Hot Stocks To Buy As Opposed To Boring Bonds?

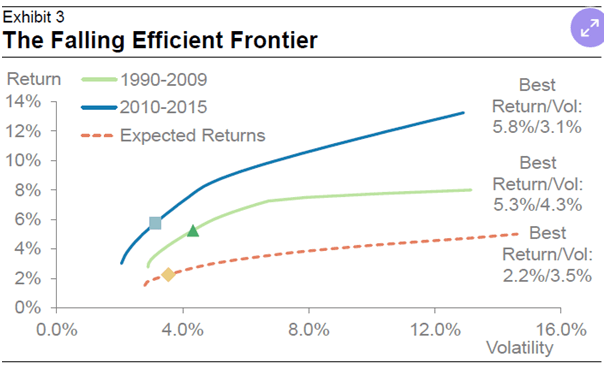

This article came into being as Morgan Stanley, stated that investors should look forward to low returns only. They based these claims in part on the “The falling Efficient Frontier model”, depicted below. For this article, the word hot stocks refer to stocks with great technicals and good momentum.

Their definition of paltry equates to gains of roughly 5% a year. If that is the case, most investors are already used to well below mediocre as, an enormous percentage of the populace is sitting on the sidelines, or they have parked their money in treasuries. You do not have to settle for mediocre returns, for the model these chaps are using is flawed at best.

Source Bloomberg.com

This model states that the best of times are behind us and that going forward the outlook is not so bright. In other words, this model is about to collapse.

How should you react to these so-called erudite predictions; ignore them for other than a lot of hot air, they are not a reflection of reality.

Right of the bat, logic should kick in; the problem is the model, not the markets. Hence, the only fitting place for such advice is the lowly trash can.

In effect, what Morgan Stanley is stating is that the only way to make money now sacrifice growth for risk. We think that many individuals have already made that choice, especially in this ultra low rate environment that punishes savers and favours speculators.

Has it ever been easy to make money in the markets?

Not really, because, if it were every Tom, Dick and Harry would be rich. Instead, these chaps should have stated that if one focuses on spotting the new trends, one could easily overcome the shortfalls presented by this model. Their line of thinking in our opinion is gobbledygook

So what is the solution

- place less in bonds; the 50;50 stock/ bond portfolio is a thing of the past

- Devote some time to spotting new trends; You can find this by looking at sectors that are just starting to break out. Once you determine this, look for the strongest stocks in that sector. Do not focus on traditional assets only; Look for stocks that offer growth potential; their revenue and quarterly profits should be trend upwards

- Diversify; do not fixate on one asset class or one sector only. Spread your beats. If you are young, you can afford to take on more risk as you investment horizons are different from those who are fast approaching retirement age.

To demonstrate that stocks are far sexier than Bonds, we randomly selected some ETF’s plotted their returns from 2002. We even included the Gold ETF, which has been one of the worst-performing ETF’s for the past three years and the returns were still not too shabby. Now Imagine you focused on finding the strongest stocks in the strongest sectors, how much better the results would be? If one chooses the right hot stocks (stocks that have good momentum and good technicals), then one has an above-average chance of beating the markets

In the end, it is your money, do not listen to the talking heads or the so-called experts. Take control of your money or someone else will.

Hot Stocks To Buy and The Tactical Investor Take, Aug 2019

Nothing changes, and that is why the masses are destined to lose. If you examine every single bubble in history, the storyline is the same. If you are a new subscriber, this is the most important lesson you need to grasp. This is mass psychology in action; never follow the masses unless you are looking for a quick end. Market Update Aug 8, 2019

Now that the masses are almost in a full-blown panic mode, the above statement applies more than ever. The crowd is always wrong. Mass Psychology can be used in almost any aspect of one’s life. In this publication, the focus is on investing. However, one quick way to get some guidance is to understand that no matter what the arena is; if the masses fully embrace the concept, the investment, the philosophy, etc., the safest bet is to take an opposing viewpoint.

Other articles of Interest:

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Experts Finance Predictions for 2019

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)

Popular Media Lies To You: Don’t Listen To Experts As They Know Nothing (March 3)

Fiat Money; The main driver behind boom & Bust Cycles (March 1)

Permabear; It Takes A Special Kind Of Stupid To Be One (Feb 21)

US Debt To GDP Means Nothing To Bonds & Stocks (Feb 12)

Technology-Driven Deflation Will Kill The Inflation Monster (Feb 7)

Business Investment & Stock Market Uncertainty (Jan 31)

Dow 30 Stocks; what are they saying about the markets (Jan 30)

Stock Market Bull 2019; Follow The Trend & Avoid The Noise (Jan 29)

Long Term Trends & Bull Market Bear Market Nonsense (Jan 16)

Bull & Bear Market 2019: which one will prevail (Jan 14)

When will the Fed raise interest rates (Nov 11, 2015)