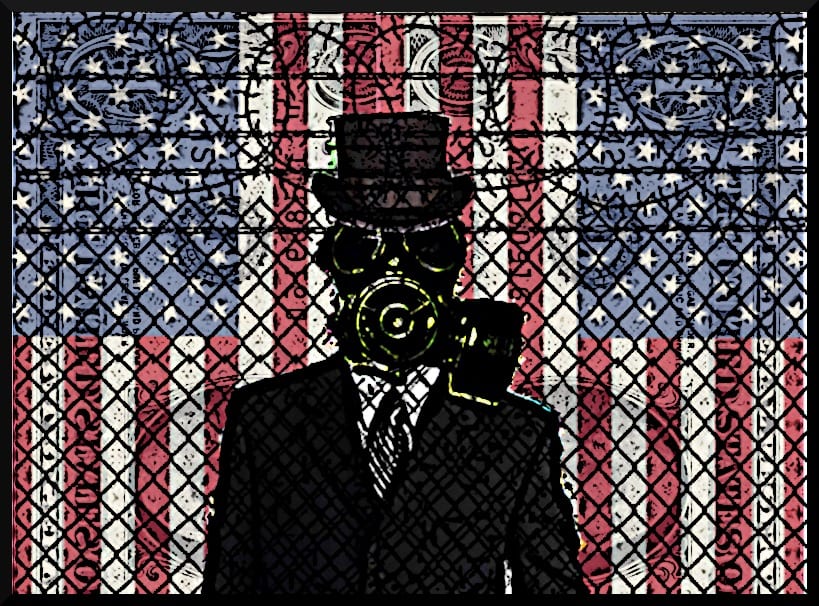

Wall Street Bull: Their Business Model is Based on Bull

Updated Jan 21, 2023

While it is true that the financial industry has a long history of unethical practices, it is also important to note that not all professionals in the industry are guilty of fraudulent behavior.

There have been numerous examples of fraudulent behavior by Wall Street firms and professionals. The GameStop short squeeze incident, which occurred in 2021, is just one recent example. The incident highlighted the unfair advantage that hedge funds and large institutional investors have over retail investors, and it showcased the power of social media in influencing financial markets.

Furthermore, the financial crisis of 2007-2008, often referred to as the Great Recession, exposed numerous instances of fraudulent behavior by banks and other financial institutions. The crisis was triggered by the collapse of the subprime mortgage market, which had been fueled by risky lending practices and excessive greed. Banks encouraged their clients to lie on loan applications, and they even created “no income verification loans” that allowed borrowers to state any income they wanted in order to qualify for credit. This led to a housing market bubble that eventually burst, causing widespread financial turmoil and economic recession.

Additionally, there have been numerous instances of insider trading and market manipulation by Wall Street firms and professionals. In 2019, for example, a former investment banker at Goldman Sachs was sentenced to three months in prison for insider trading. He had shared confidential information about pending mergers and acquisitions with a friend who used the information to make profitable trades.

The fees charged by mutual funds and other investment products have come under increased scrutiny in recent years. While some argue that the fees are justified by the value provided by financial advisors, others contend that high fees can significantly eat into investment returns and make it harder for investors to achieve their financial goals.

While there are certainly honest and ethical professionals in the financial industry, there have been numerous examples of fraudulent and unethical behavior by Wall Street firms and individuals. From the subprime mortgage crisis to insider trading scandals, there have been many instances where the interests of the small guy were overlooked in favor of the profits of the big guys. However, it is important to recognize that not all financial advisors and firms are guilty of these practices, and it is important to do your due diligence when choosing a financial advisor or investment product.

Wall Street Bull: Stealing With Impunity

Despite efforts to regulate the financial industry after the 2007-2008 crisis, fraud and unethical practices continue to plague Wall Street. A prime example of this is the case of JPMorgan Chase & Co. and Millennium Health LLC. JPMorgan was aware that federal authorities were investigating Millennium, the largest drug-testing lab in the U.S, but failed to disclose this information to the lenders who were about to lend the company $1.8 billion in April 2014. According to a person with direct knowledge of the matter, Millennium had claimed that this information was not material, thus JPMorgan believed it did not need to disclose it.

In most markets, such an omission would be considered unethical or worse, but in the leveraged loans market, valued at $800 billion, anything goes. This case is just one example of the pitfalls of a market that is largely unregulated. Borrowers have the ability to limit who can access their financials, control the type of data they receive, and blacklist certain investors from ever buying the loan.

