Dollars for Rails, Gold for Nerves: What Central Bank Gold Buying Really Signals

Nov 11, 2025

Strip the theatre out of it. This isn’t the “death of the dollar” dirge the perma-bears rehearse every winter. Trade still runs on dollar rails. What’s changing is custody and nerves. Central bank gold buying says the quiet part out loud: it’s not creed, it’s custody math. If your reserves can be frozen with a memo, the asset isn’t yours. So the world’s treasurers are trading sanction‑sensitive IOUs for sanction‑resistant ballast. Dollars for rails, gold for nerves. That’s the regime shift.

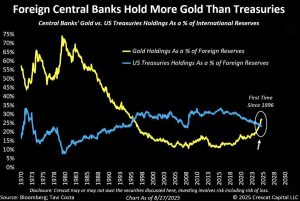

Bretton Woods tied faith to metal. The 1971 shock untied it and left the world holding IOUs. The 1997 Asian crisis minted the “self‑insurance” doctrine: pile reserves so big no one can push you. The 2014–2022 sanctions era proved reserves aren’t just numbers; they’re custody risks. Now, in 2025, official gold sits above Treasuries in the global stack for the first time in decades. It isn’t a funeral. It’s preference, learned the hard way.

Call the headline what it is: fear. When the West froze Russian reserves, central banks worldwide didn’t debate philosophy; they quietly re-ran their worst-case. What if our assets are at an unfriendly terminal? What if political reach extends further than we admitted? The answer wasn’t to abandon dollar rails—those still move goods at scale. The answer was to diversify the ballast: more gold, more commodities, more assets custodied where hands can’t reach as easily.

Mechanics: custody, repatriation, and sanction-path risk

Where the bars live matters. Allocated metal in your vault or a friendly one you can compel is a different animal than an unallocated claim in a city that might not pick up your calls. Repatriation trends aren’t about nostalgia; they’re about path dependency. Sanction‑path risk is the story. Even “safe” assets go political if the custodian can freeze them. Gold narrows that path. Some commodities start to do the same when settlement lines shift and storage is local.

Gold’s share of official reserves has risen toward the high twenties while Treasuries have slipped into the low twenties. Central banks now hold on the order of tens of thousands of metric tons of metal—roughly the mid‑thirty‑thousand range by recent tallies—valued in the trillions, and more than comparable stacks of Treasuries by current marks. The World Gold Council has flagged persistent net purchases: modest monthly adds—high teens of tonnes at times—and a year trending toward roughly nine hundred tonnes total, the fourth straight year running at more than twice the long‑term pace. These aren’t blow‑off numbers; they’re the steady hum of a policy shift. Read them as behavior, not prophecy.

The paradox: rails vs ballast

Here’s the contradiction you must hold without flinching. The dollar remains the operating system for trade because nothing rivals its pipes at this scale. At the same time, reserves diversify away from assets that can be politicized. That means rails stay in dollars, while ballast migrates to gold and, increasingly, to commodity exposures and non‑Western custody. The world isn’t de‑dollarizing; it’s de‑custodializing. The motive isn’t revenge. It’s survival.

Base case: the slow creep. Central banks keep buying in the same steady rhythm, official COFER shares drift, and the Shanghai–London gold premium stays modest. In this tape, you maintain a core metal position, prefer allocated holdings you can audit, and add on weakness rather than headlines. If you want equity torque, you keep it small, patient, and diversified.

Stress case: a sudden sanction or banking shock. Paper gold vehicles drain, premiums spike, miners whipsaw. In that tape, you buy physical on pullbacks in three staged tranches, you hedge the mining sleeve against broad drawdowns, and you refuse to chase euphoric up‑wicks. Keep the nerve, not the drama.

Squeeze case: supply disruption layered on geopolitics. Refiners strain, backwardation flashes, logistics snarl. In that tape, you stop chasing entirely, shift toward producers with clean balance sheets and royalty/streamer models, and hold dry powder for the second swing when premiums normalize. The trade is survival with dignity, not grabbing headlines.

Your operator’s panel: a watchlist that actually helps

Watch the official reserve mix, not just the price. Follow the trend in reported reserve composition. Track the Shanghai–London premium; if it persists, that hints at structural tightness outside Western venues. Compare flows in listed gold products to official purchases; when public sells and officials buy, that divergence tells a story. Keep an eye on cross‑currency basis for dollar funding stress. Note energy settlement headlines in non‑dollar currency; they won’t erase the rails, but they do thicken the ballast picture. None of these are perfect. Together, they give you a weather map.

Position in threes over twelve months. Buy weakness, not narratives. Put your core in allocated metal with an audit trail, domestic if possible or in a jurisdiction you can live with under stress. Avoid leverage in the core; that turns ballast into a bet. If you want equity exposure, split it across diversified miners and royalty/streamers, and keep a rebalance rule you’ll obey on spikes. Write the dumb rules that save you: no adding to losers in the miner sleeve, a two‑loss‑week stop for speculative trades, and a recognition tax—if you need an audience to buy it, pass. Trim ten to twenty percent when weekly candles go parabolic alongside media euphoria; refill only after a proper cool‑off or when premiums ease back to normal.

Commodities as shadow currency (the uncomfortable part)

Commodities don’t vote. They don’t file press releases. They simply clear or they don’t. As prices climb and scarcity stories multiply, politics will chase them, and public FOMO will follow. That’s how blow‑offs happen. Don’t cosplay as a prophet. Price these cycles as human. Governments will call it precaution; crowds will call it a “new paradigm”; both will be late. If this cycle runs, it will build quietly for years and then sprint all at once. Your defense is a plan that assumes you will feel late even when you’re early.

It’s not proof that paper is doomed tomorrow. It’s not a clean line from chart to catastrophe. It’s not a crusade against America. It’s the oldest story in finance: confidence cracked, custody repriced, portfolios adjusted. You can respect that without chanting. The loudest forecasts usually die first; don’t join them.

Risk, humility, and the second swing

Gold can and will correct. Miners can out‑earn or underwhelm. Premiums can compress. Sanctions can be walked back. This positioning is about reducing one path of failure (custody reach), not eliminating volatility. Expect drawdowns. Expect boredom. Expect to feel wrong just before your plan starts looking right. That’s what plans are for.

Central bank gold buying is a message written in the only language that matters in reserve management: behavior. Rails stay in dollars because scale still demands it. Ballast migrates to gold and other stores of value because custody just got a lot louder in the risk calculus. You don’t need to believe in doom to understand that. You need a structure you can live with on bad days: tranches, allocated holdings, a small, disciplined equity sleeve, and rules that keep your nerves from spending your future. Dollars for rails. Gold for nerves. That’s the signal. The rest is theatre.