Editor: Vladimir Bajic | Tactical Investor

Executive Compensation & Greed: Navigating the Abyss of Wealth Disparities

Updated Feb 18, 2024

Introduction: Dissecting the Corporate Wealth Paradigm

Modern corporations present a complex and often controversial financial landscape, with wealth allocation becoming an increasingly contentious topic of discussion. Executive compensation, characterized by the often-astounding salaries and bonuses of CEOs and other top executives, has become a symbol of wealth disparity, sparking debates about fairness, income inequality, and the ethical implications of our economic system.

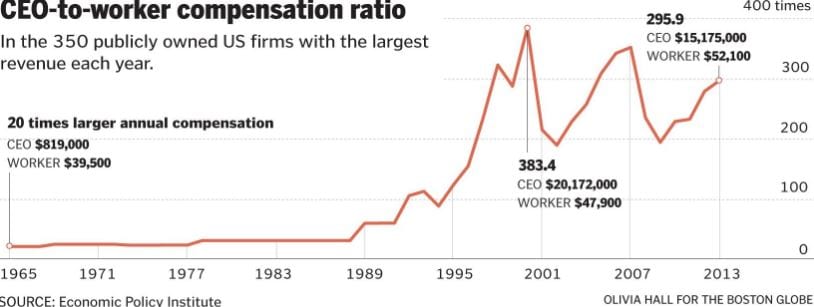

The stark contrast between the earnings of the corporate elite and the average worker’s wage within the same company has highlighted issues of social justice and economic balance. The data suggests a widening wealth distribution gap within corporations, creating a pronounced divide between executive management and the workforce that drives the company’s daily operations.

This article aims to provide an in-depth analysis of corporate wealth distribution, focusing on executive compensation and its broader societal implications. We will explore the complex mechanisms governing executive pay, scrutinize corporate governance principles, and consider the societal repercussions of the growing wealth chasm within corporations.

The ensuing sections will offer a clearer understanding of the multi-layered dynamics that shape our corporate environment and their broader implications on society. As we delve deeper into this subject, we aim to shed light on the intricate realities of wealth disparities in the corporate world, providing a comprehensive understanding of this significant issue.

C-Suite Realities: Wealth Dynamics and Societal Ripples

A prime example of the wealth disparity in corporations is the case of Elon Musk, CEO of Tesla Inc. In 2020, Musk’s compensation package was valued at $2.3 billion, making him the highest-paid executive in the U.S. This figure is staggering compared to the median employee salary at Tesla, which was reportedly around $58,455 in the same year. This means Musk earned nearly 40,000 times more than the average Tesla employee.

Corporate Governance

Corporate governance plays a significant role in determining executive compensation. For instance, the board of directors at Apple Inc. decided in 2021 to award CEO Tim Cook a pay package worth $14.7 million despite the economic downturn caused by the COVID-19 pandemic. This decision was based on the company’s financial performance and the board’s belief in Cook’s leadership abilities. However, this has led to debates about whether such high compensation is justified, especially considering the economic hardships many face during the pandemic.

Societal Implications

The societal implications of wealth disparities within corporations are far-reaching. For example, the wealth gap can contribute to social unrest, as seen in the Occupy Wall Street movement in 2011. This protest was primarily fueled by anger over the perceived greed of Wall Street executives, whose high salaries and bonuses starkly contrasted the economic struggles of many Americans following the 2008 financial crisis.

In conclusion, these examples illustrate the complexities of executive compensation, the role of corporate governance, and the societal implications of wealth disparities within corporations. They highlight the need for ongoing discussions and potential reforms to address these issues.

Executive Compensation and the Impact of Stock Buybacks

Stock buybacks have become a prevalent strategy in corporate finance, influencing executive compensation and raising questions about its long-term implications. When companies repurchase their shares, it reduces the number of shares available in the market, potentially boosting earnings per share (EPS) and stock prices. This can benefit executives whose compensation packages are tied to stock performance through stock options or restricted stock units (RSUs).

For example, consider a CEO with stock options exercisable at $50 per share. If the stock trades below $50, the possibilities are essentially worthless. However, if a stock buyback program drives the share price above $50, the CEO’s options become valuable, providing a financial incentive.

Executives may also have performance targets tied to financial metrics like EPS, which can be artificially inflated through share repurchases. This can lead to bonuses and other performance-related pay, even without a genuine increase in net income.

