your momentum names, and cycle back in some economic sensitive names because that’s what we think the real mispricings are.” yahoo Finance

Stock Market Bubble 2020 Conclusion

These individuals who felt clever by criticizing us during the market downturn will soon experience regret if they haven’t already. They made the same mistake in the past, vowing never to succumb to fake news or panic that led them to sell their shares at the market bottom. However, like mentally unstable individuals, they repeated the same error at the most inopportune moment, using the excuse of “it’s different this time.” The truth is, it will always be different, and that’s the excuse the masses will perpetually use to justify their emotionally driven selling instead of buying with logic.

This pattern will repeat itself over and over again because the collective mindset of the masses lacks proper understanding. Hence, the saying, “misery loves company,” and stupidity demands it. Success is based on adopting an approach that is likely to attract criticism from the masses. The only saying that comes to mind is that the truth hurts, and indeed it does.

Achieving success in the markets requires mastering control over one’s emotions. However, this cannot be accomplished through force, as it is not sustainable in the long run. Instead, it demands self-realization that emotions serve no purpose in the realm of investing. How can one attain this self-realization? Primarily through self-observation and, secondarily, by reading the right books. A curated list of recommended books is provided in the passcoded section of the website. A helpful approach to expedite the process of enlightenment is to perceive the stock market as a vast video game.

Considering the current discontent among the masses, every significant market correction should be embraced like a lost love, recognizing the potential it holds.

Other Articles of Interest

BIIB stock Price: Is it time to buy

Stock market crashes timelines

Dow theory no longer relevant-Better Alternative exists

In 1929 the stock market crashed because of

Apple Stock Predictions For 2020 and Beyond

Apple Stock Buy Or Sell: It’s Time To Load Up In 2020

Apple Stock Price Target: Is It Time To Buy AAPL