Copper outlook: To dance or Not to

Updated March 2023

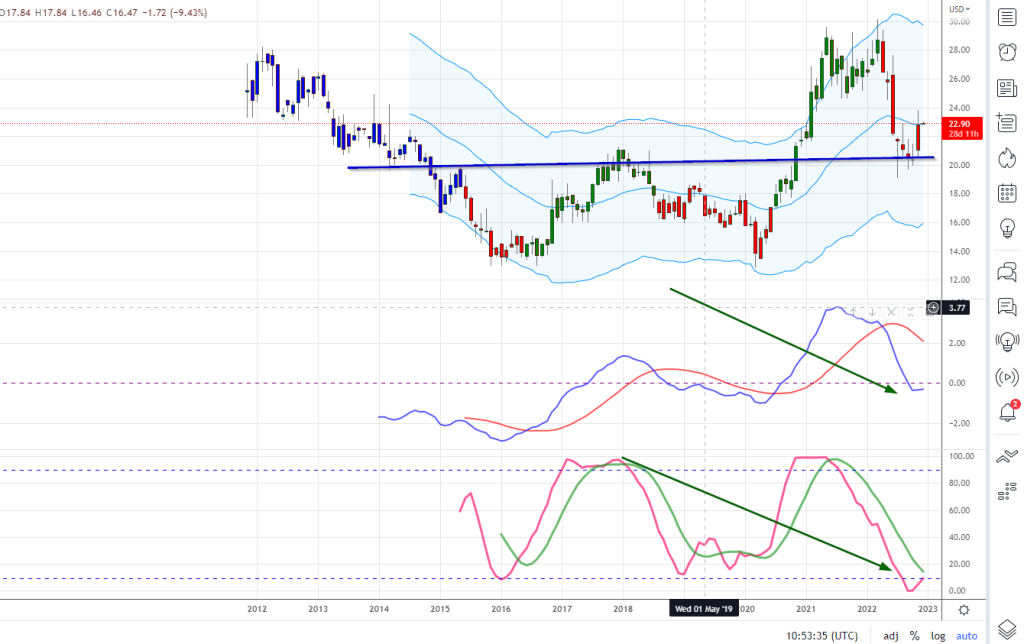

In the August 27 market update on the copper outlook: we stated that Copper (another leading economic indicator) is not faring so well.

That outlook is accurate, but from a longer-term perspective, one could argue that it trades in the oversold ranges and will soon move to the extremely oversold ranges.

Copper market base formations and the stock market have an uncanny relationship. In every instance, the markets rallied shortly after Copper put in a bottom.

While the markets will gyrate in the short term, the long-term outlook suggests that the Fed will cave in shortly before or after Copper puts in a bottom. The long-term copper outlook (18-24 months) is bullish, and astute investors would do well to accumulate the strongest stocks in the sector. Two plays that come to mind are SCCO and FCX

Courtesy of tradingview.com

Copper Outlook: March 2023 Update

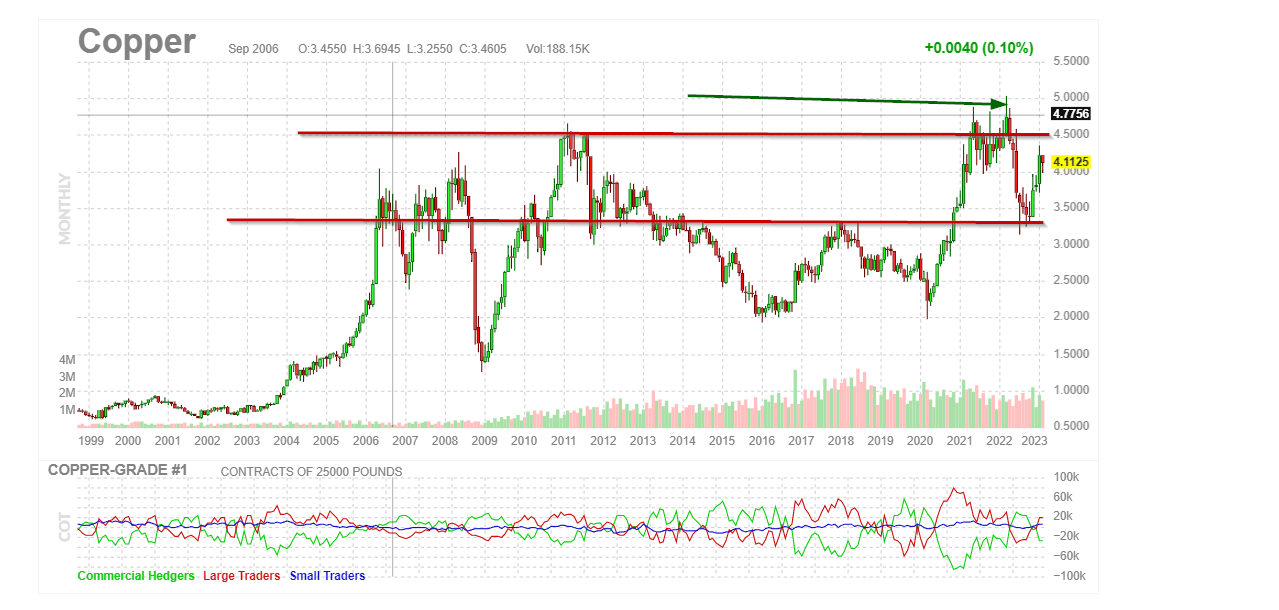

2022 saw copper hitting new highs, indicating that the global economy was not in dire straits. Instead, the root cause of our troubles lay in the ill-conceived political decisions made by confident world leaders. At the forefront of this pack of “stupid leaders” was the United States. Despite a brief slump, copper held steady and impressively surged beyond the 4.50 mark, revealing that issues with inflation and supply were merely symptoms of bad policies – and President Biden’s policies were chief among them.

