Updated Dec 2023

Dow Jones Industrial and the Economy

The U.S. loves to dictate rules and enjoys pointing a finger at nations it deems that are not playing fair. In reality, the truth is that the U.S is the one that does not play fair, it says one thing and does another. For example, it talks about free markets and how it has the welfare of its citizens in mind. How it has done a lot to stimulate the economy since the great recession of 2008. Let’s examine each of these points one by one

US Markets are Free

Our response to this delusional statement is “Tell us another joke”. Any shred of freedom was eviscerated once the Fed first flooded the markets with several rounds of QE and then purposely held interest rates at ultra-low levels for a record period. This has triggered one of the biggest corporate debt binges of all time. Corporations now have decided to borrow and use these funds to boost earnings. This money is not invested in the company to purchase capital goods or to do anything that improves the bottom. What they are doing is buying back huge numbers of shares and thereby artificially boosting the EPS. Modern alchemy at its best, we addressed this scheme in detail in an article titled Share buybacks just another WallStreet Scam

The US has the welfare of its citizens at heart.

This is another Joke. If the government cared about its people, 75% would not be leaving from paycheck to paycheck. The number of individuals on food stamps would not continue to soar, and the average salary (when inflation is factored in) would not be lower than 10 years ago. Finally, the Fed would not punish savers and reward speculators by keeping rates low for an excessive amount of time. In this article titled Oops, we did it again; we covered the issue of why we expect this period of low interest to last for a very long time.

Stimulating the economy

By stimulating the economy, they mean running the printing press; then they have done a splendid job. However, if we look at things clearly, the Fed and the government have done a pathetic job stimulating the economy. All they have done is create the illusion that all is well by providing corporations with easy access to hot money. This hot money is then used to repurchase shares or indulge in other speculative activities that create the illusion all is well. This illusion will end as soon as the supply of hot money is cut. As long as it is easy to raise debt, as is the case now, as interest rates are so low, this strategy will work.

The problem is that this strategy allows many companies that should have been bankrupt long ago a second lease on life as they now have access to funds they would not have had before. As evidence of this, look at how much time was spent over the possibility that the Fed would raise rates by a pathetic 0.25 basis point. If the economy were improving, a Fed hike should have been seen as a positive event as it indicates that the business outlook is improving.

Navigating the Market Amid Rising Volatility

As we’ve repeatedly emphasized, an increase in market volatility is anticipated and expected to escalate even further. The year commenced with significant momentum, and the current market turbulence shows no signs of subsiding.

Given that volatility is predicted to reach unprecedented heights, it’s crucial to grasp the nature of these market dynamics. Markets will inevitably experience robust upward movements followed by sharp declines – this is the essence of volatility.

Consider the following excerpt:

Among the hardest hit sectors are airlines, major insurers – who may face tens of billions in claims due to recent events – as well as financial services, travel and hospitality, and retail stocks. Conversely, defence and security stocks emerged as the day’s biggest winners. “I understand it’s tough right now. Transportation businesses are suffering, and the market was already in a correction phase prior to this crisis. However, the fundamentals for economic growth remain intact,” Bush assured reporters at the Pentagon.

Former Labor Secretary Robert Reich, currently a professor at Brandeis University in Waltham, Mass., encourages companies to consider their options. “Companies have the option to repurchase their own stocks, and I hope companies will take this into serious consideration,” says Reich. Nevertheless, experts agree that restoring the exchange to its full operational capacity will be challenging. Full Story

Navigating such market conditions requires a keen understanding of these dynamics and a robust investment strategy capable of weathering these periods of increased volatility.

Upon reading this article, one might be inclined to believe that the author possesses a deep understanding of the subject matter. However, if you follow the link, you’d discover that the article was penned years ago when the Dow hovers just below 9000. Fast forward to today, and the Dow has doubled in value since the article’s publication, even accounting for the current market pullback.

If the predictions were inaccurate then and numerous others, what makes the present any different? Will the markets now plummet dramatically? We believe it’s more likely that the markets will end the year positively rather than crashing to new lows.

The naysayers have been anticipating this crash for a long time. Had they heeded their advice, they would have faced bankruptcy multiple times. Yet, these same naysayers appear to be faring quite well, suggesting that they peddle information to their subscribers or clients they do not act upon.

It’s important to remember that the market is a complex entity influenced by many factors. While staying informed and considering various perspectives is crucial, critically evaluating the information and advice you receive is equally important.

A Simple Game Plan for Market Volatility

The strategy should be straightforward and concise in the face of rising market volatility.

Strong pullbacks should be seen as buying opportunities**. Investors should compile a list of stocks they wish to own. When the markets pull back significantly, it’s time to invest in a selection of robust blue-chip stocks. While the markets are currently retracting, this is an excellent opportunity to assemble a list of top stocks you’d like to own.

A basic understanding of trend analysis can be beneficial in this context. For instance, understanding the type of trend can help identify the area of value on the charts so you know exactly where to enter your pullback trade. In a strong uptrend, the area of value is at the 20MA, for example.