While the alignment of interests between executives and shareholders can be beneficial, concerns have been raised about the long-term value creation for the company. Critics argue that resources spent on buybacks could be invested in research and development, employee growth, or other areas that contribute to sustainable success.

The debate surrounding stock buybacks and executive compensation is multifaceted. Some argue that buybacks can be a legitimate way for companies to return excess cash to shareholders and demonstrate confidence in their financial health. However, others question whether buybacks are being used to manipulate market perceptions and enrich executives at the expense of broader corporate growth and investment.

Recent discussions have focused on potential reforms to ensure buybacks are conducted in a balanced manner that considers the interests of all stakeholders. Proposals include increased transparency, restrictions on timing and volume, and closer alignment of executive compensation with long-term corporate performance.

Stock Buybacks: A Strategic Tool for Companies and Investors

Stock buybacks, where companies repurchase their shares, have become a common strategy in corporate finance. While often associated with boosting executive wealth, they can also serve as a strategic move that benefits the company and its investors.

Recent studies have challenged the conventional narrative surrounding stock buybacks. Research analyzing over 4,000 buybacks from 2004 to 2014 found that companies engaging in share repurchases tend to outperform the market in the long run, experiencing higher returns on assets and equity and increased earnings per share growth.

By reducing the number of outstanding shares, companies can enhance their earnings per share, making them more attractive to investors. This can lead to an increase in stock price, benefiting all shareholders, including executives.

Stock buybacks can signal to the market that a company believes its stock is undervalued. This can create confidence among investors, attracting new shareholders and potentially further driving up the stock price.

Contrarian investors who believe going against the crowd can lead to profitable opportunities may find stock buybacks intriguing. When a company announces a buyback program, it often faces scepticism from market participants. This scepticism can create a buying opportunity for contrarian investors who see the potential for value creation and are willing to take a calculated risk.

While stock buybacks have been associated with executive wealth accumulation, they can also be a strategic move that benefits the company, its investors, and even contrarian-minded individuals seeking unique investment opportunities. The ongoing debate highlights the need for careful consideration of the impact of buybacks on long-term value creation and the equitable distribution of resources.

Stock Buybacks and Corporate Profits: A Revised Perspective

While often debated, stock buybacks can serve as a strategic tool for companies. They can boost earnings per share (EPS) by reducing the number of shares outstanding, making the company more appealing to investors and potentially increasing stock price and market capitalization. This financial leverage can be reinvested in areas like workforce development and innovation.

Buybacks also act as a capital allocation tool. When companies repurchase shares, they signal confidence in their stock’s value, potentially a more favourable use of capital than other less promising investments.

The interplay between buybacks, workforce investment, and innovation isn’t straightforward. Companies can prioritize shareholder returns while investing in their workforce, research, and development. This can drive productivity and profitability, benefiting shareholders.

Corporate finance decisions are multifaceted and influenced by market conditions and growth opportunities. While buybacks play a significant role, they aren’t the only factor in a company’s investment strategies.

Recently, there’s been a shift towards balanced capital allocation, with companies considering environmental, social, and governance (ESG) factors. This includes assessing buybacks’ impact on all stakeholders, not just shareholders.

Introducing a 1% excise tax on stock buybacks by the Inflation Reduction Act could influence corporate behaviour, prompting companies to reassess their buyback strategies.

.

Executive Compensation and Stock Buybacks

The shift in CEO pay structures during the 1990s, with a cap on deductible CEO salaries, led to an increase in stock-based compensation. This change aimed to align executive interests with shareholder value. By reducing the number of shares outstanding, stock buybacks can increase earnings per share (EPS) and stock prices, potentially raising the value of executives’ stock-related compensation.

Critics suggest that focusing on stock-based compensation may encourage short-term strategies over long-term corporate health. They argue that executives might prioritize immediate stock price increases, possibly at the expense of investments in areas like research and development or employee compensation.

However, not all buybacks are driven by executive self-interest. Many executives view buybacks as a sound capital allocation strategy, especially when investment opportunities are limited or when the company’s stock is perceived as undervalued.

Recent trends show a push for aligning executive compensation with long-term performance and broader stakeholder interests. Shareholder activists and regulatory bodies have advocated for more transparency and accountability in executive pay structures. Efforts are being made to link compensation to sustainable growth metrics and corporate social responsibility.

The introduction of a 1% excise tax on stock buybacks by the Inflation Reduction Act is a recent development that may influence corporate buyback strategies and executive compensation practices.

