The Smart Investor

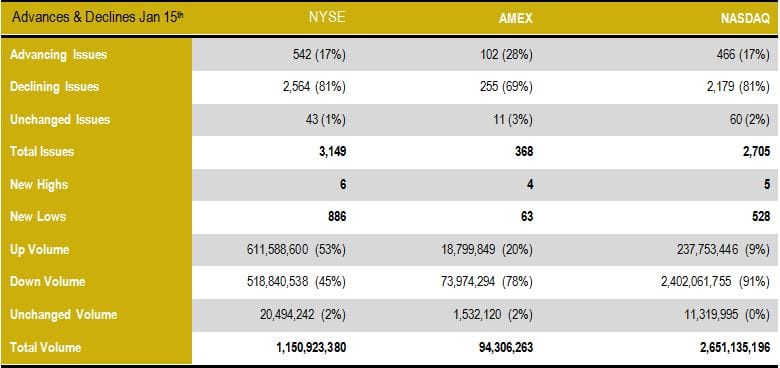

Pay attention to the overall trend. The markets are selling off on low volume in general and rallying on higher volume. Pay attention to the Up volume as this provides you with even more information. The surge in up volume tells you how intense the buying is. On Thursday, Jan 14th the markets rallied strongly. Up volume on the NYSE swelled to a whopping 428% and sold off the following day Jan 15th on low volume.

We are providing an extensive list of data to illustrate how in general it is the masses that are letting their emotions do the talking and selling when they should be buying. Mass psychology states that you should be nervous when the masses are Joyous and Joyous when the panic. They are in panic mode right now.

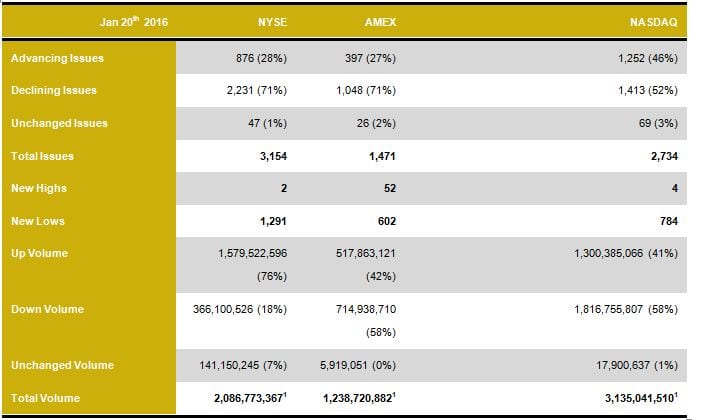

On the 20th of Jan, the Dow shed 250 plus points, but the volume on the NYSE did not even make it to the 3 billion mark.

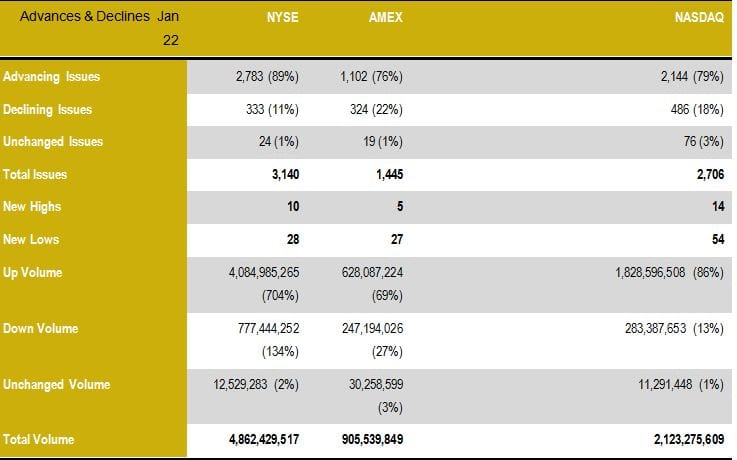

Markets closed on a positive note on Jan 22nd and volume soared once again. If you look at the history, you can see that in general someone is buying the dip and this someone is most likely the smart money. Look at up volume it soared by a massive 704% on the NYSE.

