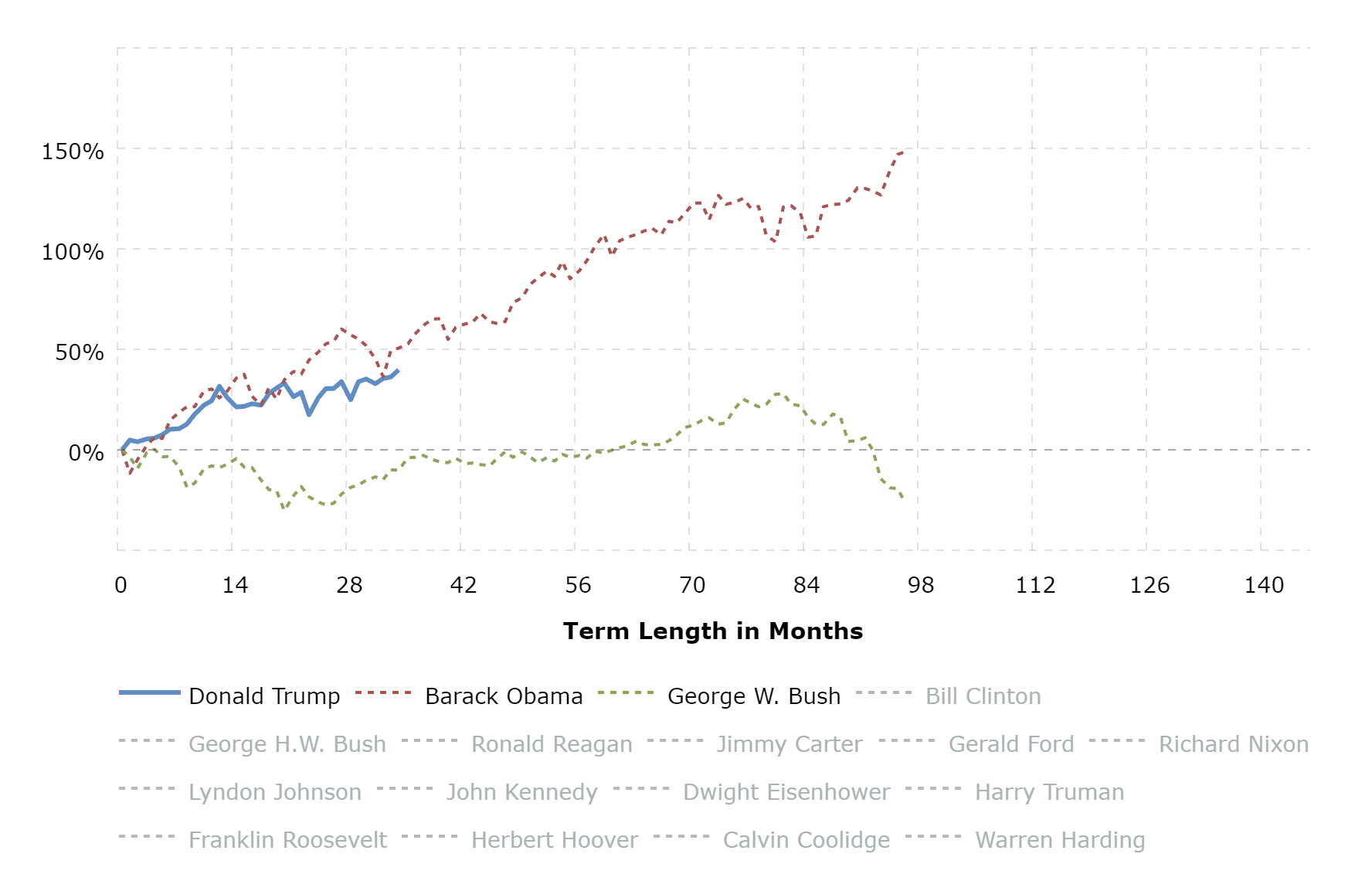

Stock Market Since Trump Took Office

The average trader has a convoluted view of the markets and the world. They are forever willing to bend the definition of risk and opportunity to suit whatever perspective is taking the lead role at the moment. When prices are low, they assume that it is the wrong time to buy because they are bound to go lower, and when they are soaring upwards, they assume that it is the right time to buy because they are bound to soar even higher. The concept of risk to reward is thrown out of the window; they state they seek an opportunity with low risk, but their actions speak otherwise. No Bull Market has ever ended on a note of fear; they end when the crowd is in a state of ecstasy. Market Update Nov 26, 2018

Stock Market Since Trump Took Office: Results to date are excellent

source: https://www.macrotrends.net/

Clearly, Trump is referring to the Dow Jones Industrial Average (DJIA), which is currently about 26,000. At the close on election day (November 8, 2016), the DJIA was about 18,300. So, check – The 7,700 gain (42%) certainly qualifies as thousands of points – and that does not include dividends, which take the total return up to 53%.

Was that gain earned consistently?

Why ask this question? Because, in analyzing performance, we want to see proof that a good, long-term return is not the result of one, shorter-term run-up that is unlikely to be repeated.

