Shattered Fortunes: Unveiling the 1987 Stock Market Crash

Updated May 2023

Although a “Black Monday” type event could happen again, it’s essential to recognize that anything can occur in the markets. Simply waiting for such an event is like putting all of your eggs in one basket, which goes against common sense investment principles.

While market crashes do occur, markets tend to be in bullish modes more frequently than bearish ones. Therefore, it’s logical to focus on the potential for the market to trend upward rather than just on the possibility of a crash. However, it’s essential to exercise caution and not take undue risks.

One way to stay on the right side of the market is to use a simple formula: buy when there is fear and pessimism (when “there is blood in the streets”) and sell when there is optimism and excitement among investors. In other words, paying attention to mass sentiment can give investors early warning signs.

To understand the dynamics of sentiment, it’s essential to delve into the principles of mass psychology. By understanding how the crowd behaves, investors can make more informed decisions about when to enter and exit the market.

From Boom to Bust: The Untold Story of the 1987 Stock Market Crash

Remember that when the markets inevitably correct, the media will hype it up as a crash to scare the masses, with blame placed on some arbitrary factor already planned in advance. While the public panics and runs for the hills, the big players scoop up top shares for a fraction of their worth. The illusion of the president being the most powerful person is just that – an illusion. As long as fiat money exists, every president will be bought and paid for.

The big players have trillions at their disposal, making the idea of a great leader nothing more than a pipe dream. You are only free to do what you’re allowed to do, including the president. Reflect on this; we’ll expand on it later, but the hint is “fiat money.” At the Tactical Investor, we deal with reality and identify new trends. Everything else falls into the category of idle gossip. While it may feel good to rant and rave, it’s a waste of energy. Our focus should be on finding ways to make the best of the hand we’re dealt.

Market Crashes equate to opportunity.

The events of the 1987 stock market crash are a stark reminder of the unpredictability of markets. However, despite periodic downturns, the markets ultimately continue to follow a general upward trend. Therefore, it’s essential to focus on the long-term trend and not be swayed by fearmongering and doomsday predictions.

While the markets will inevitably experience corrections in the future, some more severe than others, viewing these events through a long-term lens is crucial. Investors can determine the best times to move into or out of the market by paying attention to the overall trend. Back-breaking corrections, in particular, can present significant buying opportunities for those who are patient and strategic.

As long as fiat currency remains the primary exchange system, talk of the world ending is overblown. Rather than succumbing to fear or hype, investors should prioritize maintaining their health and wealth by staying attuned to the trend and acting accordingly.

Riding the Waves: Capitalizing on Another 1987 Stock Market Crash

For decades, the media has been guilty of distorting news stories to sell the masses sensationalized and often misleading information, especially in the financial markets. However, the complete unmasking of this behaviour occurred in the aftermath of Trump’s presidency. The sheer volume of absurdity that the media focused on was alarming and highlighted the dearth of intelligence required to produce and consume such content.

Many of these so-called reporters may have IQs hovering slightly above the threshold for intellectual disability, but this observation should not surprise us. After all, if everyone were a genius, life would be much more challenging. It’s essential to appreciate the predictability of these “penguins” who make the task of trading markets easier due to their irrational and reactive behaviour.

By controlling the media, the Fed wields immense indirect control over the minds of the masses, primarily through the manipulation of fiat money. This situation creates a perfect environment for mind control, where individuals believe they are free, but in reality, they are only free to make decisions that don’t matter. Take a moment to observe the world around you and determine for yourself if this notion of freedom holds true.

The stock market crash of 1987 presented an irresistible feast of opportunities.

The V readings have seen a significant uptick of 200 points since the last update, indicating a potential shift in market sentiment. While the market continues to be bullish, it’s important to acknowledge the possibility of an upcoming correction that could drive the Dow down by 3500-5000 points. It’s difficult to predict the extent of this correction, but focusing on the trend rather than the noise is a simple yet effective strategy. Investors should buy when the crowd is panicking and sell when they are overly exuberant.

In addition to potential market fluctuations, the political situation in America and Europe is expected to become increasingly volatile. Violence is likely to escalate in Europe, America, some parts of South America, the majority of the Middle East, and to a lesser extent in Asia. However, Asia is expected to experience a relatively peaceful time, with a few exceptions in hotspots such as North Korea, Pakistan, and parts of India. It’s important to remain vigilant and informed but not let fear and panic dictate investment decisions.

The problem with most individuals is that when they look at the markets, they do so with biased eyes. They already have preconceived notions, and they look for data to support these notions. Market Update May 19, 2017

Fear mongers will ply the same story of Gloom 100 Years from Today

Despite the passage of time, the outlook for the masses remains unchanged. Over the past century, they have consistently failed to learn from history and have reacted to the same stimuli in predictable ways. Even a hundred years from now, we expect the outcome to remain the same.

