Japanese Yen to Dollars Dynamics: Resilience and Rally Ahead

Updated June 2023

Over a decade, spanning from the profound statements made in early 2013 to the ever-evolving landscape of 2023, a remarkable journey unfolds, encompassing monumental discoveries, transformative advancements, and the relentless march of progress.

The Yen is still in a corrective stage, and as it’s oversold could experience a rally that could last for one to several weeks before it resumes its correction. There are signs now that it will or should test the 118.00 range. A test of the 118 range will most likely result in a much stronger rally, as this zone has a lot of support. This relief rally, though strong, will fail and eventually, 118 will be taken out. Unless the Yen generates a buy signal (and there is no sign of one yet), it should test the 118.00-118.90 ranges. Market update Nov 27, 2012

To indicate that a bottom is in place, the Yen should not close below 118.08. A close below this level means it is ready to test the April 2011 lows. Market update Dec 23. 2012

The Yen could not hold the above 118.08 and went to cut right through its April 2011 lows. The daily sell signal has no slowing, so we will modify our exit instructions. The Yen appears to be ready to test the 110 ranges. Therefore, this outlook will remain valid unless a new buy signal is triggered when FXY trades down to the 110 ranges put in orders to close out all positions in YCS.

As stated in the last update, once the Yen signals that a tradable bottom is in place. We will be looking to open up positions in FXY. Our preferred method will be to sell puts and use the money from the sale of the puts to purchase calls on FXY.

Shaping the Future: Japanese Yen to Dollars Long-Term Outlook

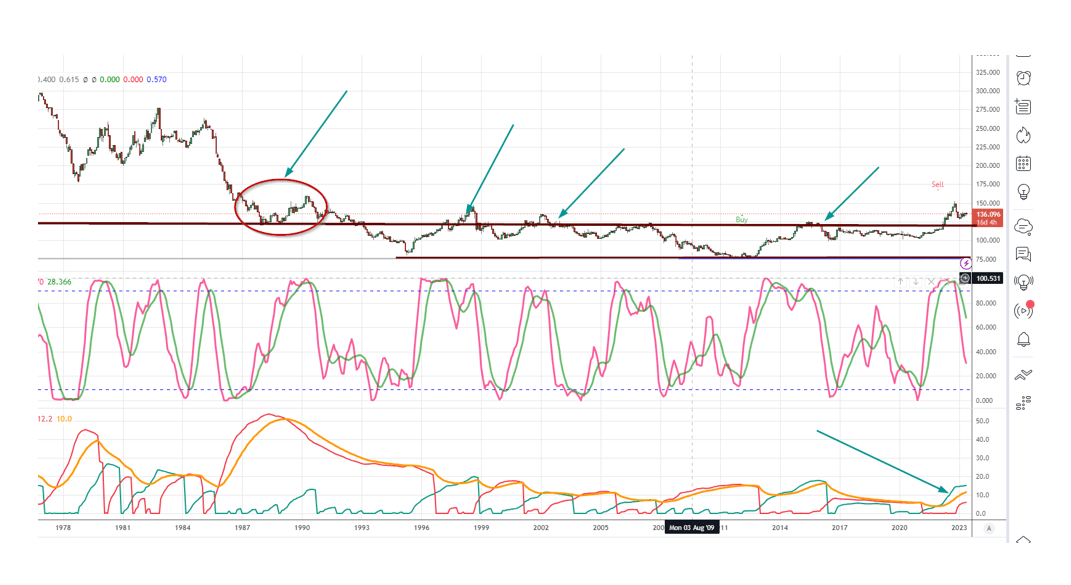

To gain a proper perspective, it is essential to consider historical charts when assessing the current state of the Yen. Despite negative sentiments about the Yen, it is essential to note that the current situation is quite favourable compared to the 70s and 80s.

Returning to the 1970s, it is worth noting that the Yen traded at a staggering rate of over 350 to the Dollar. When we consider this historical context, the present circumstances appear remarkably favourable. The angle of observation plays a critical role in identifying long-term patterns. For those that fixate on the short-term outlook, skull bones and tea leaves should suffice.

When analysing the channel formation, one can see that the upper line (brown) has transformed from a point of resistance to a zone of support. This zone of support can be traced back to the late 80s, as indicated by the red circle. In the long term, for Yen’s outlook to become bullish, it is necessary to breach this support zone. Lower values are advantageous for the Yen, whereas higher values benefit holders of the USD. For the Yen to have a chance of testing the 80 range, it would require a monthly close below 123.00. Until this milestone is achieved, trading activity within the range of 124-150 is expected to be highly volatile.

A Journey of Resilience: Yen-Dollar Trade’s Long-Term Outlook and Profit Potential

FXY is likely to test its previous lows before establishing a long-term bottom. It is of utmost importance to exercise patience as this trade continues to develop, as this trend reversal will likely persist for several years. Ideally, we expect FXY to decline to 60 or even below before putting in a bottom.

Ideal setup. FXY trades at 60 or below and triggers a positive divergence signal.

The Yen offers a promising opportunity for substantial long-term trade, much like the case with the Dollar. I remember when the Dollar traded above 1.60 against the Euro. Our assertion that the Dollar would eventually reach parity with the Euro sparked a flurry of emails questioning our sanity. Some even went as far as to suggest that we would deeply regret making such a statement in the years to come. However, as the saying goes, the rest is history.

FAQ

Q: What is the current status of the Japanese Yen in relation to the Dollar?

A: The Yen is currently in a corrective stage, potentially leading to a rally lasting one to several weeks before resuming its correction.

Q: Are there any key levels to watch for in the Yen-Dollar exchange rate?

A: Monitoring the 118.00 range as a potential testing zone for a more substantial rally is crucial, as it holds significant support.

Q: How can we determine if a bottom is in place for the Yen?

A: A close above 118.08 indicates a bottom is in place. A close below this level suggests a potential test of the April 2011 lows.

Q: What is the outlook for the Yen in the long term?

A: Yen’s outlook suggests the potential for a decline to the 110 range. The focus remains on identifying a tradable bottom before considering positions in FXY.

Q: What historical context should we consider when assessing Yen’s current state?

A: Compared to the 1970s and 80s, Yen’s present circumstances appear favourable. The upper line of the channel formation has transformed from resistance to support, dating back to the late 80s.

Q: What values would benefit the Yen in the long term?

A: Lower values benefit the Yen, while higher values favour USD holders. A breach of the support zone, with a monthly close below 123.00, would increase the likelihood of the Yen testing the 80 range.

Q: What is the ideal setup for trading FXY?

A: Ideally, FXY should trade at 60 or below and trigger a positive divergence signal before considering positions.

Q: What is the potential for long-term trade with the Yen?

A: The Yen offers promising opportunities for a substantial long-term trade, similar to the case with the Dollar. Historical examples, such as the Dollar reaching parity with the Euro, indicate the potential for significant shifts over time.