Black Monday 1987: Seizing Opportunities Amidst Crashes

Updated Dec 2023

Stubbornness does have its helpful features. You always know what you’re going to be thinking tomorrow. Glen Beaman

These individuals persist unwaveringly in relentlessly promoting this questionable narrative to an unsuspecting audience. It’s a remarkable display of repeating the same ineffective message, hoping for a different outcome. Unfortunately, the outcome remains unchanged this time, at least for now. Perhaps these individuals should consider a career in fiction writing, as they seem completely detached from reality. For years, we have confidently asserted, and rightfully so, that until the sentiment shifts, this market will continue its ascent to new heights.

Despite the overwhelming volume of articles published this month, one can’t help but notice a striking similarity among them. Originality is notably lacking in these pieces. The recurring theme revolves around October, marking the anniversary of the 1987 crash, with a predictable focus on its catastrophic aspects. Hardly anyone seems to acknowledge that it ultimately presented a historic buying opportunity.

The spotlight remains fixed on how the financial world seemingly came to a standstill. However, it did not; what truly halted was the flawed rhetoric propagated by the predecessors of today’s so-called “experts” back in ’87. This further underscores the notion that many financial writers may have chosen the wrong profession. One word succinctly encapsulates all of this absurdity: “Rubbish.”

Navigating Market Sentiment: A Look Beyond the Headlines

Take a look at these sensational headlines; it seems the loudest braying comes from the penguins, also known as jackasses when it’s already too late. The time to sound the alarm is when everyone is calmly sipping from the Kool-Aid fountain, not when everyone is already jittery. When anxiety sweeps through the crowd, it’s the opportune moment to craft your list of potential investments.

1. “Could History Repeat? Examining the 1987 Stock Market Crash” – Reuters

2. “Comparing 2017 and 1987: Black Monday’s Legacy” – Market Watch

3. “Black Monday Redux? Wall Street’s Concerns on the 30th Anniversary” – express.co.uk

4. “30 Years After Black Monday: A Reflection” – courier-journal

5. “Buying Opportunities at the 30th Anniversary of the 1987 Crash” – Money Show

6. “Remembering the Crash of ’87: Insights from Wall Street Insiders” – Bloomberg

7. “Is a 1987-Style Market Crash Possible Again?” – USA Today

Is a Black Monday 1987-Style Event Completely Off the Table?

Our conviction remains steadfast: the market is poised for a correction, and for discerning investors, referring to it as a “crash” is somewhat imprecise. A substantial correction appears to be the more likely scenario, mainly as most astute investors positioned themselves in the market well ahead of time.

It is the herd mentality that will eventually lead to a surge in market participation as the market approaches its peak, and these latecomers will bear the brunt of the much-debated crash. The events of 1987’s Crash and Black Monday serve as stark reminders that the masses often find themselves on the wrong side of the fence, consistently buying high and selling low. These cycles persist because the collective mindset is predisposed to failure. In simpler terms, misery tends to seek company, which explains this widespread mentality.

At present, despite the markets being oversold, fear levels remain relatively low. Therefore, until widespread panic ensues among the masses, there’s a likelihood that we’ll witness another round of selling. This corrective wave has the potential to push most indices down to or even below their 2022 lows. The NDX (Nasdaq 100) is anticipated to diverge from the broader trend, making it a likely candidate for this scenario. Additionally, the Tactical Investor Alternative Dow Theory suggests that the markets are heading for a downturn, as indicated by a negative divergence signal. The only way to counter this is for the Dow utilities to generate a positive divergence signal or to plummet into extremely oversold territory. Given their current trajectory, this adjustment could take up to three months.

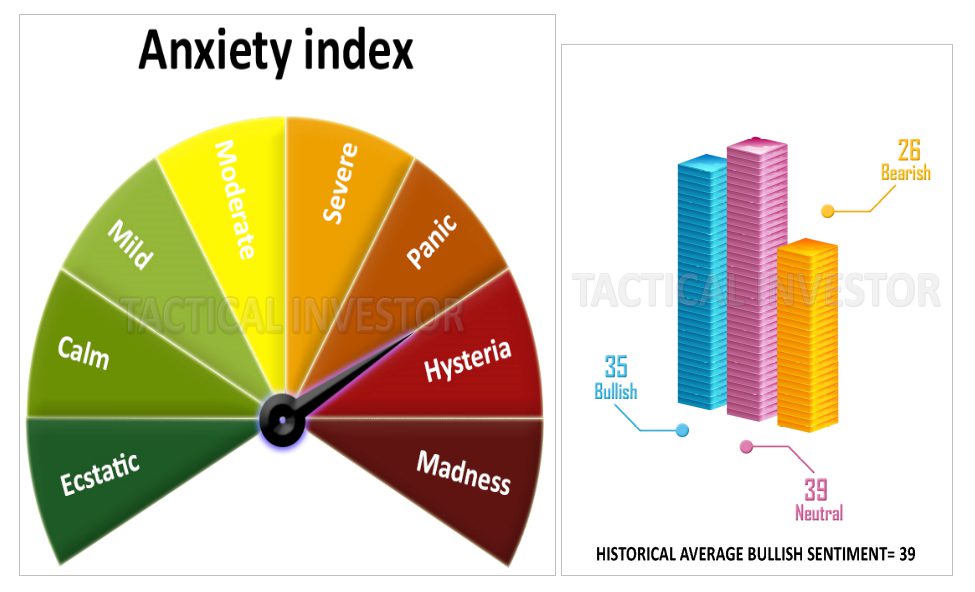

Market Sentiment: Crowd Is Not Scared

Bullish sentiment has increased somewhat, and the general public is not as anxious as they were at the beginning of this month or last month. However, unless the indicators suggest that this public sentiment has turned euphoric, the possibility of a crash remains unlikely.

