Market Timing Indicator: Valuable Tool or Merely Hot Air?

Updated March 27, 2024

The first thing we want to clarify to everyone is that our Goal is not to predict the exact top or bottom at any given instance. If we do happen to expect this, as has been the case in the past, we will assign this feat to Lady Luck. Trying to predict the exact top or bottom is an exercise in futility and best suited for fools. What we look for is signs of topping or bottoming action. Once we spot this, we use our proprietary tools to determine entry points that offer the best risk-to-reward scenarios.

Until 2012, the ultimate timing indicator and the Smart money Indicator were the primary tools we used to determine this action. However, in Dec 2012, we replaced all the instruments with the Trend Indicator. We employ this primary instrument to assess market direction once we have identified that we use the secondary tools to validate the signal.

Ultimate Market Timing Indicator

The Ultimate Market Timing Indicator is a powerful tool that combines 39 different indicators into one, allowing us to identify markets that are close to bottoming or topping. We examine this data in multiple time frames, focusing on daily, weekly, and monthly time frames, to confirm valid signals.

Adaptability is crucial in the ever-changing market landscape. We continually strive to improve our tools and adjust our mindset to stay ahead of the market’s evolving faces. This commitment to improvement ensures we can provide accurate and timely market insights.

Insights from John Swift and George Orwell

John Swift, a renowned market analyst, emphasizes the importance of adaptability in market timing. He states, “The market is a living, breathing entity that constantly evolves. To succeed in market timing, one must be willing to adapt and evolve with it”.

George Orwell, a celebrated author and keen observer of human nature, offers a unique perspective on market timing. He notes, “To see what is in front of one’s nose needs a constant struggle”. This observation highlights the importance of maintaining a clear and focused perspective when analyzing market trends.

This is why we have developed an even better indicator, one that we believe is our best indicator to date: the trend indicator.

Some random factors to consider

This market has yet to experience the “feeding frenzy stage; as the masses have taken so long to embrace this market, this stage will be spectacular. Expect the markets to take off vertically once the groups jump in; it seems complicated to believe that the Dow could take off like a rocket after such a massive correction, but that will happen if this hysteria subsides.

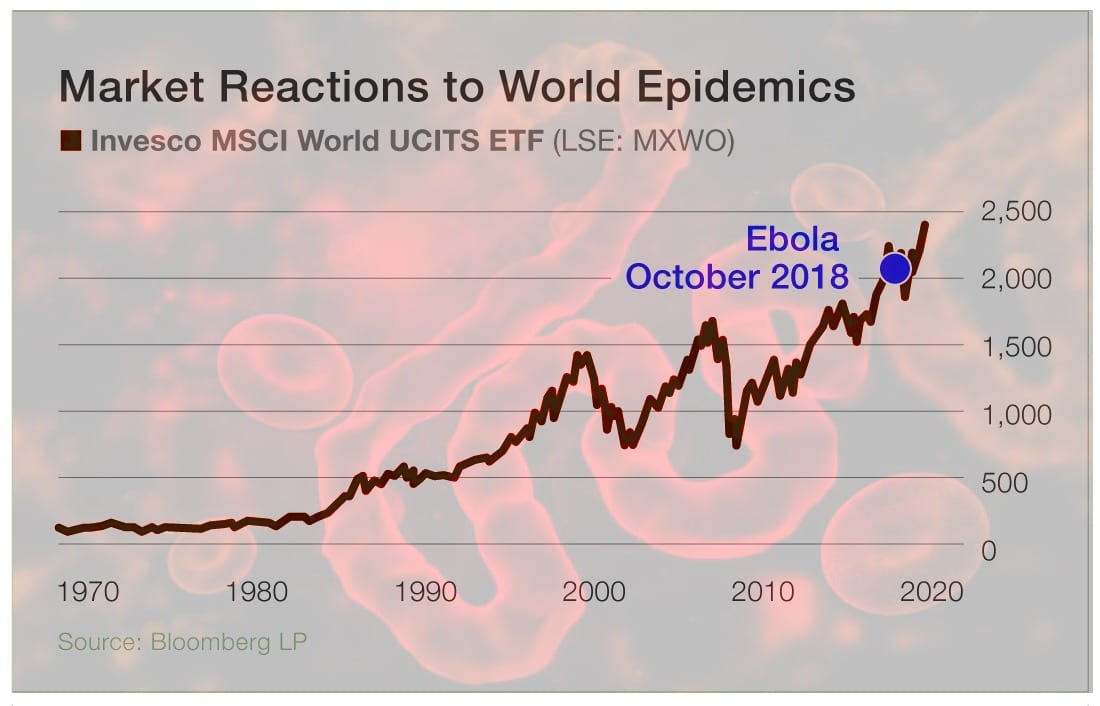

We have seen the same paranoia before; look at the above chart. We have had such deadly outbreaks before, but in the end, once the panic subsides, the markets resume their upward trend.

As the Tactical Investor says, “every disaster leads to a hidden opportunity”, and the only way to spot that opportunity is not to give in to panic. We envision a similar outcome for the coronavirus; the markets could still sell off, but that sell-off should be viewed through a bullish lens.

From a psychological perspective, the longer the masses resist, the better it is, which means this bull will continue to trend higher. Use strong pullbacks to open positions in quality stocks. Forget the noise and focus on the trend.

Articles of interest:

Which Type of Account Offers Tax-Deferred Investing for Retirement?

How to Start Saving for Retirement at 35 and Ensure a Comfortable Future

The Unveiling: Proof Oil Is Not a Fossil Fuel—A Deeper Dive

Blue Gas Unleashed: Separating Hype from Sustainable Reality

From Striving to Thriving: How to Start Saving for Retirement at 50 – It’s Not Too Late

The Power of Saving: Why is Saving Money So Important for Your Future?

What is a Bull Market vs Bear Market: Timeless Insights from Investment Pioneers

Which Is the Best Option for a 22-Year-Old Investing for Their Retirement? Stocks

The Lavish Tale of the Dot-Com Bubble: When the Internet Took the World by Storm

Why Diversification Is an Important Part of Investing: It’s Critical to Success

Unleashing the Beasts: What is a Bull Market? What is a Bear Market

Explain Why Diversification Is Such an Important Concept When It Comes to Investing for Your Future

How to Achieve Financial Freedom Before 30: Strategic Solutions

What is a Bull Market? Unleashing its Power

Unlocking the Secrets: How to Achieve Financial Independence?

Dow theory no longer relevant-Better Alternative exists

In 1929 the stock market crashed because of