Editor: Vladimir Bajic | Tactical Investor

Is Now a Good Time To Buy Stocks?

First Identify the Trend:

Once you identify the trend, it is very easy to find top plays. You can use any screener to identify stocks that meet with your criteria. Finviz is an example of a good stock screening tool.

What drives the markets? Most individuals will state that it is either fundamentals or the technical structure of the market; sadly to state both groups are wrong. Emotions drive the markets and even though machines perform a large part of the daily markets transactions; their programmers are humans. Only when machines start programming machines might we arrive at the day where emotions play a minor role. For the record, there is a way to track machine behaviour using the principles of Mass psychology. Logic is nothing but a perception, and that perception is based on an emotional construct. What’s logical to one could appear utterly illogical to another human, and that will apply to AI one day.

If emotions drive the market and the masses are being driven insane by some or all of the above developments, then what does it suggest. Well, our hypothesis is as follows

Polarised individuals are easy to manipulate

- A polarised man is easier to rob than a calm man, but polarise the crowd, and it becomes infinitely easier to rob and manipulate this same man. Nobody pays attention to the obvious; their attention is being redirected towards issues that will elicit a strong emotional reaction. For example, it is almost a given that the national debt is going to be raised to levels deemed stupendous in comparison to today’s levels. Why? Nobody cares, and the experiment with Bitcoin proves it. So with the Fed hell-bent on flooding the system with money, the answer to the question; Is now a good time to buy stocks would be yes. However, use strong pullbacks to open new positions.

- If the masses are not going to worry about the national debt, then the level of market manipulation can be pushed to levels that will be deemed illegal by today’s standards. Which means that without a doubt we can state several crises are going to be created most of which will be more significant than the 2008 financial crisis? On the same token, we can state that the ensuing boom cycles will be even spawn raging bull markets. To put it simply, every crash is going to be a stock market buying opportunity. Though one has to know when to jump in as jumping in at the wrong time, would be akin to catching a falling dagger. We do not have to worry about that issue as the trend indicator handles that part quite well.

Masses are not Euphoric so embrace sharp Pullbacks

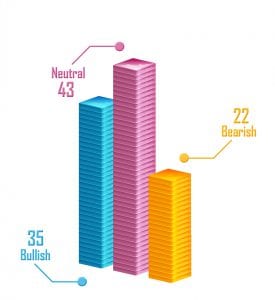

In fact, the number of individuals in the neutral is at one of its highest levels ever, and the combined score of neutral and bears stands at 65. When the number of individuals in the neutral camp surges, it indicates that uncertainty is rising. Bearish individuals generally have conviction even if they tend to be wrong more often than they are right. On the other hand, individuals in the neutral camp lack conviction; they have no backbone.

Is Now a Good Time To Buy Stocks: Final Thoughts

What everyone needs to remember is that boom and bust cycles are part of the game and each cycle is going to get worse as long as Fiat is in play. Look at the money supply charts and any long-term chart of the stock market, and there is not one instance where any so-called crash proved to be the disaster the experts were claiming it would be. In fact, they all proved to be buying opportunities. Furthermore, as we are living in a world where everything is just a click away, the downtime of each disaster has been minimised. While the 2008 financial crisis was fast and furious, it was brought under control quite quickly, and the ensuing bull that emerged was one of the most aggressive bulls of all time.

Stock Market Outlook Oct 2019

When the trend is positive (UP) train yourself to view strong pullbacks, corrections and other negative developments through a bullish lens. Anyone can panic in the face of trouble, but only the astute individual can stand still and direct their energy to spotting opportunities. Don’t do what the masses are trained to do, for, after all these years of panic, they have nothing to show for it. Market Update Sept 15, 2019

The Dow did not drop below 25K, but it did trade down to the 25,700 ranges, and in doing so, it satisfied the minimum downside targets. This does not mean that the Dow cannot test the 25,000 ranges; as stated before we would be very happy if this came to pass. The crowd has continued to pull money out of the market, indicating as always their uncanny ability to sell at precisely the wrong time.

The anxiety gauge is now deep in the hysteria zone, confirming that the crowd is going against the overall trend and that once again; they are on the wrong side of the markets. Note that we do not focus on short term periods; we focus on intermediate and long term timelines.

When you combine the bears and the neutral the score has consistently fallen in the 60-70 ranges, so what we need now is a shock type event, which will push this score up to the 75-80 ranges. Market Update Sept 25, 2019

The so-called strong pullback and we use the word “so-called” because when you factor in how high this market is trading from its 2009 lows or even 2015 lows, the current pullback is a non-event. Based on the weekly charts of the Dow, there is still room for more downside action before our indicators move into the oversold ranges.

Copper continues to put in a bullish pattern and once the MACD’s on the monthly charts experience a bullish crossover, we suspect it will not be too long after that before the markets explode.

Tactical Investor Alternative Dow Theory States It’s a Good Time To Buy

According to the Tactical Investor alternative Dow Theory, if the Dow utilities trade to new highs, it is a good omen of things to come. In other words, the Dow industrials will follow the same path sooner or later. The Dow utilities surged to new highs in September and as a result, the Dow industrials and transports are expected to follow suit. The transport sector is expected to outperform the overall market. We are looking at both IYT and XTN as possible future candidates and we might even add TPOR to our list but it will be placed under the secondary candidates and will be labelled as a high-risk play (3X leveraged ETF)

Huge amounts of money have left the market indicating that the crowd is panicking at precisely the wrong time. History indicates that whenever the masses panic, an opportunity is usually around the corner. Hence the only one that is going to take another round of beatings is the masses.

The Markets are mimicking the pattern they put in 2009; if this pattern completes it will lead to an explosive upward move.

Other Stories of Interest

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Edward Griffin author of Creature from Jekyll Island illustrates that the Fed is an Illegal Entity

Best Stocks To Buy 2017