Low Rates

Updated Dec 2021

Central bankers wanted to put the fear of God into the masses, and to a large degree, they have succeeded in doing so; the masses are so afraid that they continue to hoard their money and refuse to put it into the market. They have been foolishly assuming that this bull market will crash and burn for the past eight years, and still, they won’t surrender their false beliefs.

Central bankers knew that people would save more and more out of fear initially due to economic uncertainty, even though rates were and still are low. They know that many will remain wary when negative rates hit the US and even when banks start charging them a fee to hold onto their money. People increasingly save because of uncertainty; they don’t know the future.

Low Rates Set to fuel super Bull Market.

Experts will state that central bankers miscalculated, but the truth is that they did not miscalculate; they were planning for this. Eventually, when the pain becomes too intense, the masses will realise that they have no option but to speculate, and suddenly, they will all act in unison. They will jump out of the box and start to look desperately for higher yields, and there is no better casino in town than the stock market. It offers the allure of infinite wealth but rarely delivers such gains to the masses.

The idea here is to back the crowd into a corner like you would a rat in a small cage; finally, when it has nowhere to turn, it will lash out and strike, realising that its life is at stake. Whether it wins or not is irrelevant. The goal was to get into lash out like a tiger. If the central bankers are successful, they will have created one of the most significant stimulus programs in history, and the masses will fund it.

Low Rates Are Here To Stay

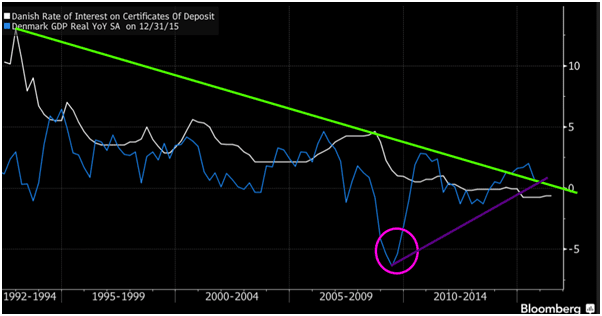

Denmark’s GDP started to rise (look at the chart below) after rates turned negative, which was the program’s whole purpose. Note that shortly after the crisis of 2008-2009, rates were pushed lower faster than at any period before in the last 20 years; the lower they dropped, the higher the GDP; in fact, one can conclude that it’s in an uptrend.

Yes, we are aware that this fake and illusory; hot money supports the whole economy, but this is taking place worldwide, and it will not stop. Some countries have just embraced it, while others are on their way to embracing it; this is a race to the bottom, and it won’t stop or end until everyone is on board. Denmark has embraced negative rates for over four years, while in the U.S, the Fed is preparing the masses for a day when negative rates will become a reality. We suspect that America will embrace negative rates for much longer.

“Negative rates are counter-productive,” said Kasper Ullegaard, head of fixed-income overseeing more than $15 billion at Sampension in Copenhagen. The policy “makes people save more to protect future purchasing power and even opt for less risky assets because there’s so little transparency on future returns and risks.”

Yes, they are counterproductive over the long run, but in short to medium time frames, they can produce a helluva bang, and that is all the top big players care about. They will cash out well before the next financial crisis hits.

“I’m very concerned about what these low, negative rates mean,” Stendevad said. “I’m concerned about what they mean for asset pricing. Clearly, they are driving asset prices. That’s the intention, but it’s always a cause for concern when asset pricing is driven more by central bank policy than cash flow generation.”

They are and will continue to do so; the idea is to create the mother or grandfather of all bubbles. When the masses decide to speculate, so much money will flow into the markets that all assets, including Gold, will fly; some will soar to the moon, some to the sun and some possibly to the next galaxy.

This Hated Bull Market Will Continue To Trend Higher

We have continuously stated that this Bull Market will run much higher than most envision and will only end when the masses join the party. We have pounded this theme repeatedly over the past few years, and much to the dismay of the naysayers, the markets have soared in the stated direction. The following extract was sent out to our paying subscribers in April 2016.

And as expected the bull continued to trend higher. In fact, the SPX put in a new six months high and is dangerously close to testing its old highs; so what do the naysayers have to say now, Nada? But, don’t you worry; they will start yelling again shortly, stating that all hell is ready to break loose the moment the markets start to correct. Market Update April 19, 2016

The markets have continued to trend higher since the last update, and overall we expected this as the trend was up, and none of our sentiment indicators had moved to the extreme zones.

Battle Plan

Fundamentals clearly are not supportive of this market; if one relied on fundamentals, one would be shorting this market a long time ago, and by now, you would either be bankrupt or on your to the loony bin. Hot money drives this market, and the situation will turn explosive when the Fed embraces negative rates. The Fed has no option but to adopt negative rates; we are in the midst of a massive currency war, and the only alternative left on the table is to “devalue or die”.

Therefore, the plan is simple; every healthy pullback must be viewed as a buying opportunity. This bull market will only end when the masses join the party, and they are a long way from embracing one of the most hated bull markets in history. Low rates are here, and they will be around for a long time to come.

Other Articles of Interest

Millennials being squeezed out of Housing Market (20 May)

The problem is Fractional Reserve Banking-we don’t need Gold Standard (15 May)

BBC Global 30 Index Signals Dow Industrial Index will trend higher (11 May)

Stock Market Bull not ready to buckle (4 May)

Fear mongers are parasites that profit from your fear (2 May)

Gold Bugs think & stop listening to Fear mongers (1 May)

Fear mongers are parasites that profit from your fear (27 April)