Benefits of owning gold

March 2023

Owning Gold has become increasingly beneficial due to its growing demand and limited supply. Central banks are purchasing unprecedented amounts, driving an 18% jump in annual Gold demand to 4,741 tons in 2022. With experts predicting further demand spikes, owning Gold may provide a hedge against inflation and diversify investment portfolios.

In addition to its growing demand, owning Gold can safeguard against geopolitical instability, inflation, and uncertainty. The current global political climate is volatile, and economic uncertainty persists. In times of crisis, Gold tends to hold its value and may even increase, making it a popular hedge against inflation and market volatility. As such, many investors view Gold as an essential component of a diversified investment portfolio.

Demand outpacing supplies

The demand for Gold has been growing steadily in recent years. According to the World Gold Council’s Q2 2021 Gold Demand Trends report, demand for Gold had increased by 9% compared to the same period in the previous year. This strong demand continued in 2022 and is expected to remain strong in 2023, with many experts predicting that demand could spike another 10% in 2023.

However, Gold supplies have not been keeping up with demand. The same report noted that mine production had only increased by 4% year-over-year, and Gold recycling, a significant source of Gold supply, had decreased by 4% year-over-year.

This trend was reflected in Q3 of 2022, where Gold demand (excluding OTC) was 28% higher year-over-year at 1,181t. Year-to-date demand had increased by 18% compared to the same period in 2021, returning to pre-pandemic levels.

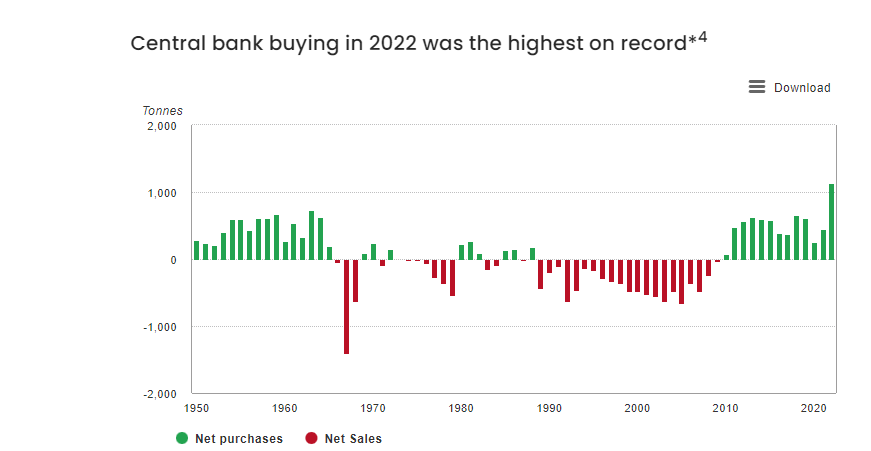

The surge in demand has been driven by central bank purchases and vigorous retail investor buying. Annual Gold demand jumped 18% to 4,741 tons in 2022, the largest annual figure since 2011, fueled by record fourth-quarter demand of 1,337 tons. The World Gold Council noted that most central bank purchases were unreported, with a 55-year high of 1,136 tons bought annually. CNBC

The image below speak for themselves.

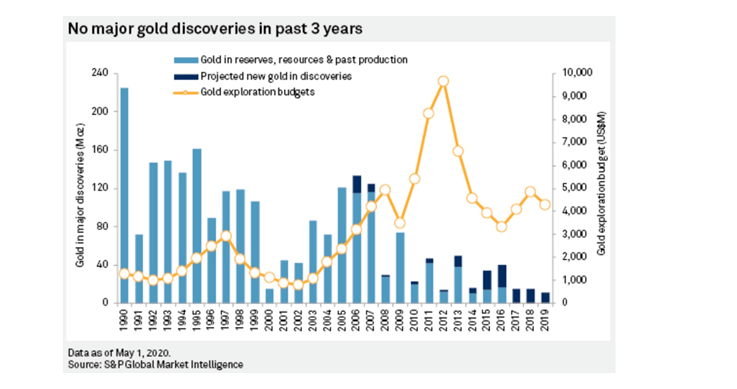

No Major Gold Discoveries In Decades

S&P Global’s analysis revealed that only 25 significant gold discoveries were made in the past decade, containing just 7% of all gold found since 1990. Exploration has been focused on older findings and later-stage assets, resulting in a lack of new significant deposits being discovered. This leads to an increasingly short pipeline of substantial, high-quality assets required to replace ageing gold mines. Additionally, S&P Global’s report indicates that the share of gold exploration budgets devoted to grassroots exploration has been halved since the 1990s. This lack of new discoveries is concerning as gold remains a valuable asset in today’s market.

Conclusion on the Benefits of owning gold

Gold has been a valuable asset for centuries and has remained an essential investment for investors worldwide. It is a tangible asset that holds value and has the potential to act as a hedge against inflation and uncertainty. The World Gold Council’s Q2 2021 Gold Demand Trends report highlighted that demand for Gold had increased by 9% YoY, while mine production had only increased by 4%. Gold recycling, a significant source of Gold supply, had also decreased by 4% YoY.

The strong demand for Gold is expected to continue in 2022, with experts predicting another 10% increase in demand. However, there has been a lack of major gold discoveries in recent years, which could lead to a shortage of large, high-quality assets needed to replace ageing major gold mines.

Central banks worldwide have been increasing their gold reserves, purchasing record amounts of gold in 2022. This trend reflects the growing importance of Gold as a safe haven asset in times of uncertainty and geopolitical instability. Gold has also been used to diversify portfolios, providing a hedge against stock market volatility and currency fluctuations.

The articles below validate Central banker’s thirst for Gold

- “Central banks snap up gold amid uncertainty” (Reuters, 2021): https://www.reuters.com/article/centralbanks-gold/central-banks-snap-up-gold-amid-uncertainty-idUSL1N2KU22L

- “Central Banks Are Buying More Gold Than Ever Before” (Bloomberg, 2020): https://www.bloomberg.com/news/articles/2020-10-12/central-banks-are-buying-more-gold-than-ever-before

- “Why central banks are buying more gold than ever” (World Gold Council, 2021): https://www.gold.org/goldhub/gold-focus/2021/06/why-central-banks-are-buying-more-gold-ever

- “Central Banks Keep Buying Gold as a Hedge Against Increased Volatility” (Fortune, 2021): https://fortune.com/2021/02/25/central-banks-buying-gold-volatility-hedge-inflation/

- “Central banks bought more gold in 2019 than any time since the 1960s – and 2020 could be even bigger” (MarketWatch, 2020): https://www.marketwatch.com/story/central-banks-bought-more-gold-in-2019-than-anytime-since-the-1960s-and-2020-could-be-even-bigger-2020-01-31

- “Central banks add to gold reserves as diversification continues” (World Gold Council, 2021): https://www.gold.org/goldhub/gold-focus/2021/01/central-banks-add-gold-reserves-diversification-continues

Other stories:

The next American Disaster is Student Debt (Feb 12)

Central bankers embrace Negative interest rate wars (Feb 10)

Gluttonous colleges fueling higher education bubble (Feb 8)

One chart clearly illustrates the coming student debt crisis (Feb 7)

One chart illustrating economic recovery is 100% Fiction (Feb 6)

American economy recovery not real & funded via debt (Feb 5)