When “Fiat money” eventually comes to an end, the game will remain the same. The top shadow players will scare the masses, causing them to stampede, and then they will swoop in to buy everything for next to nothing. Fear is a powerful weapon that the top players use with precision, knowing precisely how to elicit a reaction from the masses. The only antidote is to change one’s perspective, viewing fear as an opportunity rather than a threat. By refusing to follow the herd and instead marching to our own drumbeat, we can ride on the coattails of the big players, avoiding the fate of those who get slaughtered en masse.

The striking similarities between the 2020 stock market crash and the infamous Black Monday are unmistakable.

As the market experiences a significant pullback, insiders are taking advantage of the opportunity to purchase shares. One way to measure the intensity of their buying is by checking the sell-to-buy ratio. A reading of 2.00 is considered normal, while a ratio below 0.90 is exceptionally bullish. However, the current ratio is a staggering 0.35, indicating that insiders are buying up shares at an unprecedented rate.

This level of insider buying is a clear signal of confidence in the market, and investors should take note. While short-term market fluctuations can be unpredictable, long-term trends suggest that the market will continue to trend upwards. By paying attention to insider activity and the overall trend, investors can make informed decisions and capitalize on opportunities presented by market downturns.

Today’s readings are incredibly bullish. With a Vickers benchmark NYSE/ASE One-Week Sell/Buy Ratio of 0.33 and a Total one-week reading of 0.35, insiders are not just buying shares – they’re devouring them. This level of insider buying clearly indicates their confidence in the market and should signal to investors that now is a great time to buy. https://yhoo.it/2TV0cE2

Insider Actions: A Clear Signal of Market Opportunities?

While insiders may not have a pulse on the broader economy, they certainly have a keen understanding of the inner workings of their own companies. Their recent buying spree is a clear indication that this market pullback represents a once-in-a-generation buying opportunity for investors.

Adding to the bullish sentiment, the Fed has announced its decision to open its commercial paper funding facility, providing unsecured business loans. This move injects additional liquidity into the market, providing further support for investors who are taking advantage of the current buying opportunity.

Investors can make informed decisions about when to buy and sell by paying attention to insider activity and broader market trends. With insiders aggressively buying shares and the Fed providing additional support, it’s clear that now is an excellent time to take advantage of the market’s current conditions.

The Federal Reserve announced plans to open a commercial paper funding facility to support companies facing financial stress due to the coronavirus outbreak. This move is part of the Fed’s broader effort to provide additional liquidity to the market and help maintain stability in the economy. Investors should stay informed about these developments and how they may impact their investment strategies. https://yhoo.it/3d6gmlj

The masses are in a state of disarray.

Despite recent market volatility, there are signs that the worst news may be priced in. The markets are so close to pricing in a recession that it will only take a few pieces of good news to trigger a melt-up. One potential source of good news is the widespread implementation of mass testing, which could help mitigate the coronavirus’s spread.

Investors should follow the tried-and-true strategy of selling joy and buying panic. As the crowd continues to overreact and throw out the proverbial baby with the bathwater, savvy investors can capitalize on buying opportunities. By keeping a cool head and focusing on long-term trends, investors can make informed decisions that position them for success in any market conditions.

COVID Crash Proved to be Another Opportunity

September is often perceived as one of the worst months for stock market investors, but this couldn’t be further from the truth. In fact, it’s an excellent opportunity to buy stocks at lower prices. Unfortunately, many investors fall victim to the secret desire to lose syndrome, which leads to impulsive decisions and missed opportunities.

At The Tactical Investor, we know that patience and discipline are key to success in the stock market. We never chase investments and always follow the principle of buying low and selling high. Our approach has paid off, with many of our subscribers enjoying significant gains in recent months.

One example is CUB, which struggled for a while but saw a healthy pattern and surged in September, resulting in gains of 28%. Similarly, AIN is displaying a similar way, but we always remind our subscribers never to deploy more money into any single play and to deploy equal amounts into each play.

It’s essential to remember that the trend is your friend, and everything else is your foe. We can achieve long-term success by staying disciplined and following the market’s trends.

Outlook for 2023: Another Opportunity

Anxiety and fear often precede a stock market bottom, as evidenced by past experiences. The current fear and uncertainty levels among T.I. subscribers are approaching those seen during the October 2008 market crash. If fear levels rise and reach an all-time high, it will be added as a criterion for the highly coveted FOAB (Father of All Buys). T.I. has three more conditions to meet before achieving FOAB, but if they are met, almost everyone at T.I. would invest everything they have and more into the market. However, the use of leverage/margin is not advised unless one is willing to take on additional risk.