As a result, the good doctor Copper is currently gaining momentum and is set to trade past 4.50. Unfortunately, this means that the market will be range-bound for years, a scenario that will be a bane for long-term investors who focus on indices.

However, it presents an excellent opportunity for traders who can effectively use market psychology and technical analysis to make a killing. Leading economic indicators play an essential role in trading, providing valuable insights into the future state of the economy and helping traders make well-informed decisions.

Copper is a market that is forward-looking and can be volatile. Despite a wide range of trading activity since 2006, with a sharp downturn in 2008-2009. However, copper will experience a significant upward move, eventually driving its price to the 9 to 11 range. Furthermore, it is highly possible that one index could break new highs, but a range-bound market may be the most likely path for the next 18 to 36 months.

Turmoil in the Copper Market?

The demand for copper is increasing due to its widespread use across various industries, and the global supply is facing shortages. As a result, the stock prices of companies producing copper are expected to rise, presenting a compelling investment opportunity for investors. Companies such as FCX and SCCO are worth considering due to their ability to maintain high production levels and navigate the volatile copper market.

The demand for copper is expected to increase even further as governments worldwide push for sustainable energy alternatives, including wind turbines and solar panels, which require copper in their construction. Investing in copper stocks provides a promising opportunity for investors to capitalize on the projected growth of this essential commodity.

In light of the current global copper shortage, investors should remain focused on copper stocks, as these stocks are poised to rise in value as the demand for copper continues to escalate. With the increasing demand for copper and the current supply shortages, investing in copper stocks such as FCX and SCCO can provide savvy investors with an excellent return on investment.

Random thoughts on Investing

Achieving success in investing requires a powerful combination of understanding mass psychology and utilising technical analysis. Comprehending the crowd’s behaviour can gain valuable insights into the market’s dynamics. Identifying trends becomes more straightforward once these insights are acquired. Additionally, incorporating the fundamental principles of crowd behaviour and market psychology plays a crucial role in identifying trends and making informed trading decisions.

Furthermore, embracing the principles of contrarian investing.

FAQ: Copper Outlook

Q: What is the current outlook for copper?

A: The August 27 market update indicated copper is not faring well. However, from a longer-term perspective, it trades in the oversold ranges and is expected to move to the extremely oversold ranges.

Q: Is there a relationship between copper market base formations and the stock market?

A: Yes, in every instance, the markets rallied shortly after copper put in a bottom, suggesting a correlation between copper and the stock market.

Q: What is the long-term outlook for copper?

A: The long-term outlook for copper (18-24 months) is bullish, and astute investors may consider accumulating solid stocks in the sector, such as SCCO and FCX.

Q: What factors influenced copper’s performance in 2022?

A: Copper hitting new highs in 2022 indicated that the global economy was not in dire straits. Issues with inflation and supply were primarily attributed to ill-conceived political decisions, particularly in the United States.

Q: What is the current momentum of copper?

A: Copper is gaining momentum and is expected to trade past 4.50. However, this suggests a range-bound market for years, which may be challenging for long-term investors focused on indices.

Q: What role do leading economic indicators play in trading?

A: Leading economic indicators, such as copper, provide valuable insights into the future state of the economy and help traders make well-informed decisions.

Q: What are the future price expectations for copper?

A: Copper is a forward-looking and volatile market. While there has been a wide range of trading activity since 2006, including a sharp downturn in 2008-2009, copper is anticipated to eventually experience a significant upward move, potentially driving its price to the 9 to 11 range. However, a range-bound market may be the most likely path for the next 18 to 36 months.

Q: How is the demand for copper expected to evolve?

A: The demand for copper is increasing due to its widespread use in various industries, and global supply is facing shortages. Investing in copper stocks, such as FCX and SCCO, can benefit from this essential commodity’s projected growth.

Q: Why should investors focus on copper stocks?

A: With the current global copper shortage, investing in copper stocks becomes crucial as these stocks are poised to rise in value due to escalating demand. Companies like FCX and SCCO, which maintain high production levels and navigate the volatile copper market, are worth considering for potential returns on investment.

Q: Are there any other articles of interest related to copper?

A: There are other articles covering various aspects of the copper market that may provide further insights and information.

Other Articles of Interest

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Unraveling the Enigma: The Dark Allure of Mob Mentality

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Unmasking Deceit: Examples of Yellow Journalism

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Investment Journal: Charting the Course Toward Financial Triumph

Trading Success: From Riches to Rags and the Rise to Wealth Mogul

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology