When the crowd panics, cash is king.

Updated Dec 31, 2023

We received many emails when the markets were plunging, both from our free newsletter service and a few from the premium services. The common theme in around 90% of the emails was that we had lost our minds. 36% of those emails contained colourful language. For the record, most unsavoury emails originated from those who subscribed to the free newsletter. Most would have countered with a fiery response.

In contrast, we were delighted to receive such emails, for they informed us that the masses were dead wrong and why we would blast individuals going out of their way to provide such valuable data. We surprised some of the recipients by sending an excellent thank you note. Our free newsletter service has over 40K subscribers, and as such, it provides precious sentiment data.

Just remember, before you state you wish more people were/are more brilliant, picture how much harder it would be for you to navigate if all those around you were as sharp as you are. In the end, be thankful for the morons of the world, for they provide investors with valuable data that can be used to increase one’s net worth and stay out of harm’s way. Furthermore, this data reveals what we have always stated: that no good deed goes unpunished and that a good Samaritan usually ends up as a dead Samaritan. Never offer to help someone who does not seek it; they will likely string you up the nearest pole if you do so.

Cash is King Now: What About Tomorrow

Now, these wise guys who felt so smart by blasting the hell out of us during the market meltdown will weep tears of blood shortly if they are not already doing so. They made the same mistake, promising never to fall for the fake news/hysteria that made them dump their shares at the bottom.

But like mentally deranged individuals, they did precisely the same thing at the worst possible time, and what was their excuse; “it’s different this time”.Well, it will always be different, and that’s the excuse the masses will use forever to justify the fact that they let emotion overrule logic and sell when they should have been buying. Ultimately, this story will be repeated repeatedly because the mass mindset knows no better. Hence, the saying misery loves company, and stupidity demands it. Success is based on taking an approach bound to draw shouts of criticism from the masses. The only saying that comes to mind is the truth hurts, and boy does it.

Market Sucess equates to……?

To succeed in the market, you must control your emotions. However, this is not achieved via force, which never works in the long run. One has to come to the self-realisation that emotions are useless when it comes to investing. How is this achieved? Primarily via self-observation, the second factor is reading the right books. We have provided a list of books in the passcoded section of the website. One way to fast-track the enlightenment process is to view the stock market as one giant video game.

What is the biggest tragedy in one’s life? Your death. Yet, does one sit and obsess over this fact every single day? No one deals with it because one understands it’s inevitable. Thus, it’s pretty interesting, almost fascinating, that individuals can’t come to the same conclusion regarding corrections and crashes. The market will inevitably crash or correct sooner or later, but before the crash, the masses are always euphoric. Once in a while, as was the case recently, the massive correction is engineered. As a market crash is inevitable, so is an enormous recovery; the recovery phase is stronger and more rewarding than the crash phase.

Fear begets Fear

But the masses will never focus on this; they will focus on how the market could trend lower, why it’s not the right time to buy yet, or why it’s different this time and a host of other rubbish that makes no sense. And when the markets eventually surge to new highs, these penguins will look back in horror at how they did exactly what they promised never to do again. The sad part is that while they make the same promise again, they will react similarly the next time the market pulls back.

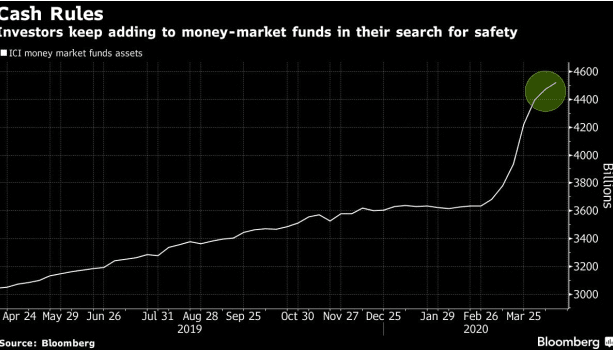

The chart below illustrates that Cash rules right now

Weekly flow data from Bank of America Corp. and EPFR Global show a clear investor preference for money-market funds. Assets under management in this category have swelled to $4.5 trillion following seven weeks of inflows that added $877 billion to the cash pile.

The fund manager survey from early April showed that institutional investors now hold the most cash since the 9/11 terrorist attacks.

In the week through April 15, investors put $52.7 billion into cash, compared with $14.1 billion in additions to bond funds and $10.7 billion of inflows into equities, according to the BofA note. The latest data highlight the vulnerability of the rebound in global equities, which have rallied more than 20% from their March lows on optimism about expanding monetary and fiscal aid, as well as an easing coronavirus case count in major regions. https://bit.ly/2SlozJX

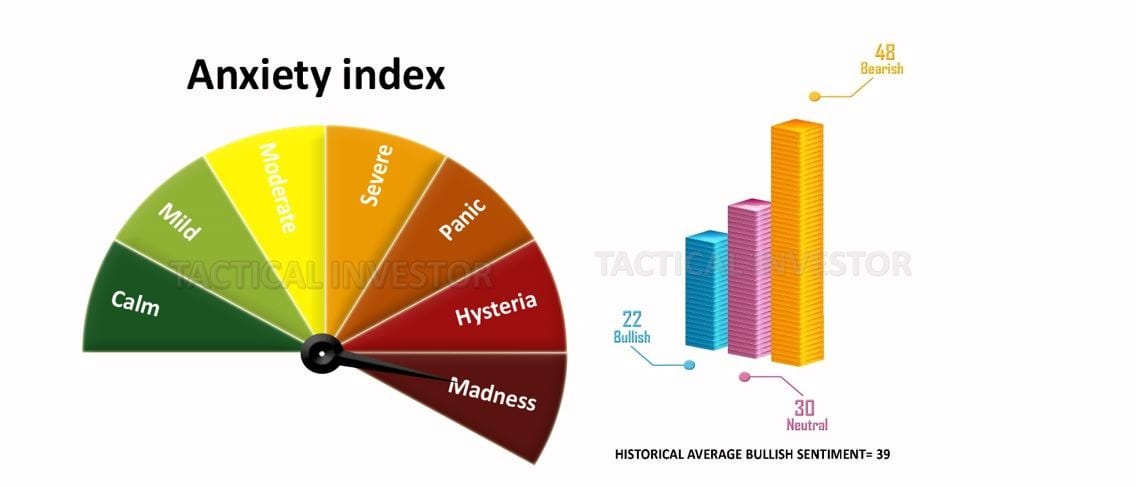

Investor Sentiment

The crowd is still in a state of disarray, and this is probably what the Anxiety index is measuring. Look how they flock to money market funds that pay next to nothing, but they offer safety. Well, thank goodness for the mass mindset, for as they seek safety, we will do the opposite and keep buying.

These brilliant minds are holding 4.5 trillion in cash; what a feeding frenzy this will create when these enlightened (us being sarcastic) individuals finally realise it’s time to jump in. While they think cash is king, they will cry once the markets recoup most of their losses, for then the cash will lose its king status and join the ranks of the jokers.

Investors in China poured more than $141 billion into domestic money-market mutual funds in the first quarter, bringing the sector’s total assets under management near a record high. https://yhoo.it/3bTuu0y

China Mimicking the U.S?

The same phenomenon occurs in China, indicating that distance is not a limiting factor when dealing with the mass mindset. The more the crowd derides this market, the happier you should be.

In the age of coronavirus, cash is indeed king. That’s the view, at least, of many significant investors selling everything from stocks to bonds to gold to raise cash.

Bank of America Merrill Lynch, in its March Fund Managers’ Survey, indicated that month over month, cash among funds had seen the 4th largest monthly jump in the survey’s history, from 4 per cent to 5.1 per cent. Like buy-side fund managers, sell-side advisors also feel the need to be conservative, waiting on the sidelines for the market selloff to settle. https://cnb.cx/3bQmbCz

The saying should be changed to: in the age of ignorance, cash appears to be king but will soon face the same outcome the naked emperor did. It took a kid to point out the obvious that the dude was fat, naked and sorely in need of some shock therapy.