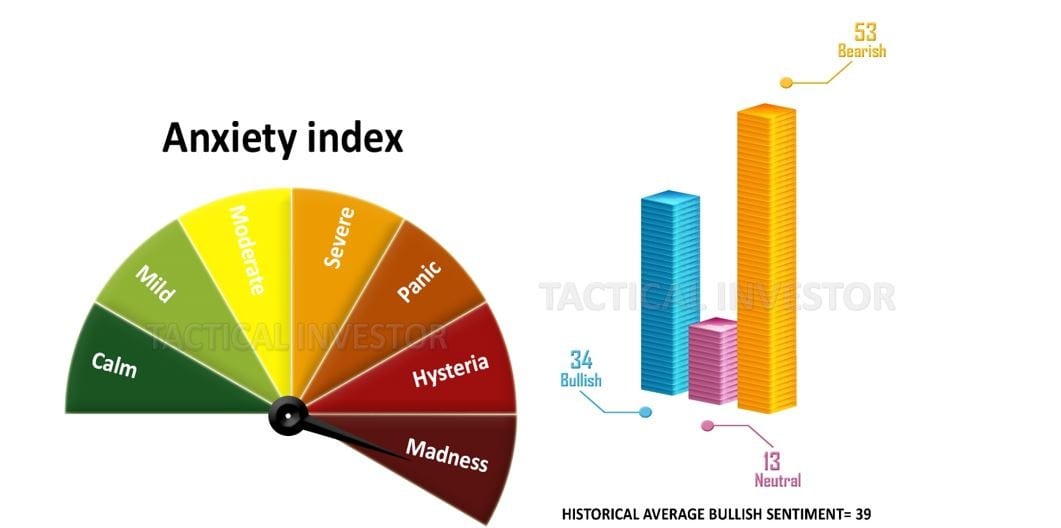

Bullish sentiment readings have yet to reach their historical average, and one possible explanation is that traders are waiting for better prices. However, the problem is that the prices they were hoping for have already been reached, and it remains uncertain whether they will jump in or continue to wait for even better prices.

Overview and Summary of the Article

Market crashes have historically been viewed as times of panic and fear, with investors running for the hills. However, history has shown that these crashes can also be buying opportunities for astute investors who keep a cool head and follow the market’s trends. By using mass psychology and understanding the dynamics of sentiment, investors can identify early warning signs and make informed decisions that lead to long-term success.

Black Monday : A Long-Term Buying Opportunity?

The 1987 stock market crash was a mouth-watering opportunity for those who understood mass psychology and had the discipline to stay focused on the trend. While the media hyped up the crash and blamed arbitrary factors, savvy investors scooped up top shares for a fraction of their worth. The big players have trillions at their disposal, making the idea of a great leader nothing more than a pipe dream. The key is to stay focused on the trend and view every back-breaking correction as a long-term buying opportunity.

COVID Crash Another Opportunity

The COVID crash in 2020 was viewed as a terrible time for stock market investors, but it was, in fact, an excellent opportunity to buy stocks at lower prices. The Tactical Investor always advises its subscribers to have patience and discipline, never chase investments, and follow the principle of buying low and selling high. This approach has paid off, with many subscribers enjoying significant gains in recent months.

Outlook for 2023: Using Mass Psychology to Win in the Markets

Anxiety and fear often precede a stock market bottom, as evidenced by past experiences. The current fear and uncertainty levels among T.I. subscribers are approaching those seen during the October 2008 market crash. However, if fear levels continue to rise and reach an all-time high, it will be added as a criterion for the highly coveted FOAB (Father of All Buys). The Tactical Investor has three more conditions to meet before achieving FOAB, but if they are met, almost everyone at T.I. would invest everything they have and more into the market. It’s essential to remember that the trend is your friend, and everything else is your foe. By staying disciplined and following the market’s trends, investors can achieve long-term success.

Using Mass Psychology to Win in the Markets

Investors who use mass psychology to win in the markets understand that the media often twists news to sell the masses rubbish, especially in the financial markets. The Fed indirectly controls the media through fiat money, and fear is the weapon the top shadow players use with laser-like precision to control the masses. However, by altering the angle of observance and viewing fear as an opportunity, investors can ride on the coattails of these big players and achieve success.

Conclusion: Market Crashes Are Buying Opportunities

Market crashes have historically been viewed as times of fear and panic, but they can also buy opportunities for savvy investors who keep a cool head and follow the market’s trends. The key is to use mass psychology to understand the dynamics of sentiment and identify early warning signs. By staying disciplined and focusing on the trend, investors can achieve long-term success and turn market crashes into buying opportunities.

More Must-Reads: Compelling Articles You Don’t Want to Miss

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

Dogs of the Dow 2024: Barking or Ready to Bite?

What happens when the stock market crashes? Opportunity!

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Clash of Titans: Unleashing Inductive vs Deductive Reasoning

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach