Stock Markets & Economy

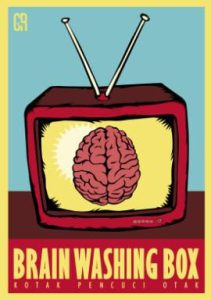

Trying to gauge where the economy is headed is almost always a waste of time; other than pouring over useless statistics and having consumed a large dose of time, you will be none the wiser. If this activity were indeed useful then almost all Economists would be millionaires; sadly, they are not. They are usually working for large multi-million or billion-dollar corporations, who can afford to hire them to come out with these silly scenarios that they don’t even believe in. It’s not by coincidence that economics is referred to as the “dismal science.”

Most successful businesses don’t waste time trying to figure out where the economy is headed; they are looking at what they have to do to improve their business. In today’s age of hot money, there are two options on the table. Work hard and try to produce a better product or come out with something new that will replace an older product or service and offer it at a better price. The second option, borrow large sums of money and buy back your shares and magically improve your EPS, without doing anything extra. A large number of corporations are focussing on the second option as it’s very easy for corporate officers to reap in large bonuses without doing anything.

Naysayers rant of a list of negatives some of which would include the following:

- The current economic recovery is the weakest on record since 1949; so what. How is this data supposed to help you regarding investing in the market? It can’t because it tells you nothing. The economic recovery has been weak for years on hand and yet each year the Dow trends higher. If this data were relevant and investors paid attention to it, then the market should have crashed and should have been putting a series of lower lows.

- The dollar is weakening; wait a second were not experts claiming that a strong dollar was bad for the economy and how did that argument work out? So why would anyone pay attention to this nonsense? In reality, the dollar is still much stronger than it was back in 2010. There is no such thing as a strong dollar or strong Euro; it’s all relative as the world is locked in a competitive, currency war. In this war, there is no option but to devalue or die.

- Weak Economic Growth; another useless static that has no bearing on market direction; if it did the markets should have crashed already; instead, it is trending higher. This data can be revised upwards and next month growth rates could come in higher than expected. All this data is manipulated anyway so why the focus on any of this nonsense. The only two things that matters are emotions and price action. The crowd is still extremely bearish, and price action is positive. Translations, markets will experience corrections ranging from mild to wild; these pullbacks should be treated as buying opportunities.

We could also use data (manipulated) to create a bullish picture; wages are rising, unemployment has dropped, energy prices are lower, and inflation is non-existent. However, this data is as equally meaningless as the data used to come out with projections for where the economy is heading.

Stock Markets & Economy: the last 8 years

The last eight years are a perfect example. On its best day, this economy can be compared to a plane flying with one engine; the second one is not working. The plane needs both for optimal performance, but it can still continue operating with one. Mass psychology clearly illustrates that markets top when the masses are Euphoric; how did the housing bubble end. It did not end on a note of panic but a note of euphoria.

Conclusion

Don’t waste time pouring over useless economic data; all the data is twisted anyway so what sense can you hope to make from it. Focus on the emotion and trend (price action); the trend is always your friend. What investors are interested is in earnings and EPS has been improving even though in many instances the technique being used to boost them borders on fraud, earnings are still growing. Furthermore, the market does not seem to care about what method is employed to improve EPS; for if it did, the market would not be trading next to the all-time new high territory.

Other Articles of Interest:

John Oliver on the Dangers of Sub-Prime Auto Loans (August 21)

On Fraud, Lies & Corruption Hillary Destroys Trump (August 9)

Currency devaluation wars & officers getting shot for nothing (August 9)

Fed’s War on Cash; Germany Joins Negative Interest Rate Club (August 8)

Goldman Obtains information Illegally & Fined only 36 million (August 7)

Pope Francis States Islam should not be Identified with Violence (August 5)

Media & Market Manipulators over exaggerating Brexit Effect (August 1)

Mugabe’s misdeeds & Zimbabwe’s Path to Hell (July 29)

America Fighting Bin Laden War Not Islamic State Terrorism War (July 29)

Zero Percent Mortgage Debuts setting next stage for Stock Market Bull (July 27)

Long Term Stock Market Bears Always Lose (July 27)

Putin Crushes CNN Reporter Fareed Zakaria Biassed Question on Trump (July 13)

Negative rates will fuel the biggest Bull Market rally in History (25 May)

Media Manipulates Financial Markets via Good & bad News (21 May)