Study the past, if you would divine the future. – Confucius. Chinese, Philosopher Quotes

Housing Market 2018 Crash

Updated Jan 2024

The housing market crash of 2008 was a significant event in U.S. financial market history. It was triggered by the subprime mortgage crisis and had far-reaching consequences for the economy. The explosive growth of the subprime mortgage market, which began in 1999, played a significant role in setting the stage for the turmoil that unfolded in 2008. The crash resulted in a sharp decline in home sales and prices, with sales down 13% and the national median price falling nearly 6%. The crash had a profound impact on the U.S. economy and led to a recession known as the Great Recession.

Several factors contributed to the housing market crash of 2008. One key factor was the availability of easy credit and the proliferation of subprime mortgages. Fannie Mae and Freddie Mac made home loans accessible to borrowers with low credit scores and a higher risk of defaulting on loans. This led to a surge in mortgage fraud and an unsustainable housing bubble.

Another factor was the speculative nature of the housing market at the time. Price growth was driven by speculation, and credit expansion fueled the bubble. However, it’s important to note that the reasons for the increase in house prices were not primarily speculation or credit expansion but rather record-low mortgage rates and a fundamental shift in housing demand.

Current Housing Market Outlook

Currently, experts do not expect a housing market crash shortly. There are several reasons for this outlook. First, inventories are still relatively low, which means there is a limited supply of homes for sale. This lack of inventory has led to bidding wars and upward pressure on prices. Additionally, there is significant demand from household formation, and low mortgage rates have made homeownership more affordable for many buyers.

While there are concerns about affordability, with high-interest rates and inflated home values making it challenging for first-time homebuyers, most experts do not anticipate a crash in the housing market. Instead, the market is expected to see a positive home price appreciation in the coming years, albeit at a slower rate than in recent years.

It’s worth noting that the housing market is influenced by various factors, including economic conditions, interest rates, and government policies. Therefore, it’s essential to monitor these factors and stay informed about any changes that could impact the housing market in the future.

Housing Market 2018 Crash & The Bubble Effect

Updated Jan 2024

Most of these individuals were buying houses instead of renting, so when they walk away from their homes, they only risk their credit but essentially nothing else. You then have the next category who thought they could make a fortune by buying 2-3 or even more houses; again, for the most part, they were able to buy these houses with little or no money down or to use the leverage of the previous house purchased as collateral for the next house.

Banks were pushing a lot of individuals in the housing valuation sector to over-evaluate houses. Now, in the aftermath, this situation, which borders on fraud, is being investigated when it should have been studied and brought under control before the housing market went out of control. In the end, it comes to the same old story: greed seems to blind even the savviest of investors; bankers are known for being cautious, but during the housing mania, it appeared that they threw caution to the wind and just focused on today’s bottom line instead of looking out into the near future.

Housing Market 2018 C and Liar Loans

For the most part, the majority of the individuals who purchased homes with little to nothing down did not lose that much money. Look at it this way: they would still have to pay rent so, the monthly mortgage payments could be viewed as monthly rental payments; in most cases, one could argue that if a small down payment was made, most of it was recovered when these individuals ceased to pay their mortgages; yes, it is a different way to look at the situation. However, it’s valid, it takes two to tango and one to cry. So, these susceptible people are equally to blame, as are the evil bankers.

These individuals are not losing that much money; they are giving up the profit they could have once locked in had they sold their houses at the right time. Yes, ones, credit rating is important and valuable, but stupidity extracts a high price and those who did not think or let greed rule will now need to have long, intimate talks with the grim Reaper. To an outsider, it might look like we are taking a light view of the situation, but we assure you we are not. We know of individuals who did not even ask the mortgage brokers what their rates would be once the deceiving low adjustable rates ended.

There were numerous stories of individuals bidding up prices in the tens of thousands just because they thought they could more than make up this money in 1-2 years. At one point, Apartments in Vegas with a view to the strip were commanding premiums of 50k plus; imagine this insanity paying 50k more just to be able to look down at a stupid overlit strip. These individuals did not take the time to evaluate what they were getting into or what they stood to lose if the housing market crumbled; they had only one thought in mind, and that was to make as much money as they could make.

For illustrative purposes, we are going to provide very simple examples of how, in most cases, individuals did not lose much except to sacrifice and, in most cases, destroy their credit ratings.

Couple 1

Let’s say the rent for their home was 1800 dollars a month, and they bought a home in 2005 with a very low adjustable mortgage of 2%; based on this, their monthly payments come in at, say, 1478 a month. At one point they were even offering rates of between 0%-1percent for the first 2-3 years of the mortgage. They jump because it now looks like they could own a home for less than what they were paying for in rent; stupid reasoning for you never own the home till it’s paid off in full. Also, the Adjustable-rate was not taken into consideration; euphoria has a way of blinding everyone. When the low adjustable rates ended mortgage payments in many cases doubled.

Let’s assume that their credit was average; at one point even individuals who had bankruptcies on their records could get a mortgage. So the house value falls, payments double; the math is simple they walk away. What have they lost? Other than their average credit nothing much. Once again we are not saying a person’s credit rating is not important but we are looking at the situation from what one lost financially and not from the emotional stress and trauma that comes about from destroying one’s credit.

2nd scenario

Good credit and so-called smart individuals

Purchased several homes and rented them out to use the rent to pay the mortgage but kept on doing this until the end instead of bailing out when they were sitting on lovely gains. Some smart, astute individuals did a bailout, but the majority held thinking that the party would never end. Look at some of the big housing names such as BZH, LEN, etc. many of them bought huge tracts of land for insanely inflated prices, and some even bought large patches in the desert.

The picture is the same. Prices have fallen, rates have doubled, and they can’t make their payments. So what do they lose? A huge amount of potential profit and their very good credit status, but regarding real money lost they have not lost that much.

There are other variations of this, but the picture is the same; in the end, it’s the institutions that gave these mortgage and the ones that repurchased them that have lost the most.

Housing Market 2018 Crash Losers

What the majority of the small investors lost was the possibility of owning a home and their credit rating as they had over-leveraged themselves to the hilt. Now some would point to the tent cities cropping up for example in California as an illustration of the pain many of these individuals are feeling. Let’s examine this a bit more deeply.

In many cases, these individuals were forced out of their homes and into the street because they lost their job, which means that even if they were renting, they would have been thrown out of their homes for not being able to pay the rent. Indirectly their jobs were affected by the downturn in the industry, but this would have happened regardless of whether they bought a house or not. If you lose your job, no one is going to let you live rent-free unless they have lost their minds. Had they instead of taking this risk decided to live one or two standards below their over-inflated lifestyles and put this money into a savings account they would have had something to fall back on a rainy day.

What is causing their real pain?

Well, the slowdown in the economy and the huge number of layoffs. Thus the pain caused is not directly related to the purchase of their homes but to the fact that many of them were indirectly employed by the housing sector. The real pain is once again being caused by over-exuberance; everyone over-invested in one sector (the housing sector), and as prices rose, they started to live like the rich and the famous. The pain that is being caused now is no different from the pain that was caused during the internet mania; in the end, some great bargains will be found as was the case in the aftermath of the dot-com era.

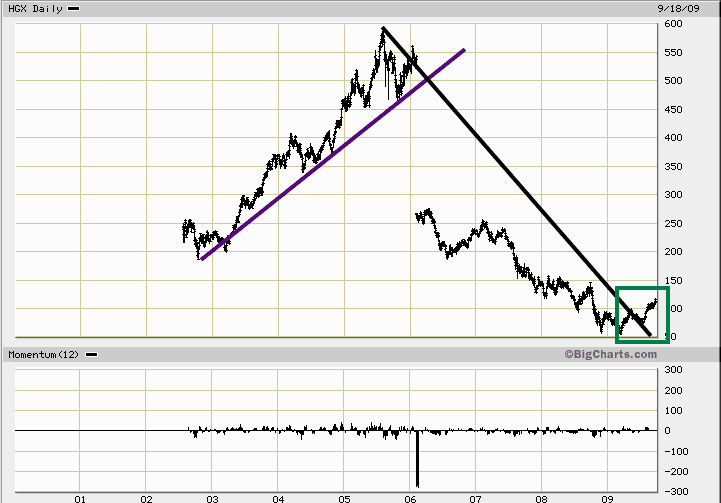

While it may look tempting to purchase housing stocks right now we would wait a bit longer for its far better to play safe then jump in too early as one could be flying from the frying pan and straight into a smouldering fire; markets have a tendency to overshoot these days and just as the housing sector overshot to the upside it will most likely do the same on the downside. As an example let’s take a look at LEN

