March 26, 2023

A Symphony of Contrarian Crescendos: Delving into the Cacophony of the US Debt

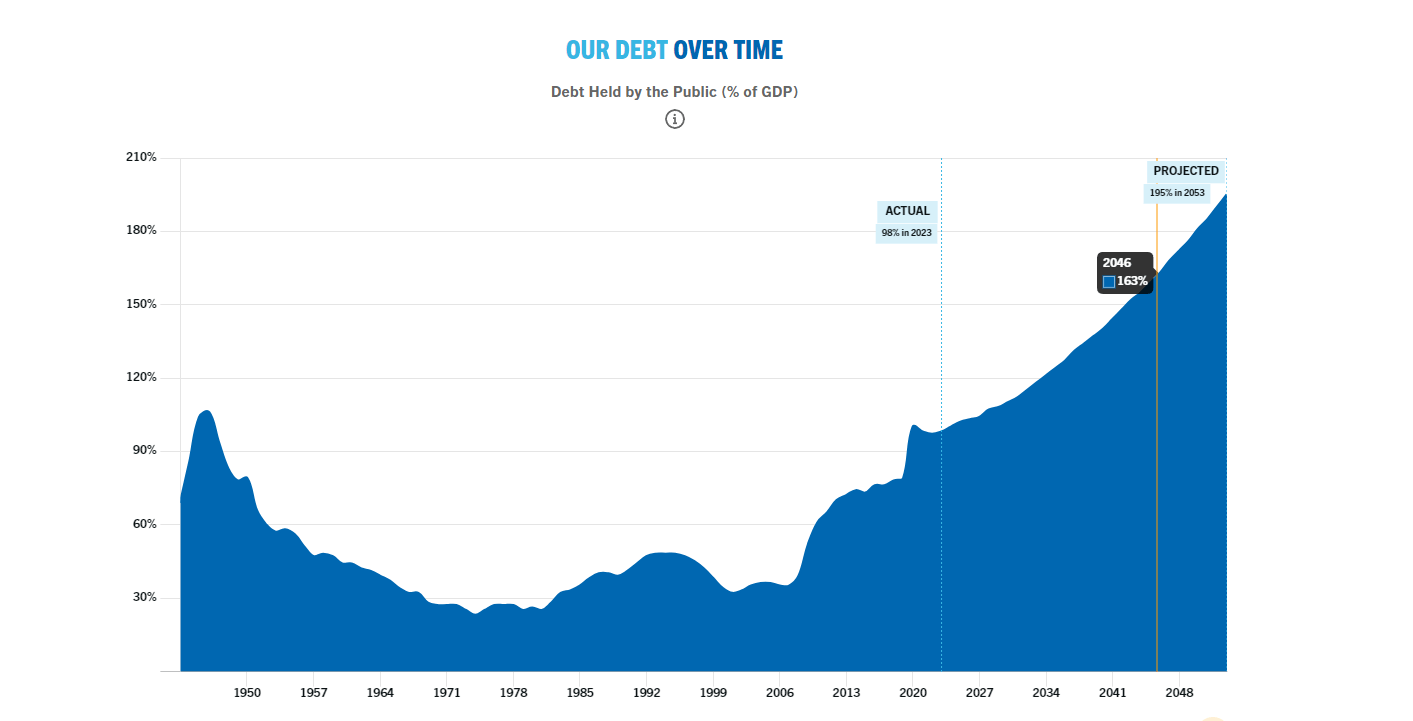

My hands tremble, the screen flickers, a sea of red—how did we get here? Endless cycles, the us debt rising, a spectre haunting the markets. China, Russia, golden hedges against a falling empire, and I, a mere player in this grand game. The us debt, like chains, shackles us to uncertainty while nations prepare for the downfall, their watchful eyes calculating. The clock ticks, the dollar weakens, and my mind races. Can I trust these markets, or shall I seek solace in the gleam of bullion? Our debt is always in the back of my mind, a constant reminder of a bleak future.

source: www.pgpf.org/national-debt-clock

A Sensory Imagery of Financial Turmoil

Dark clouds gather above, mirroring the heavy atmosphere in the trading room. Tension thick as fog, the acrid scent of fear and desperation permeates the air. Voices rise and fall, a cacophony of despair and fleeting hope. The us debt, a heavy stone tied to the market’s once buoyant heart, sinks ever deeper into the abyss. The graphs, once vibrant green, now bleed, a crimson tide consuming all. Investors, their eyes wide with apprehension, clutch their pearls as the weight of the us debt begins to take its toll.

Cyclical Shadows: A Tale of the Stock Market

A flashback to 1978, the highest monthly foreign central bank sales of U.S. Treasury debt, the us debt’s spectre is looming. History weaves a tale of repetition, an endless loop of booms and busts. We return to the present, the debt’s shadow ever more significant, yet the cycle continues. A glimmer of hope, a market surge, only to be followed by a staggering plunge, like Icarus, soaring too close to the sun. The debt is a constant reminder that history, cruel and unforgiving, marches onward in its cyclical dance.

Investors’ Conflicting Perspectives

“The us debt, it’s going to crush us!” one investor cries, their voice quivering with fear.

“But it’s been growing for years! We’ve always managed,” another retorts, exuding an air of confidence.

“Do you not see the signs? Russia, China, they’re preparing!” a third interjects, desperation creeping into their tone.

“And yet, the markets still move, don’t they?” fourth investor muses, attempting to maintain a sense of calm.

The room fills with disjointed voices, a cacophony of clashing opinions and perspectives, the us debt the ever-present spectre that fuels their discord.

In Contrarian Harmony: The Bold Investor’s Requiem

A contrarian by nature, I refuse to be swayed by the fearful cries of my fellow investors. I embrace the uncertainty, the us debt’s haunting presence and seek opportunity in the chaos. With a steely resolve, I navigate the treacherous waters of the market, guided by a contrarian compass. For it is in the shadows, the overlooked spaces, that true opportunity lies. The us debt, while a spectre to most, becomes a beacon, a signal to forge my own path amidst the tumultuous waves of the financial seas.

Other stories of interest:

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

Dogs of the Dow 2024: Barking or Ready to Bite?

What happens when the stock market crashes? Opportunity!

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Clash of Titans: Unleashing Inductive vs Deductive Reasoning

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

who runs foreign governments, that’s right it is the freaking pathological Zionist,

this is how they are control the market. is a freaking game to them.