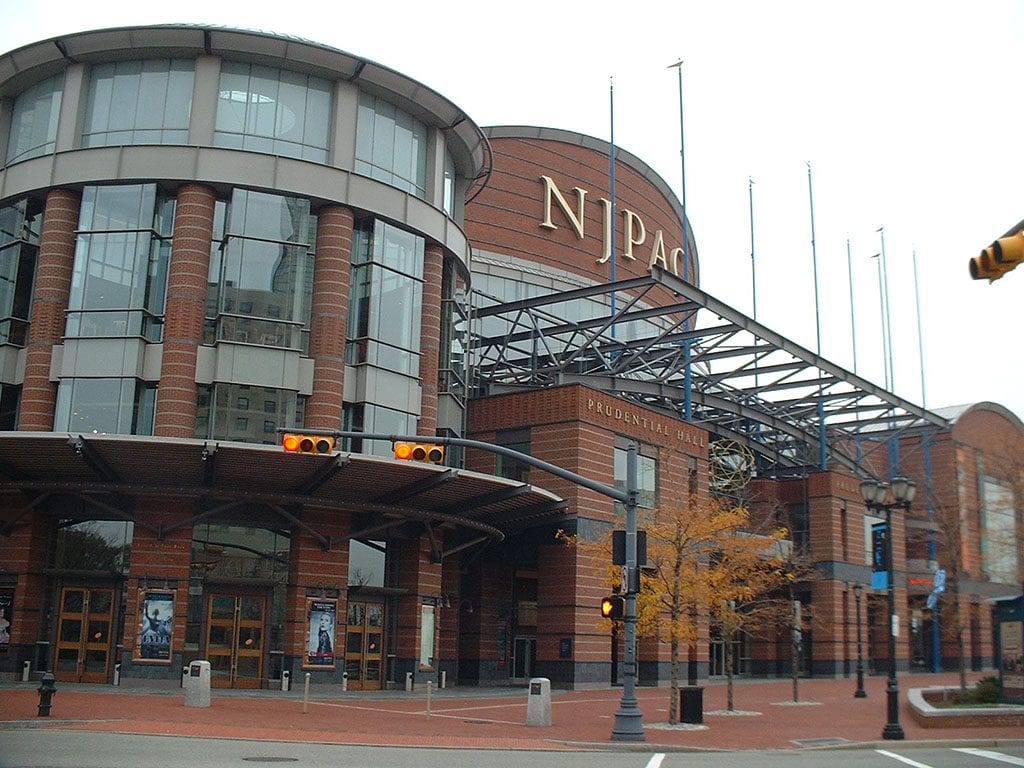

Port Authority to pay $12M more to Newark

“This new revenue the city will realize from the Port Authority could mitigate the need for a property tax increase,” Newark Business Administrator Jack Kelly told members of the Newark Regional Business Partnership.

Kelly said the city had renegotiated annual lease payments with the agency from the current $85 million to $97 million next year, an increase of $12 million in city revenues that could offset increased expenditures and eliminate the need for a tax increase in 2017. Mayor Ras Baraka, who also attended the Wednesday morning business gathering, corroborated Kelly’s assessment of the increased Port Authority payments in an interview afterwards. Nj.com

Article of Interest

now that we have covered the Port Authority to pay $12M more to Newark issue, take a look at this interesting story.

The stronger the deviation the better the opportunity, the trend is your friend unless you try to fight for if you do it will turn into your nemesis. We would like one person to point out one instance over the long when a permabar has been correct on the trend of the market. If you betted against the market in the run you would be blown out of the water decades ago, that is why there is not one successful permabear when one takes the long term perspective. Case in point, the backbreaking so-called market crash of 1987 and the even scarier one of 2008. The chart below clearly proves that being a long term bear is dangerous for one’s financial health

History illustrates that they will keep lowering the targets until the markets suddenly reverse course, catching them off guard once again. The crowd never wins, and that’s one of the main lessons investors need to understand when it comes to investing. Market Update May 7, 2019.

Since 2003, we have not found one piece of financially related news from Mass media that could have been used to help any investor in the long run. In fact, mass media outlets seem to take delight in stampeding the masses at precisely the worst time and pushing them to them into the Euphoric camp when the smart thing to do was to bail out.

A simple winning strategy is to buy when the masses are stampeding and the trend is up and vice versa. Stock Market cycles and forever QE

Other articles of interest:

1st World Corporate America & Third World Regular America (30 May)

Negative rates will fuel the biggest Bull Market rally in History (25 May)

Millennials being squeezed out of Housing Market (20 May)

Problem is Fractional Reserve Banking-we don’t need Gold standard (15 May)

BBC Global 30 Index Signals Dow industrial Index will trend higher (11 May)

Stock Market Bull not ready to buckle (4 May)

Fear mongers are parasites that profit from your fear (2 May)

Gold Bugs think & stop listening to Fear mongers (1 May)

Fear mongers are parasites that profit from your fear (27 April)

Plain evidence that financial experts know even less than Jackasses (26 April)