In a subsequent article, we will provide a list of the top sectors based on relative strength and a list of the top 10 stocks in the market.

Remember, pullbacks are temporary price reversals or corrections occurring within the current trend’s context**. They are brief retracements against the dominating trend before the price returns to its original direction. Pullbacks are considered opportunities to enter trades at lower prices in the trend’s direction. Traders anticipate that the trend will continue after the retreat is completed.

However, it’s important to note that pullbacks can be messy and uncomfortable, especially for newer traders. But, your ability to recognize good entry points for strong stocks pulling back in an upward-trending market will make you more money and help you become a consistent trader.

In conclusion, the key to navigating market volatility is to view strong pullbacks as buying opportunities, have a list of desirable stocks ready, and understand basic trend analysis to identify the best entry points.

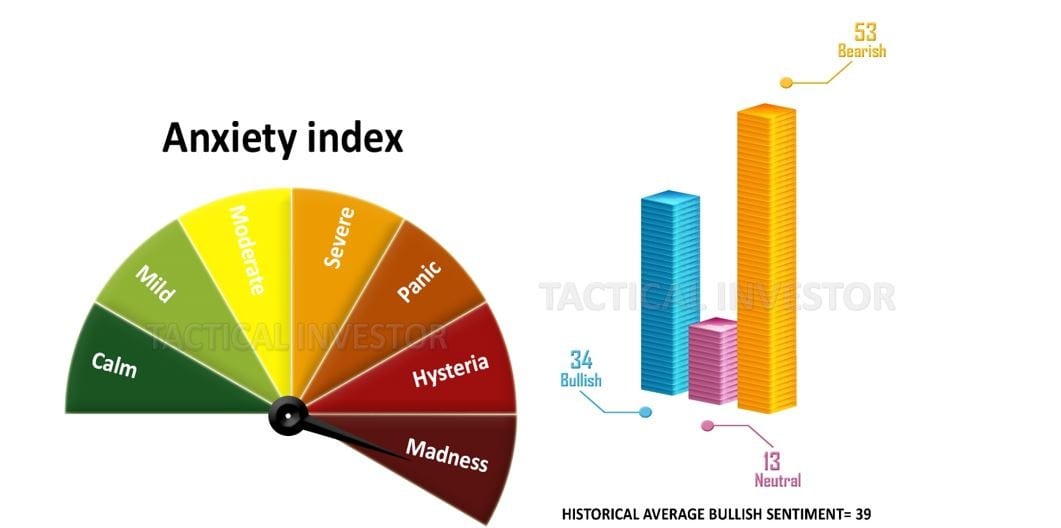

Sentiment Analysis: Crowd Panic Signals Opportunity

No bull market has ever ended when the crowd was worried. Our sentiment indicator illustrates that the crowd was far from euphoric before the correction started, and the crowd is now moving into the anxiety, gloom, and doom camp. Under such a scenario, it is hard to envision a market crash. The number of bulls has dropped dramatically, and the number of bears has spiked in the past two weeks. The Dow Jones Industrial average is ready to soar higher. Every Market needs to release a dose of steam before it trends higher.

The psyche of the average trader has taken a beating, so this correction will likely end up being the most severe correction since 20111. However, rather than setting the path for a massive crash, we believe this correction will set the foundation for a strong bull run.

The Dow Jones Industrial And Overall Market Outlook April 2020 Update

The mass mindset is hard-wired to panic. One can overcome this shortfall by observing this behaviour impartially and asking this simple question: “Why am I doing something that has never led to a positive outcome?”. Secondly, as we have advocated for years, one should maintain a trading journal, and the best time to put pen to paper or fingers on a keyboard is when the markets are tanking. Make a note of the emotions that are swirling through your mind. Jot down some of the headlines the media is pushing out and observe the reactions from your fellow man. This information will prove priceless in the weeks, months, years and decades to come.

.

The markets are trading in the extremely overbought ranges on the weekly charts, and in theory, they should let out some steam, but the monthly charts, for now, are exerting more upward pressure than they usually do. It should be noted that the weekly charts also move relatively slowly, so there is still time for the markets to let out some steam.

Articles That Push the Boundaries of Knowledge

How To Get Financial Freedom: Escape the Herd for Lasting Success

Legalized Food Poisoning: America’s Toxic Diet by Design

“””Investing for dummies”””: Follow The Trend

Executive Compensation Driving Share Buybacks

Illusions of Economic Recovery: Negative Interest Rate Controversy

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Inside the Market Psychology Cycle: Unveiling Trends and Tactics

South China Sea Showdown: Intensifying Heat on the Horizon

Will the Stock Market Crash: Analyzing Possibilities and Implications

China Quantitative Easing: Battling Economic Slowdown

What is Data Manipulation: The Dark Side?

Corruption in China: Government’s Aggressive Crackdown on Wrongdoings

These Are The Things That Scare Americans The Most

Exotic Art: The Fusion of Art and AI Brilliance

Negative Thinking: How It Influences The Masses

Stock Market Crash Date: If Only The Experts Knew When

Permabear; It Takes A Special Kind Of Stupid To Be One