Average Student Debt

The, key ingredient for any crisis are greed, desperation and a fake sense of need, regardless of the cost of the item that is being sought. Think tulip crisis or mortgage crisis and the student loan market is following the exact same pattern. Hence, the outcome is going to be the same. You cannot kill stupidity; stupidity is the only bull market that has never experienced a correction and probably never will. The clock below illustrates the mind-boggling rate at which new student debt is being created. This crisis will make the mortgage crisis appear like a walk in the park.

The Congressional Budget Office is forewarning that unless strict measures are implemented soon, our national debt will soar to $30 trillion by 2026. Our response is that nothing will be done unless someone who is willing to challenge the status quo is elected. If that does not occur, then expect the national debt and student debt to spiral out of control. The masses have are sedated and almost in a comatose state; overworked and underpaid they don’t have the energy to challenge the system. And the Top shadowy players have no intention of changing the status quo. This is what they want as it allows them to bleed the masses without having to encounter resistance.

The delinquency rate on student loans is already 11% and this is set to rise and students are paying more and more for less and less. What do we mean? They take on huge amounts of debt but have a hard time landing a job that can pay back this debt. The solution, make it harder to qualify for student loans and this will force prices lower as universities will finally have to compete for students that have the money to pay as opposed to strangling debt-free students for life with massive amounts of debt that most will never be able to pay off

Introduction to Mass Psychology and Investing (Vide0)

Average Student Debt is skyrocketing

The latest student loan debt statistics for 2020 show how serious the student loan debt crisis has become for borrowers across all demographics and age groups. There are 45 million borrowers who collectively owe nearly $1.6 trillion in student loan debt in the U.S. Student loan debt is now the second-highest consumer debt category – behind only mortgage debt – and higher than both credit cards and auto loans. The average student loan debt for members of the Class of 2018 is $29,200, a 2% increase from the prior year, according to the Institute for College Access and Success.

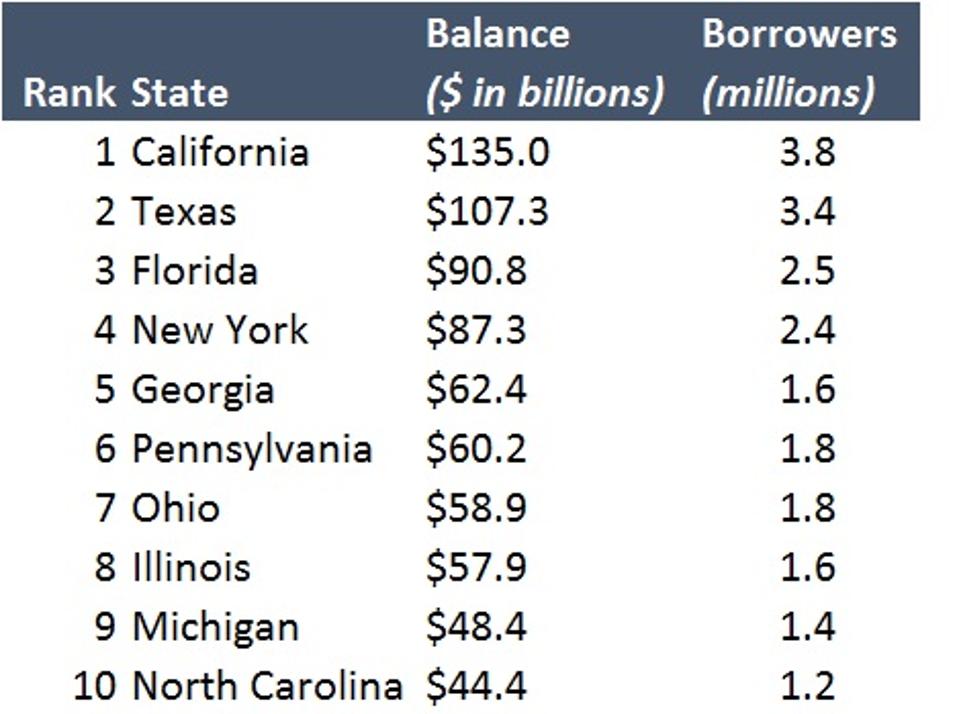

California, Florida, Texas and New York represent more than 25 of all U.S. student loan borrowers who collectively owe more than $420 billion of student loan debt. Forbes

Game Plan on dealing with Average Student Debt

Learn how to invest in the markets and make sure you don’t end up depending on your corporate pension or government-controlled social security. Subscribe to our free newsletter to keep abreast of the latest developments; we cover everything from the financial markets to the World’s food supplies. Mass Psychology knows no limits, utilised properly it can spot trends in any market, and we can show how to protect yourself and benefit from these new trends.

Other related articles:

Stock Trends & The Corona Virus Factor (March 14)

Misdirection And Upcoming Trends For 2020 And Beyond (March 13)

Trading The Markets & Investor Sentiment (March 3)

Brain Control: Absolute Control Via Pleasure (Jan 20)

Indoctrination: The Good, The Bad and the Ugly (Jan 15)

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)