President Trump, while taking actions that he feels are supportive of the U.S. economy and U.S. businesses, in general, has had only short-term, positive effects. At this point, the overall results, as measured by the stock market, are negative.

Time will tell if positive results can return. In the meantime, realize that the “thousands of points” are water under the bridge for the market period we are in, and they do not continue to convey a high grade onto President Trump. Full Story

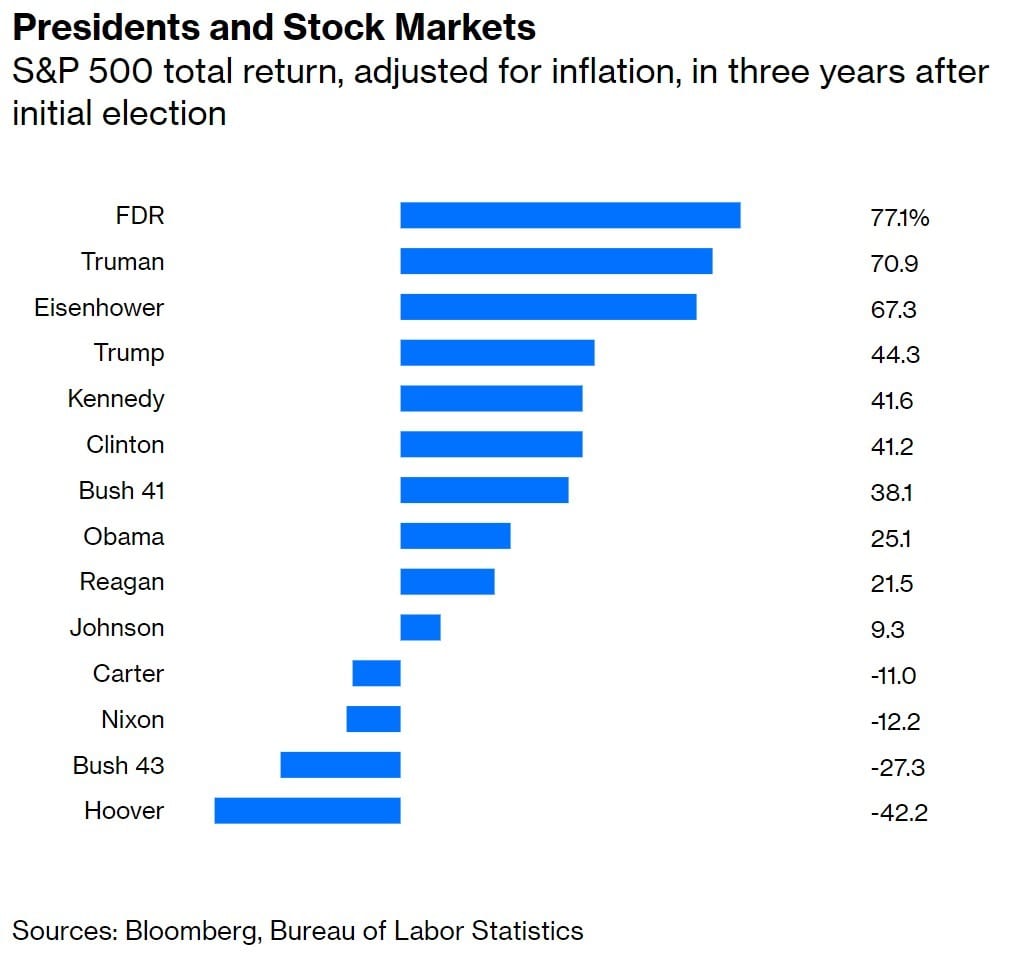

Stock Market Since Trump Won the Election

So here’s the total return on the S&P 500, adjusted for inflation, for the first three years after the initial election of every president since Herbert Hoover:

Tactical Investor views on Stock Market Since Trump Took Office

When you combine the bears and the neutral the score has consistently fallen in the 60-70 ranges, so what we need now is a shock type event, which will push this score up to the 75-80 ranges. Market Update Sept 25, 2019

The so-called strong pullback and we use the word “so-called” because when you factor in how high this market is trading from its 2009 lows or even 2015 lows, the current pullback is a non-event. Based on the weekly charts of the Dow, there is still room for more downside action before our indicators move into the oversold ranges.

However, the current pullback was sharp enough to create chaos in the sentiment camps. Bearish and neutral sentiment add up to 80%, and this has to be viewed as fantastic development. As we stated in the Sept 25th issue, we hypothesised that we could be moving towards a new norm.

The new norm is that it’s okay to be a bit nervous and sit on cash, so the only way to shake things up is to trigger stampede and that is what the top players might be gearing up to do. Investors are sitting on a huge amount of cash. Market Update Sept 25, 2019

The trend is positive and one should remember what we have stated all along; as long as the trend is bullish (positive) every pullback regardless of intensity has to be embraced and the stronger the deviation, the better the opportunity. The human mindset thrives on misery; it’s hardwired towards negativity. Stock Market Under Trump: What’s the Next Stop

Other Articles of Interest

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)