LEN Stock Price

From roughly Jan of 2000, LEN started to take off; the housing sector was in the first stages of a substantial upward move while the financial markets were embarking on the first leg of a massive correction. LEN soared from roughly 7 dollars in Jan 2000 to a high of 68 dollars on July 05; it has since given up most of those gains, and like the internet bust, we feel that it, together with DHI, PHM, etc., are all probably going to at the very least test their pre-breakout prices. In Lennar’s case, this would equate to a price of roughly 7 dollars.

Today’s article stating that a record 4 million (9% of total homeowners) homeowners were either behind on their payments or in foreclosure does not exactly bode well for this industry Full Story. It indicates that the worst is still not over, or, more importantly, the market has probably not yet priced all the potentially negative news that still could emerge from this sector. Let’s not forget that not all Adjustable rate mortgages have reset yet; Census data indicates that roughly 2 million mortgages will reset from May 2008 to Sept 2008, almost double that of 2007.

New Mortgage Rules

New legislation which was passed to help owners will only help a small percentage of the total as the guidelines are rather strict. Most individuals are living from paycheque to paycheque but let’s assume that they happen to have 1-3 months of reserve payments and for argument’s sake let’s choose three months. Foreclosure times vary considerably from state to state so let’s assume that an average period would be seven months.

Thus, roughly in July of 2009, a whole wave of new foreclosures will hit the markets, and given the fact that it is taking roughly 11 months to sell a home now, we are left with this sobering thought: who would have the guts to go out and buy in the midst of all this chaos? We think very few would be brave to venture out during such trying times. The real estate sector needs to go through a stage where the amount of bad news coming out starts to slow down and the number of foreclosures starts to drop before the brave would risk venturing out to buy; this means that at the very least the real estate market won’t put in a bottom until early 2010

Conclusion

The housing market crash of 2008 was a significant event in U.S. financial market history, triggered by the subprime mortgage crisis. However, the current outlook for the housing market does not indicate an imminent crash. While there are concerns about affordability, low inventory levels and significant demand are expected to support the market in the coming years. It’s important to stay informed about market conditions and factors that could influence the housing market in the future.

In situations like this, we’ve observed that markets often need to hit rock bottom before they start to recover. Consider the dot-com era when stocks like CMGI plummeted from $166 to just $4, and Yahoo from over $124 to $20. Investors felt hopeless, hoping for a miraculous turnaround that never came.

For context, CMGI eventually bottomed out at $1, and Yahoo dropped to as low as $4 before bouncing back. We’re likely to see a similar pattern in the housing market before it stabilizes for the long term. Take PCLN, for instance. Despite a drastic decline of over 90%, it managed to climb from $6 to a recent high of around $126. While it’s still far from its previous peak, anyone who bought in at $6 to $20 is now enjoying significant gains. This same principle applies to the housing sector.

Men nearly always follow the tracks made by others and proceed in their affairs by imitation, even though they cannot entirely keep to the tracks of others or emulate the prowess of their models. So a prudent man should always follow in the footsteps of great men and imitate those who have been outstanding. If his prowess fails to compare with theirs, at least it has an air of greatness about it. He should behave like those archers who, if they are skilful when the target seems too distant, know the capabilities of their bow and aim a good deal higher than their objective, not in order to shoot so high but so that by aiming high they can reach the target. – Niccolo Machiavelli 1469-1527, Italian Author, Statesman

Other Articles Of Interest

Russians show patriotism on nuclear bunker tours (Jan 6, 2016)

Chinese firms extend Moscow’s rail networks (Jan 6, 2016)

Remaking Moscow lures more Chinese investment (Jan 6, 2016)

Syrian war profiteers: 15 companies that benefit (Dec 31)

Despite Challenges and Sanctions: Russian oil & gas remain profitable

China overtakes U.S. Now world.s largest Economy (Dec 20)

Americans favour coffee to stock market investing (Dec 17)