I add this, that rational ability without education has more often raised a man to glory and virtue, than education without natural ability. Marcus T. Cicero

Trump and the Economy

Before we get into the meat of this article, we would like to state at the onset that this article is not politically orientated. This election has probably been more divisive than any other election in U.S history. There are those who love Trump and those who detest him. Our views are based on market trends and not politics. Before the election results came in, we went on record to state that a Trump win would from an investing perspective prove to be a great buying opportunity and the masses would panic and dump their shares. We took the same stance on Brexit, and as they say, the rest is history.

From a contrarian angle (and not a political point of view) a Trump win could be construed as a positive development; non-contrarians will demand to know why? Mass Psychology clearly states that the masses are always on the wrong side of the equation. A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking. Tactical Investor

Trump and the Economy: His Agenda Appears Bullish for the Stock Market

Trump’s agenda is in some aspects strikingly similar to that of Ronald Regan’s who was known for his pro-growth policies. When Regan took office, unemployment was in the 7.5% ranges by the time he left office it had dropped down to 5.4%. GDP growth surged and averaged 3.8% per year. Inflation was brought down to 3.7% and averaged 4.4% during his eight-year reign.

Regan’s massive tax cuts contributed to exponential growth. He cut taxes from 70% to 28% for the top income tax rate, and reduced corporate taxes from 48% to 34%. This is what probably helped drive the SPX 400% higher over the past 30 years, and these policies continue to drive the market higher. Trump is seeking to lower corporate taxes from 35% to 15% and has aspirations to reduce taxes for the average American. He also wants to embark on a massive infrastructure restoration plan, which if implemented should create thousands upon thousands of jobs.

Traits that Trump shares with Regan

- Both were outsiders

- Both were TV personalities; the only difference is that Trump is both a television personality and a businessman

- Both were ridiculed by the press and were mostly written off from having any chance at a win

- They both made promises to make America great

So how is Trump’s economy faring?

Well, by looking at the stock market, the outlook appears to be pretty good. The Dow has had Ten winning days in a row and is now up roughly 5% for the year. The markets are forward-looking beasts so they appear to be viewing Trump’s economy agenda through a bullish lens. However, everyone is getting excited over this market, which might not be such a good thing in the short term, but that is a story for another day.

Wall Street is drooling over the prospect of less regulation

And lower taxes and judging by Trump’s recent actions; he looks set to deliver on many of his campaign promises. There is a massive pile of money sitting overseas that corporations would repatriate in a heartbeat under the right conditions. Some estimates put the amount of cash sitting overseas at $2.5 trillion. Trump could soon provide them with that opportunity, and this money among many other things could be used to fund massive share buybacks which will only help propel these stocks higher. Among the biggest benefactors from a lower corporate tax rate would be GE, AAPL, and MSFT.

Under Regan, the stock market soared, unemployment levels dropped, and GDP growth rates rose significantly. If Trump takes a similar path, then the outlook for the stock market going forward could be quite favourable. However, one should always defer to Mass Psychology; if the crowd turns euphoric than caution is warranted. The time to jump in head first was in Nov of 2015, Jan of 2016 and before Trump won the elections. As the trend is still up, sharp pullbacks have to viewed through a bullish lens. The crowd is not euphoric, but the markets are extremely overbought, so prudence is justified over the short term. Investors should consider waiting for the market to let out a nice dose of steam before jumping in.

A genius can’t be forced; nor can you make an ape an alderman.

Thomas Somerville

Trump and the Economy Update September 2019

The best time to buy is when the masses are scared and the markets appear to be acting erratically. We have gone through similar phases many times in the past; the most recent of which occurred from Nov 2018 to roughly Feb 2019.

We have always stated that when it comes to the markets, discipline and patience are paramount to success, and right now, patience is called for. We will have many opportunities resembling the one we experienced from Nov 2018 to Feb 2019. As far as the masses were concerned the period from Nov 2018 to Feb 2019 was a period of stress and chaos. They always react in the wrong way at precisely the right time.

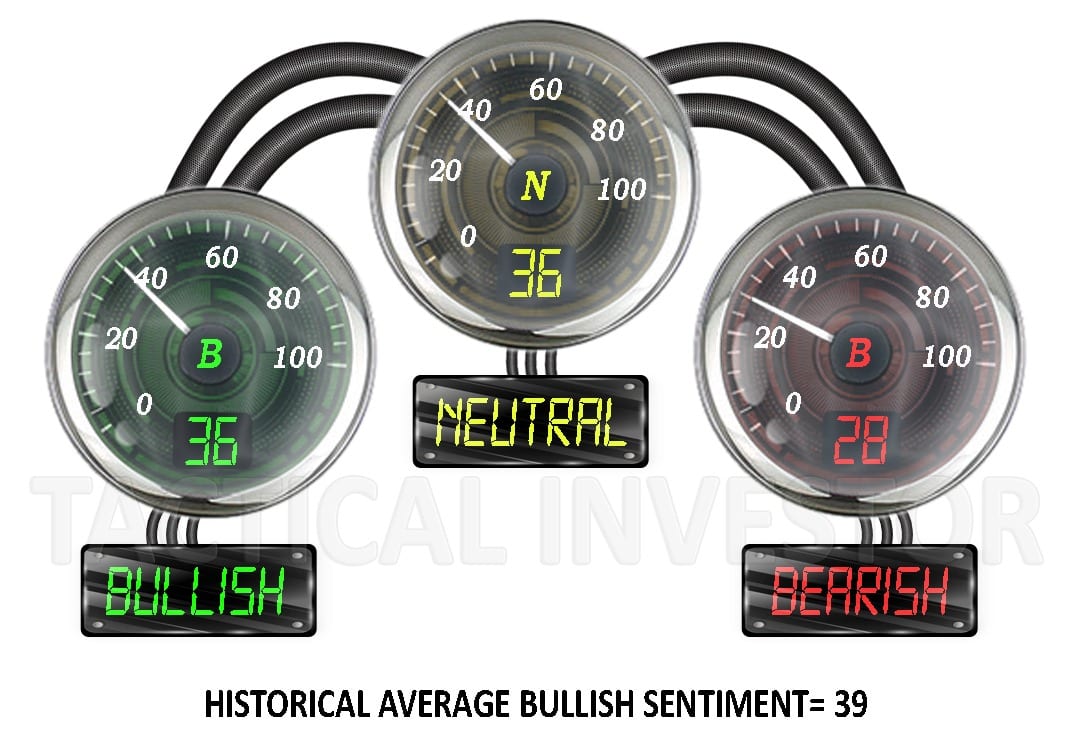

Sentiment has not changed that much this week; the current readings stand at

Notice a pattern here; the lowest reading comes from the bulls, and when you combine the neutrals and bears it adds up to 64. In the long run, the crowd is too uncertain for the markets to crash, but that does not mean the markets cannot experience a fast and furious pullback. Too many markets are trending upwards, and certain markets like bitcoin are showing signs of the“feeding frenzy stage”, and lastly, V readings are still at all-time high levels indicating that extreme volatility is something we should all be prepared for. One could, therefore, conclude that the Stock Market Forecast For Next 3 months is likely to be bullish and that all strong pullback backs should be viewed through a bullish lens.Continue reading

Other Articles of Interest

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)