When you get into a tight place and everything goes against you, till it seems as though you could not hold on a minute longer, never give up then, for that is just the place and time that the tide will turn. – Harriet Beecher Stowe (1811-1896) American Novelist, Antislavery Campaigner

US Dollar Bull Market? We Think so

This is one topic we spoke of extensively over the past few months, and we are going to list excerpts from some past updates with an emphasis on the Dec 16th market update.

The dollar is testing a 2-year support zone, and as long as it can stay above this level on a monthly basis, the outlook will remain bullish.

The dollar is also putting in a falling wedge formation which usually is bullish. It also continues to issue new positive divergence signals almost on a weekly basis. There is also a huge short position in the dollar, so a strong move up will most likely produce a short squeeze which could lead to a domino effect. We notice that the movement towards extremes is hitting almost every asset class. We have yet to witness an extreme event which has not produced a counter move in the opposite direction that is just as strong if not stronger.

To signal that the outlook is changing

The Dollar now needs to trade past the 75.80-76.00 ranges for at least five days in a row. If the dollar manages to do this, it will be in a position to trade to 80. Market update Nov 24, 2009.

We have been stating that the dollar is due to for a turnaround when almost everyone has been calling for its demise. Long-term we agree, but in short to intermediate time frames we feel that the dollar is going to give one last dying gasp. No beast ever gives up and dies without putting up a tough fight, and the dollar is a huge beast

The dollar has broken out of falling wedge

This is a bullish pattern, and the euro has broken down from a rising wedge (bearish pattern). One of the most glaring bullish factors that we feel almost everyone has missed is the action that has taken place in the Gold markets. Gold surged to put in a series of new highs as the dollar broke down.

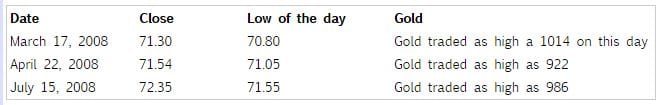

In the past 24 months, the dollar put in what we consider to be three important new lows. We are going to list the lows below in chronological order.

Something Unusual is Taking Place

Gold broke past its 1980 highs of roughly 850 several months ago. When Gold traded past its March 17, 2008 high of 1014 should not have the dollar at least tested the low it put on that day. Gold then went on to trade past the 1100 mark and then past the 1200 mark, and by now one would have expected the dollar to crack wide open and at the very least trade below 71.30. Strangely the dollar did not even trade below 74.50, and on a monthly basis, it never closed below 75.

Glaring Discrepancy

This is the single most glaring discrepancy we have noticed, and yet no one is talking about it. The Gold bugs and even the mainstream media now rants and raves about how everyone is jumping into Gold. They even mention central bankers who are supposedly busy purchasing gold. Let’s stop here for a second. Were not central bankers selling Gold when it was trading in the 300-700 ranges? Yes, everyone claims these guys are dumb and stupid. However, we think they are very devious buggers. They have generation’s worth of knowledge when it comes to currency manipulation. They are probably buying gold to trick the majority into thinking that Gold is going to roar upward without a correction. After all, it does not cost them anything to buy Gold, does it? All they have to do is print more money.

Gold traded 21% above its March 17, 2008 high. It traded as high as 1227 before pulling back. Logically that means that the dollar should have traded at least 3-5% lower than its March 17 low. Instead, it traded 4% higher. The above data indicates that something is wrong and that the dollar instead of taking a beating was putting up a very strong fight. Look how fast Gold pulled back when the dollar mounted a small rally. What do you think will occur when and if it trades to and possibly past the 80 mark?

If the above factor is not enough to make you ponder, consider the following factors

Psychologically every Tom, Dick and Harry thinks that the dollar is toast, which investing in commodities (primarily Gold) and competing currencies are the best options available to them. It is now estimated that close to 99% of traders think that the dollar is dead. Remember that extremism always brings about the opposite result no matter how good the investment might look; in this case, it would be a dollar rally. Gold used to be viewed as a contrarian investment but if you look about now, its anything but contrarian and its increasingly becoming a mainstream idea. Markets are forward-looking beasts, and we think in short to intermediate time frames the markets have already priced in the worst when it comes to the dollar.

Conclusion

The dollar is hated universally, and the distaste for it now is at historic highs. Mass psychology usually states that when something is hated so much and that the only logical place for the investment to the trend is downwards, precisely the opposite occurs, and instead it mounts a powerful rally.

A strong dollar rally will most likely put a damper on the market’s ability to rally sharply, produce a pullback in the commodities sector with the possibility of a solid pullback in the precious metal’s sector; bonds will drop (rising interest rates equate to lower bond prices), etc. The fate of the dollar is going to be a key factor in determining what several markets will or won’t do next year.

The dollar could either give a powerful confirmation that it is going to trade to and past 80 by closing above77.50 on a weekly basis or it can do this in two stages. It can trade past 76.43 on a weekly basis and then trade past 77.50 for three days in a row. The second path is slightly more bullish and could be warning that the dollar is going to trade past 82.00.

Every asset class has rallied in the face of a lower dollar

Thus a strong rally in the dollar could prove detrimental to the entire market. Market update Dec 16, 2009.

Thus individuals should not smugly gloat over the dollar’s demise, for they might be missing the real trouble that is taking place in their backyard. This problem facing the EU is another reason why the dollar could potentially mount a stronger rally than most expect and why it might even potentially surpass all our posted targets. When the ship is sinking panic takes over, and people jump before they look. Thus if anything out there makes investors feel skittish about the Euro, it could potentially trigger a mad rush for the exits. Are we saying this is going to occur? No we are not but given the large deficits five members in the EU are running; it’s safe to say that all is not well and that the situation could take a turn for the worse very rapidly. Greece could turn out to be another Iceland if they do not get their act together very very fast. Market update Jan 5th, 2010

So how do things look going forward?

First, the pattern changed slightly indicating that the dollar had to close above 78.50 on a weekly basis instead of 77.50; it did this with relative ease. It almost traded to 80 before pulling back. A close above 81 on a monthly basis will be a very strong signal for the dollar; it could potentially trade to new high and spike as high as 90; the key word to focus on is potential. Adding more firepower to the dollar is the current turbulent situation facing the EU zone. The fact that all the big EU players have come out and stated that they are not going to help Greece reveals some important data from a mass psychology perspective.

If you are not going to do something you do not have to keep repeating it. Secondly, not everyone needs to come out and say the same thing at the same time. Thirdly, if you can handle the problem then all you have to do is shut up and follow it with actions; actions speak louder than words. So far everything has been done in reverse order. We conclude that Greece is in serious trouble and the politicians there do not want to implement the necessary painful cuts as it could mean the loss of their jobs. France and Germany already know this, but they are making it look like Greece is on its own. If Greece gets a helping hand, the other beggars will start to line up. The next on the list could be Italy followed by Ireland, Spain and Portugal. If the big players help, it will have a negative impact on the Euro if they don’t help and one of the member’s defaults the outcome could be ten times as worse.

If this situation continues Germany might decide to pull out of the EU, and if they pull out the EU is dead. At this point, this is a dramatic move, and we are not stating it’s going to happen, but individuals are getting tired of helping other countries when they are having a tough time back home. The days of handouts are coming to an end. We now have several phases in action.

The devalue or die currency battle.

Take care of your problems or rot away stage (basically survival of the fittest stage)

The protectionism era, where nations start imposing huge tariffs to make local products competitive with imported products; this will be true, especially with Chinese made products.

Regarding the dollar, we have a daily and a weekly buy signal in effect. Thus the current outlook on the dollar remains rather bullish. On the Euro, we have a weekly sell and a daily sell signal in effect, and so the outlook remains bearish. It could potentially trade all the way down to the 125 ranges. If the dollar should issue a monthly buy signal, the outlook for the dollar will turn extremely bullish, and it will be a sign that Gold could potentially correct/consolidate for the next 7-9 months before mounting another strong rally. This, in turn, will increase the odds that the entire commodity’s sector is going to experience a rather strong pull back. The current action in Copper and the oil markets indicates that all is not well and the other sectors could soon follow their lead.

Do not focus on just one tree but make sure you keep your eyes on the forest too and vice versa.

There is a genius in persistence. It conquers all opposers. It gives confidence. It annihilates obstacles. Everybody believes in a determined man. People know that when he undertakes a thing, the battle is half won, for his rule is to accomplish whatever he sets out to do. Orison Swett Marden (1850-1924), American Author, Founder of Success Magazine

Articles of interest:

Why Mechanical and Technical Analysis Systems Fail

The Limitations of Trend Lines

Contrarian Investment Guidelines

Inductive Versus Deductive reasoning

Portfolio Management Suggestions

The Good And the Ugly On Trading Futures