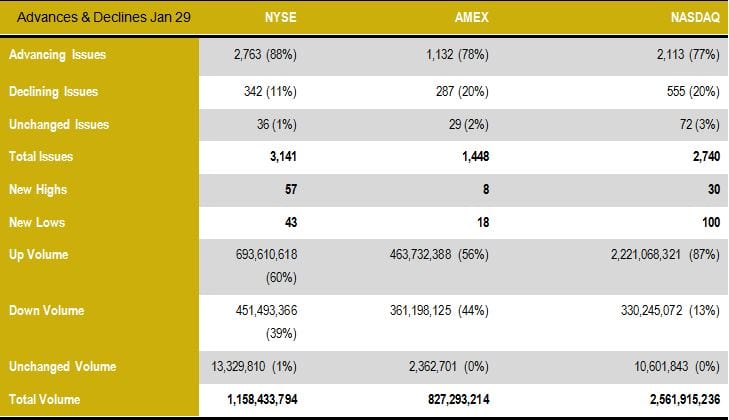

Friday, Jan 29, was the only day where volume dried on an up day, but to be fair the volume on Thursday, Jan 28 was a down day, volume was not that high either. Down testing of the lows is most likely

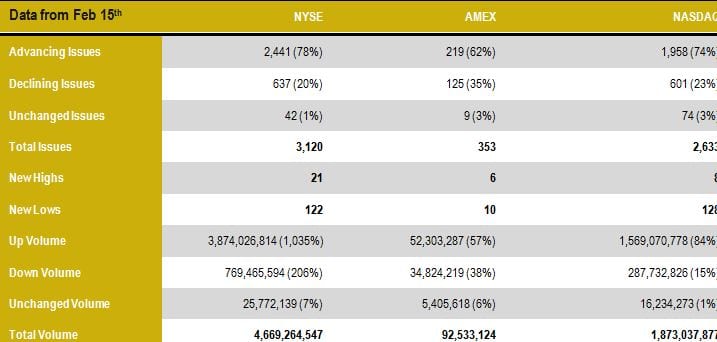

Volume surged once again on Feb 15th, indicating that the smart money once again is buying the dip and not selling into strength as the Naysayers and Doctors of doom would have you believe. UP volume surged a whopping 1,035%

.

.

To The Smart Investor, The Evidence Is Clear

Rather than selling into strength, the smart Investor is buying on the dip, while the masses panic and dump most of their holdings at rock bottom prices. This is history repeating itself or groundhogs day in real life, the game plan never changes, the masses always run for cover when the going appears to be getting tough and the smart money always comes in and scoops up gems for next to nothing.

Tactical Investor Update Aug 2019

The masses complain about better prices when their wish comes true, they panic and flee to the hills and that is what they call investing. They are either oscillating between misery or euphoria and both have a dangerously short lifespan.

Despite the media trying to create a new narrative to prove otherwise for the past several years; they have failed miserably. And this illustrates that news, in general, should either be treated as rubbish or viewed through a humorous lens.

In terms of the stock market, until the Fed changes its mind, all sharp corrections have to be viewed as buying opportunities, and backbreaking corrections have to be placed in the category of “once in a lifetime events”, provided of course the trend is positive. That is what we are here for; to inform you if the trend is positive (Up) or negative (down).

The world is going to witness a Fed that has decided to make a cocktail of Coke, Heroin, Crack and Meth and take it all in one shot. Imagine what a junkie on this combination of potent drugs is capable of doing, and you will have an idea of where the Fed is heading in the years to come. Market Update Feb 28, 2019

Game plan

Make a list of stocks and Use strong pullback to open new positions in companies that have strong quarterly earnings and revenue growth rates.

Other articles of interest:

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)