Investors made their most considerable dash for cash in history over the week that broke the bull market. They channelled $137 billion into cash-like assets and a record $14 billion into government bonds in the five days through March 11, according to Bank of America Corp. research citing EPFR Global data.. https://bloom.bg/2KOeG2Z

Shortly after this stampede, the markets bottomed—mass psychology in real-time. We hope your chaps kept a trading journal as suggested, for this crash will be remembered as one of the biggest B.S. crashes of all time. Or if we put in terms of Aesop’s fables. This is a turbocharged version of the boy who cried wolf one too many times.

The cash is King Sop saga and why the markets are rallying so strongly

So why are the markets still rallying so strongly? They rallied strongly because the sentiment was decidedly bearish; all the other stuff the experts push out is just noise. The bearish sentiment has cooled off, and the markets are primed for a pullback, which took place on Friday.

The pullback will give the players who jumped in late a reason to believe that the bear is back, and that’s when they will get hammered. The subsequent pullback could be the last time players can load up on quality stocks at a low price. The odds of GOOGL trading to the level we opened our first positions at are very slim, and that applies to PJT, HALO and a host of other plays.

‘Don’t be fooled by the recent rebound in stocks; the investment scene is beginning to resemble the 1929 market crash and the early 1930s Great Depression.’ To me, it’s like 1929 when stocks first fell, then rallied before plunging anew as the Great Depression set in. In his Bloomberg piece, Shilling pointed to the 48% plunge in the Dow Jones Industrial Average from Sept. 3 to Nov. 13 back in 1929, a pullback which may have “seemed like a reasonable correction” at the time since the blue chips had rallied 500% in the eight years leading up to it. https://yhoo.it/3aVVY42

We hope these guys keep publishing articles like this, for it will add to the volatility, creating attractive opportunities to open even more positions at a discount. You have to love these guys; they preach gloom and doom when the Fed openly states they will do whatever it takes to support this market. You don’t fight the Fed when it puts the pedal to the metal.

Why Cash is King?

Cash is often considered one of a person’s most valuable assets. There are several reasons why cash is king, including its liquidity, stability, and versatility.

One of the main benefits of cash is its liquidity. Unlike other assets, such as real estate or stocks, cash can be easily converted into other investments or used for immediate purchases. This makes it an ideal asset for emergencies or unexpected expenses.

Another benefit of cash is its stability. While other assets may fluctuate in value, money generally maintains its value over time. This can provide security for investors and savers who want to protect their wealth from market volatility.

Finally, cash is a versatile asset used for various purposes. It can be used for everyday expenses, savings, investments, and even as a down payment on a home or other major purchase.

Despite these benefits, it is essential to note that holding too much cash can also have its drawbacks. Inflation can erode the value of money over time, and there is always the risk of theft or loss.

Cash is a valuable asset that can provide investors and savers stability, liquidity, and versatility. However, balancing holding cash and investing in other assets is essential to achieve long-term financial goals.

Here are some articles and references to further explore the topic of why cash is king:

- “Why Cash is King” by Dave Ramsey, Dave Ramsey Show: https://www.daveramsey.com/blog/why-cash-is-king

- “The Case for Holding Cash” by Scott Galloway, Medium: https://marker.medium.com/the-case-for-holding-cash-f22a2c579e19

- “Why Cash is King in a Crisis” by Sarah O’Brien, CNBC: https://www.cnbc.com/2020/05/13/why-cash-is-king-in-a-crisis.html

Other Articles of Interest

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

I’m Never Going to Be Financially Secure, So Why Try?

Boost Your Financial Freedom and Secure a Home Equity Loan with a 500 Credit Score

Misdirection And Upcoming Trends For 2020 And Beyond