Stock Market Psychology: Understanding Emotions & Cognitive Biases

March 29, 2024

Stock market psychology refers to the mental and emotional factors influencing traders’ decision-making. Understanding stock market psychology is crucial for traders to effectively make informed decisions and manage their emotions and cognitive biases. This essay will explore the role of emotions and cognitive biases in trading decisions, strategies for addressing these factors, the impact of market trends and news on stock market psychology, and the principles of mass formation psychology in stock market trading. Additionally, we will discuss the effects of personal values and beliefs on stock market psychology.

The Role of Emotions in Stock Market Psychology

Emotions are pivotal in stock market psychology, profoundly shaping investor decisions. Fear and greed drive market dynamics, while loss aversion and regret further influence trading behaviour.

– Fear: Sparks panic selling, worsening market downturns.

– Greed: Fuels overconfidence, inflating market bubbles.

– Loss Aversion: This leads to holding losing positions and hoping for a turnaround.

– Regret: Encourages impulsive trades, often at peak prices.

Managing Emotional Influence

– Develop Self-Awareness: Recognize emotional triggers to control them better.

– Establish Trading Rules: Predefined rules reduce impulsive decisions.

– Implement Risk Management: Use stop-loss orders and proper position sizing.

– Maintain Emotional Resilience: Practices like mindfulness aid in emotional management.

Effectively managing emotions distinguishes successful traders from struggling ones. By acknowledging emotions’ power and employing strategies to regulate them, traders can enhance decision-making and achieve better outcomes in the volatile stock market.

The Impact of Cognitive Biases on Stock Market Psychology

Mental heuristics, known as cognitive biases, can result in erroneous choices. Confirmation bias, anchoring bias, and availability bias are three common cognitive biases that can impact stock market psychology. When traders look for information that supports their current opinions and overlook information that contradicts them, this is known as confirmation bias. Anchoring bias occurs when traders fixate on a particular piece of information, such as a stock’s price, and use it as a reference point for all subsequent decisions. Availability bias occurs when traders rely too heavily on recent or easily accessible information when making decisions.

The Impact of Market Trends and News on Market Psychology

Market trends and news can significantly impact stock market psychology. Market volatility can cause traders to experience strong emotions and make impulsive decisions. Additionally important is the effect of media and social media on market sentiment. Traders should be aware of the impact of market trends and news on their emotions and decision-making processes and develop strategies for managing them effectively.

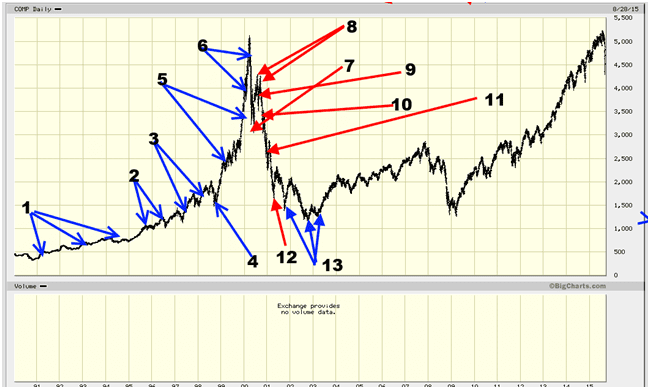

Mass formation psychology is a branch of social psychology that explores the unique psychology of crowds and how it differs from that of individuals. Understanding herd mentality and the psychology of crowds is crucial for traders to make informed decisions. Contrarian investing and crowd psychology are two concepts that traders can use to improve their results. Mass psychology takes the principle of contrarian investing and pushes it to the next level. Investors who adopt the doctrine of mass psychology will understand how to use market sentiment to their advantage.

Mass Psychology is a grossly misunderstood field, often confused with contrarian investing. Contrarians usually jump in and out of the markets too early, missing out on the most significant part of the move.

In most cases, these contrarians are fashion contrarians, meaning they choose the title because it sounds cool, and they usually lose more than they make on a given day or year. Understanding herd mentality and the psychology of crowds is crucial for traders to make informed decisions. Mass formation psychology takes the principle of contrarian investing and pushes it to the next level. Investors who adopt the doctrine of mass psychology will understand how to use market sentiment to their advantage.

Mastering Stock Market Psychology: Unveiling Emotions Behind Investment Moves

- This stock is going nowhere; it is hardly moving, and the fundamentals are weak. I need to find a high flyer that can move, not this laggard.

- Pure luck. The fools who jumped in will regret it. This is a false breakout. This stock is going to drop to new lows. I am not going to waste my hard-earned money on this junk.

- Holy smokes, the stock is still going up. Earnings are terrible, long-term fundamentals are not great, and the technical outlook is far from perfect. I think I will pass, as I am sure it will crash and burn. I am sure it is the secret code word for knowing nothing. Moreover, it is impossible to use technical indicators effectively if you are looking through an emotional lens.

- Thank goodness I did not buy it; I knew it would crash. Instead of focusing on the fact that the stock is letting out some steam and building momentum for the next leg up, the mass mindset sees only what it wants to see. Governed by useless emotions, it cannot recognise the opportunity, as it has an almost unstoppable affinity for embracing the opposite. In this instance, the market did pull back, but a close examination reveals that the pullback is just the market letting out some well-deserved steam. The market puts in a higher low, which is a very bullish development. The horde has an impeccable record of jumping into an investment when everyone is euphoric and out of them when blood flows through the streets.

- Wait a minute, what’s going on here? The market was supposed to crash. Maybe I made a mistake in not buying. Well, it’s not too late; the picture looks good, and analysts are upbeat about earnings, so I think it is still not too late to get in. The masses need reassurance that all is well, but comforts come only towards the end of the game. Finally, this chap musters the courage to jump in. Wow, it went up. Great, I’m making money.

- I was wise to wait until things improved; the markets would take off. Let me call all my friends and tell them to jump in before it’s too late. When everyone is happy, it is usually time to hit the road.

- What is going on; why is the market dropping? It’s only a pullback; I will not fall for this game again (look at reason number 4). It’s time to average down and load up.

- There you go; I knew it was going to turn around. I should have put more into the market. Next time, I will load up as this is how to make money. Now, the secret desire to lose syndrome kicks in. This guy is trapped in a euphoric mood and fails to recognise that the market did not trade to new highs. It put in a lower joy, which should have been construed as a warning signal. As we stated before, the mass mindset only detects what it wants to spot. The only thing that matters for this guy is that he made some extra money.

- It’s going down again. Opportunity is knocking, and it’s time to load up. Earnings continue to improve; all the analysts on CNBC are bullish, and therefore, it must be a good opportunity to put even more money into the markets. It’s time to back the truck and load up. I need to call everyone and tell them not to miss this opportunity. When you are sure about something, sitting out and waiting is better. Overconfidence is a sure sign that you are missing something.

- The market is hit with bad news and pulls back very strongly. Ah, this is just a temporary development. The market will recoup and trend higher. I am going to buy more and average down. Gamblers always think of averaging down and hardly think of averaging upwards. Suddenly, this chap has become an expert on the timing of the markets. Blind faith is one of the main ingredients the masses seem to have an endless amount of. If you trade the markets on faith, only one thing is waiting for you at the end of the cycle: loss and despair.

- As panic and dread set in, the person begins questioning their investment decisions. They wonder if buying more was the right choice or if they should have sold when they were ahead to secure their gains. Thoughts of cutting their losses and bailing out start to arise, they decide to wait a little longer, hoping for a sudden change in the market. They believe things will improve and that the current downturn is only temporary. However, as time passes, they become increasingly convinced that the market is a dead end and that they should get out while they still can.

- Ironically, the market shows signs of a potential rebound just as this person bails out. They are selling their positions at the bottom, driven by fear and anxiety, just as they had previously been guided by joy when they entered the market. In reality, they should have held onto their positions as the market was beginning to bottom out.

Conclusion

In the stock market, personal values and beliefs are the invisible actors, silently scripting the moves of traders and investors. Understanding these inner drivers is crucial, for they often pull the strings of decision-making, sometimes leading to a performance of triumph, other times to a tragedy of losses.

A trader who values stability and security highly may tread cautiously; every step weighed with the gravity of risk aversion. In contrast, a seeker of growth and opportunity may dance on the tightrope of volatility, their eyes fixed on the horizon of potential rewards.

The market, a stage of endless dynamics, does not bow to the will of the masses. The contrarian, a lone wolf by nature, measures success not by the echoes of their pack but by the silence they maintain from the crowd’s clamour. Yet, even the most solitary of wolves can miss the forest for the trees, neglecting to gauge the enthusiasm of their convictions.

True mastery of the market demands a watchful eye on the boiling point of emotions. At this zenith of sentiment, the contrarian may strike, going long or short with the precision of a maestro conducting a symphony of buy and sell orders.

The market is not a realm for the faint-hearted. It is a domain where the likes of Rothschild, Graham, and Buffett have etched their legacies, not through the whims of chance but through the deliberate application of discipline, research, and unyielding adherence to their core principles.

In this world, emotions are spectres that must be acknowledged yet never allowed to take the helm. For the trader who masters their inner theatre, aligning values with the unemotional calculus of market forces, the market offers a spectacle of numbers and charts and a canvas for crafting their magnum opus.

Other Articles That Are Related To Mob Behavior

Investor Sentiment in the Stock Market: Maximizing Its Use

A Crisis of Beliefs: Investor Psychology and Financial Fragility

Copper ETF 3X: Rock On or Get Rolled Over

Which of the Following Is True of Portfolio Diversification?

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Dogs of the Dow 2023: Howl or Howl Not?

Navigate Student Loans: Discover, Settle, Excel

Early Retirement Extreme Book: Dive into the Facts, Skip the Book

What Is Blue Gas? Unveiling the Energy Mystery

From Student Loans to Financial Freedom: A Post-Graduation Roadmap

How do savings bonds work after 20 years?

In Which Situation Would a Savings Bond Be the Best Investment to Earn Interest?

Which Type of Account Offers Tax-Deferred Investing for Retirement?

How to Start Saving for Retirement at 35 and Ensure a Comfortable Future

Comic strip Illustrating mass psychology in action

Avoid These Common Stock Investment Mistakes

Why Mechanical and Technical Analysis Systems Fail

The Limitations of Trend Lines

Contrarian Investment Guidelines