This lack of regulation and oversight can create an environment where fraudulent and unethical behavior can thrive, with some financial institutions prioritizing their own profits over the interests of their clients. While there are certainly honest and ethical professionals in the financial industry, it is clear that more needs to be done to ensure that investors are protected and that the industry operates with transparency and integrity.

In conclusion, the case of JPMorgan and Millennium Health LLC is just one example of the ongoing issue of fraud and unethical practices in the financial industry. It is crucial that steps are taken to address these issues and that greater regulation and oversight are implemented to protect investors and ensure the integrity of the industry. Full story

The phenomenon of over-leveraging is not limited to the Chinese markets but has been seen in markets around the world. The lure of quick and easy profits can be tempting, and when markets are bullish, the temptation to borrow money and enter the market can be overwhelming.

However, when markets begin to pull back, as they inevitably do, the consequences can be devastating. The losses can be much greater than the original investment, as investors are often forced to repay the borrowed money with interest, even if they have lost a significant portion of their investment.

This is where leverage becomes a double-edged sword. It can trigger euphoria in the market when prices are rising, but it can also cause panic when prices fall. In the case of the Chinese markets, the massive over-leveraging that occurred ultimately led to a crash in the market, as investors were forced to sell off their holdings to meet their financial obligations.

Wall Street Bull: Apps Being Used To Gain an Edge?

From traders to bankers and money managers, just about everyone in finance embraces these apps as an easy and virtually untraceable way to circumvent compliance, get around the HR police and keep bosses in the dark. And it’s happening despite the industry’s efforts to crack down on unmonitored communications, according to conversations with employees at more than a dozen of Wall Street’s most recognizable firms.

“You’re really able to operate outside of the bank,” said William McGovern, a former SEC branch chief and senior lawyer at Morgan Stanley who now works at law firm Kobre & Kim. “We have seen in our investigations that the ground is shifting under everyone, and technology changes are driving a lot of it.” Full Story

Wall Street Bull & The Conflict of Interest Factor

The issue of conflicts of interest in Wall Street research recommendations is a significant concern for investors. There are at least four primary conflicts of interest that investors should be aware of when assessing research recommendations.

Firstly, research is simply a tool for Wall Street firms to acquire other businesses, and they do not get paid separately for it. This means that research is not always objective and may be biased towards generating business for the firm.

Secondly, to gain business and attract attention, Wall Street firms may raise price targets to garner attention from investors and the company whose stock is being praised. This can lead to an analyst with the highest mark on a stock receiving more attention than an analyst with a target near the median.

Thirdly, analysts need access to the management of the companies they cover to do their job effectively. This can create a conflict of interest as a CEO may be more willing to talk to an analyst with a high target for their stock than an analyst with a lower target.

Lastly, an analyst’s income depends on how much business they help their firm generate, rather than how right they may be in their recommendations. This can create pressure for analysts to provide recommendations that are favorable to their firm’s business interests, rather than being objective and accurate. Read this about a study on the accuracy of analysts’ price targets. Market Watch

Conclusion

In summary, Wall Street’s business model is often based on unethical practices that prioritize profits over the best interests of clients. Conflicts of interest are prevalent in research recommendations, with analysts facing pressure to generate business for their firms, attract attention, and maintain access to company management. The use of leverage can also lead to over-investment and ultimately cause financial losses when markets experience pullbacks.

To address these issues, Wall Street needs to prioritize transparency and accountability. Regulators should increase oversight and enforce stricter regulations to prevent fraudulent and unethical behavior. Financial institutions should also take responsibility for ensuring their practices are ethical and in the best interests of their clients. This could involve implementing stricter codes of conduct, providing transparent fee structures, and being open and honest about potential conflicts of interest.

Investors can also play a role in promoting ethical practices on Wall Street. By conducting thorough research, seeking objective and independent advice, and avoiding the lure of quick profits, investors can help ensure that their investments align with their values and interests.

Ultimately, the financial industry must shift its focus from short-term profits to long-term sustainability and the best interests of its clients. This will require a culture shift and a commitment to ethical practices, but it is necessary to restore trust in the financial system and promote economic growth that benefits all stakeholders.

Other Stories of Interest:

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Before ’07-’08 you could and they did loan on fake ID’s, without buying a real house, everyone on Wall Street knows that, some made 50 million a day and lost 49 of it to strike 100 million ad term’s end, and nowadays all fraction’s on Wall Street still do buying and selling each others air, like all stock market’s around the world. There is on paper ten times more money, than there is real money and assets together.

Stock market’s are like slot-machines! The stock market always win, even if the German bank falls they win big.