For a long-term multi-month bottom to form, the masses would need to be in a state of hysteria. Until that point, long-term investors should use market rallies as opportunities to build up their cash reserves.

Unprecedented Investment Opportunities Amidst Market Turbulence

Reflecting on historical market bubbles and peaks, a consistent factor emerges euphoria among the masses before the market takes a nosedive. Even in cases like the tulip mania, where mass media was absent, the frenzy ultimately concluded with a sense of euphoria. Without delving further, we must acknowledge the insights from some of our long-term investor subscribers, who view this as a once-in-a-generation buying opportunity.

Assumptions and speculations primarily drove the market sell-off in 2022. This hysteria-induced selling is now creating a rare opportunity for savvy investors.

While the crashes of 1987 and 2008 are often referred to as the “mother of all buying opportunities,” we may be on the verge of a setup that surpasses even these historic events, potentially giving rise to the “father of all opportunities.” Such an occurrence is sporadic, perhaps unfolding only once in a lifetime.

The current landscape may appear tumultuous in the short term, but those who focus solely on short timelines may miss out on the potential for substantial long-term gains.

Why Not Try Something New For A Change:

Once the trend is identified, the remainder of the investing process becomes relatively straightforward. We provide numerous plays for a simple reason – to enable new traders to identify those that appeal to them. Shedding past preconceptions and embracing new concepts takes time, and we strive to simplify the process by providing a diverse selection of plays. Rather than feeling overwhelmed by the number of plays, one should understand that it’s unnecessary to initiate a position in all of them. Choose those that appeal to you and disregard the others until you become familiar with our methodology. With confidence, you can deploy more significant amounts of capital.

Create a list of stocks that you would like to own at a discount. When the markets pull back again – and there is a good likelihood that they will test their 2022 lows – you can calmly select the best stocks for pennies on the dollar while the masses panic. As with Black Monday 1987, you can utilize the next corrective wave or crash to establish critical positions in solid companies.

The Psychology Behind Market Crashes: Why They’re Long-Term Buying:

Market crashes, such as the ones experienced in 1987, 2008-2009, and the COVID crash, are often associated with panic, hysteria, and widespread pessimism. In retrospect, these crashes have proven to be some of our time’s most exceptional buying opportunities, and the strong correction of 2022 is no exception. Understanding the psychology behind these events is crucial to profit from their opportunities.

One key factor in market crashes is the mass psychology of investors. People are prone to panic, often leading them to sell off en masse, exacerbating market volatility. This psychology is evident in the 1987 Black Monday crash, when people panicked and sold their shares. However, investors who remained calm and held onto their shares were rewarded as the market rebounded and provided a tremendous buying opportunity.

Understanding Mass Psychology and its Impact on Market Downturns

Similarly, the 2008-2009 financial crisis was another example of mass psychology at work. Fear, uncertainty, and widespread pessimism gripped the market as the economic system teetered on the brink of collapse. However, those who remained steadfast and believed in the market’s underlying strength were rewarded as the market bottomed out and started to recover. Again, those who bought into the market at this time enjoyed significant gains as the market rebounded.

The COVID-19 crash was another example of mass psychology in action. The global pandemic caused widespread panic and uncertainty, which resulted in a significant market downturn. However, those who held their nerve and recognized that the market would eventually recover enjoyed impressive returns as the market rebounded.

The strong correction of 2022 is yet another example of mass psychology at work. The sell-off was based on conjectures and assumptions rather than underlying fundamentals, and this hysteria-based selling created a rare opportunity for the shrewd investor. As with previous market crashes, the market will rebound, and those with the foresight to invest now will be rewarded.

Understanding the psychology of the masses is critical to profiting from market crashes. The masses panic, sell their shares, and create opportunities for those who remain calm and believe in the market’s underlying strength. It is essential to stay level-headed, focus on the long term, and recognize that market downturns are temporary and present exceptional buying opportunities.

Market crashes, such as the 1987 Black Monday, the 2008-2009 financial crisis, the COVID crash, and the strong correction of 2022, are long-term buying opportunities based on mass psychology. By understanding the psychology behind these events, investors can remain calm, hold onto their shares, and take advantage of the opportunities presented by market downturns. The key is to stay focused on the long term, recognize that market downturns are temporary, and provide exceptional buying opportunities for those with the foresight to invest.

Conclusion

In finance, one constant prevails: market euphoria preceding a significant downturn. This phenomenon isn’t exclusive to the Black Monday 1987 crash; it’s a recurring theme throughout history. Even in the absence of modern mass media, as witnessed in the tulip mania, frenzied market peaks invariably conclude with euphoria.

Some long-term investors see current market conditions as a once-in-a-generation buying opportunity. The 2022 market sell-off was driven by conjecture and assumptions, creating a unique opportunity for astute investors.

The crashes of 1987 and 2008 are often dubbed the “mother of all buying opportunities.” Still, we may stand on the brink of an even more exceptional scenario—the “father of all opportunities.” Such a rare event may occur just once in a lifetime.

Focusing solely on immediate market movements could mean missing substantial long-term gains despite the short-term turbulence. It’s imperative to recognize the lessons of history, particularly from the Black Monday 1987 crash, as they guide us in identifying warning signs and potential investment opportunities.

In conclusion, understanding market psychology is critical to navigating market crashes like the Black Monday 1987 crash and profiting from them. Mass psychology often drives panic selling, creating opportunities for those who remain calm and believe in the market’s underlying strength. By maintaining a long-term perspective and recognizing the temporary nature of market downturns, investors can seize these exceptional buying opportunities and reap the rewards.

Obstinacy is the result of the will forcing itself into the place of the intellect.

Arthur Schopenhauer

Other Articles of Interest

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?