Trading Chart Patterns Cheat Sheet: Your Trading Companion

Updated March 2023

Upon examining the Euro chart provided, the following observations come to light:

1. The Euro formed a double top pattern, unable to surpass the resistance level of 119. A sell signal emerges around the 118.5 mark.

2. The initial target is 112.00, presenting a relatively straightforward objective.

3. The second target stands at 108, while the third target extends to 1.05.

4. A highly ambitious target of .96 exists, although it is advisable to consider taking profits within the 105-108 range, especially since the first target has already been achieved.

Source: futures.tradingcharts.com/

Euro Fundamentals and Dollar Prospects: Assessing Market Dynamics

The Euro’s fundamental situation remains largely unchanged, maintaining its unfavourable state. However, recent market activity reveals a shift in investor sentiment, with individuals transitioning from one troubled currency to another perceived as relatively less unstable. Amidst this context, it would be prudent to consider going long on the dollar within the .92 range while concurrently shorting the Euro.

Forecasts suggest the potential for the dollar to reach a multi-quarter high, raising the possibility of it surpassing the 1.02 level in the near future.

As a consequence, the expected outcome would prompt a correction in the gold market. The substantial rise in gold shares can be attributed, in part, to significant capital outflows from the bond markets, with some of that capital redirecting into the gold and silver sectors. However, it is crucial to acknowledge that these sectors are relatively small, making them susceptible to even minor shifts in money flow, resulting in significant ramifications. The fact that bullion prices have not attained new highs further supports the theory that this recent surge in gold shares is driven by money transitioning between sectors, actively seeking the next lucrative investment opportunity.

Therefore, it is highly probable that gold and silver will enter a consolidation phase, extending well into October or early November, as this adjustment allows for a recalibration of market forces.

Trading Chart Patterns Update: Gold’s Surge and Potential Delays

The recent ascent of Gold, surpassing 380 and showing minimal signs of a significant pullback, suggests a potential delay in the previously outlined scenario. There is now a possibility for Gold to test the 400 and even 420 levels. However, caution is warranted as technical and psychological indicators are currently overwhelmingly bullish, which raises concerns from a contrarian viewpoint as the general public tends to be incorrect in their market predictions.

Furthermore, Gold has entered the realm of extreme esoteric cycles, which typically signifies an unfavourable environment for long-term positions in any tradable instrument, be it stocks, commodities, or otherwise. Consequently, Gold is presently deemed more suitable for short-term trades. We will maintain our positions only for those established in our long-term portfolio during 2000, November 2002, and March 2003. Any additional positions we may take will be very short-term, specifically designated for our trading portfolio.

Trading Chart Patterns Update: Dow’s Relationship with Euro and Dollar

Upon analyzing the provided chart, it becomes evident that the Dow exhibited oscillating movements in relation to both the Euro and the US dollar. However, in the context of 2003, an intriguing observation emerges—despite the Dow repeatedly achieving new yearly highs, it appears relatively stagnant when evaluated in terms of the Euro. Instead, its movements seem to be primarily influenced by the deflated US dollar.

The dollar experienced a decline of over 30% against the Dow. Considering the Dow’s low point around 7400, a 30% increase from that level points to a target range of approximately 9620, with some minor fluctuations. Unless the dollar continues to depreciate, the Dow is expected to peak in the field of 9600-9800. Consequently, this projection suggests that the Euro is poised for a rally, indicating the emergence of a new bull market. It is important to note that this particular bull market will be distinct in that liquidity factors will predominantly drive it.

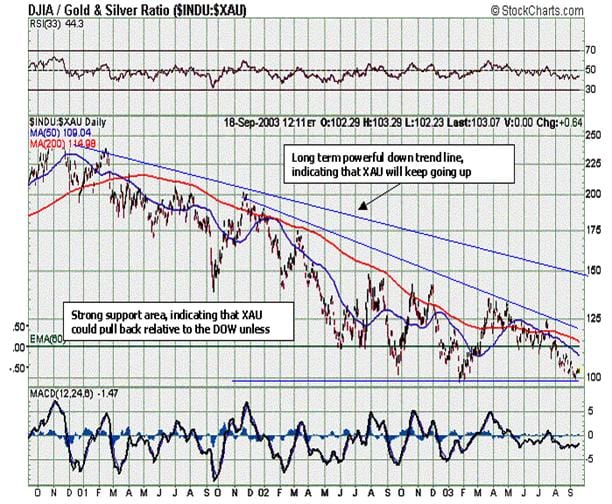

Chart Analysis: Gold, Silver, and Dow Interplay

The provided chart inherently reveals a compelling narrative. Since 2000, there has been a consistent decline in the amount of silver and gold that the Dow, as measured by the XAU index, can purchase. We stand at a critical juncture, having recently established a triple bottom around the 100 mark on the chart displayed. This support level requires the Dow and XAU to continue their simultaneous upward trajectory.

.

However, if this crucial line is breached, leading to a breakdown below the 100 zones, it could signify the potential for significantly higher gold prices. Ultimately, the eventual violation of this line seems probable. Nevertheless, it would be reasonable to expect a temporary respite in the upward movement of gold and silver as they take a breather before embarking on another rally

Random Market Reflections: Manipulation and Inequality

The Erosion of Morals and the Pursuit of Money

Our monetary system has undergone significant changes since the departure from the gold standard. With money no longer backed by tangible assets, it has opened the doors for questionable practices. As the money supply increased, moral values seemed to decline, leading us to a point where monetary pursuits often overshadow the worth of a life.

The Fed’s Role in Boom and Bust Cycles

The Federal Reserve intentionally creates boom and bust cycles through its manipulation of interest rates. Their actions disregard concerns of inflation or deflation, as they set in motion processes that generate the very outcomes they claim to combat. Understanding this intricate dance of monetary policy is crucial for those seeking a deeper understanding of the system.

Awakening the Masses: The Power of Mass Psychology

Mass psychology reveals that most people only awaken to the realities of the system when it is on the brink of collapse. At this critical point, they find themselves helpless, left with no choice but to voice their frustrations. The system perpetuates a cycle where the masses remain unaware until the ship is on the verge of capsizing.

Unveiling the Web of Influence

Stepping back and adopting a broader perspective allows us to witness powerful individuals’ intricate web of influence. Their manipulation extends beyond monetary matters, infiltrating key sectors such as the media, healthcare, and the military-industrial complex. This control shapes our collective understanding, creating a skewed reality that serves their own agendas.

Approximately 75% of individuals face immense challenges when they enter this world. Circumstances beyond their control limit their opportunities, perpetuating a cycle of struggle and inequality. This systemic disadvantage further reinforces the power dynamics orchestrated by those in authority.

Conclusion:

Unveiling the intricate web of manipulation, influence, and inequality is daunting. By understanding the erosion of morals, the role of the Federal Reserve, the power of mass psychology, and the pervasive influence of powerful individuals, we can grasp the complexities of our current system. It is crucial to recognize the majority’s struggles and work towards a more equitable society. Only through awareness and collective action can we hope to dismantle the structures that perpetuate inequality and strive for a more just and balanced future.

Originally published: Aug 20, 2003, and continuously updated over the years. The most recent update was March 2023

Exceptional Articles You Need to Read

Mastering the Art of Retirement: How to Start Saving for Retirement at 45 with Grace and Style

Investor Sentiment in the Stock Market: Maximizing Its Use

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Financial Freedom Reverse Mortgage: A Sophisticated Strategy for a Comfortable Retirement

Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

Maximizing Gains: Mastering Market Sentiment Indicators

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams

Sophisticated Strategies for US Dollar Index Investing: Elevate Your Forex Game

How much has the stock market dropped in 2023?

Visionary Views: How to Achieve Financial Freedom Before 40

A Major Problem with ESOPs is That Employees Can Lose Big