The Conflict of Interest at the Corporate Apex

The rise in stock buybacks has sparked concerns about a conflict of interest at the corporate top. Critics argue that prioritizing buybacks over long-term investments jeopardizes companies’ sustainability. This conflict is rooted in the shift from reinvesting profits for growth to favouring immediate shareholder returns. Critics warn of detrimental effects on innovation, employee compensation, and widening income inequality.

Executive compensation tied to stock performance intensifies this conflict, raising questions about long-term interests. Addressing this requires reevaluating corporate priorities, stakeholder engagement, and potential regulatory measures to ensure transparency and accountability in decision-making. Achieving the right balance between short-term gains and long-term sustainability is a complex challenge requiring collective efforts from executives, shareholders, regulators, and stakeholders.

The Social Implications

The social implications of executive compensation and wealth concentration are profound, contributing to rising social inequalities. The widening gap between executive pay and average worker wages generates frustration and a sense of injustice among workers, impacting financial well-being and limiting social mobility. Concentrating wealth at the top fuels societal divisions, erodes trust in institutions, and may lead to social and political instability.

This concentration of wealth also affects social and public services, reducing funding for essential investments in education, healthcare, infrastructure, and welfare programs. Ethical considerations surrounding executive compensation have sparked public debate, emphasizing the need for businesses to consider broader responsibilities beyond shareholder value maximization.

Efforts to address these implications involve policies promoting income equality, such as progressive taxation and minimum wage regulations. Fostering a corporate culture prioritizing sustainability, responsible practices, and employee well-being is crucial. Transparency and accountability in executive compensation, accessible to shareholders and the public, facilitate constructive dialogue to align compensation with company performance and stakeholder interests.

The Consequences of Executive Greed

Executive greed, exemplified by prioritizing stock buybacks and lavish compensation, can impede economic growth. Emphasis on short-term gains often directs resources toward stock buybacks, benefiting executives and shareholders but neglecting long-term productivity and growth. This financial engineering diminishes investments in research, employee training, and capital expenditure, hindering innovation and competitiveness and neglecting workforce investments, including wages and benefits, resulting in reduced employee morale and productivity, impacting overall economic efficiency.

Innovation, a key driver of economic expansion, suffers when companies prioritize short-term gains over long-term advancements. The consequences extend beyond individual firms, affecting the broader economy by limiting capital available for productive investments in other sectors and stifling funding for startups and small businesses, critical for job creation and economic dynamism.

Addressing executive greed requires a shift in corporate priorities, considering the long-term interests of all stakeholders. A balance between short-term returns and investments in the workforce, innovation, and sustainable growth fosters competitiveness, economic prosperity, and shared value creation. Government policies, such as tax incentives and regulations promoting long-term thinking and income equality, can incentivize companies to prioritize sustainable growth over immediate gains.

The SEC and Executive Compensation

The U.S. Securities and Exchange Commission (SEC) plays a key role in regulating the securities industry, including corporate governance practices. The “business judgment” rule, a legal principle, allows corporate executives to make informed decisions about the company’s operations and strategic direction without constant interference from shareholders or regulators.

However, this rule doesn’t permit executives to prioritize their interests over the company’s. Executives are expected to act responsibly, with due care and loyalty to the company and its shareholders.

The SEC has implemented regulations and disclosure requirements to enhance corporate transparency and accountability. Companies must disclose financial performance, executive compensation, and significant transactions, including stock buybacks. These disclosures allow shareholders and the public to evaluate executive actions and hold them accountable.

The SEC has taken steps to promote transparency and align executive compensation with long-term performance and shareholder interests. For instance, companies must disclose the relationship between executive pay and financial performance and the ratio of CEO pay to median employee pay.

Shareholders & Activism: Influencing Executive Pay and Corporate Equity”

Shareholders, crucial in curbing excessive executive pay, include activist investors and socially conscious funds. Activists wield influence by acquiring stakes, using voting rights, and advocating for fairer resource distribution. Socially conscious funds prioritize responsible practices and engage with companies on issues like executive compensation—both advocate aligning pay with long-term performance, emphasizing metrics like growth and ESG goals. “Say-on-pay” votes allow shareholders to express views on compensation, influencing companies to reform practices.

Despite controversies, shareholder activism prompts companies to revise pay structures, enhance transparency, and address concerns about excessive compensation while facing challenges in balancing talent attraction with fair pay.

Decoding Executive Compensation: Balancing Rewards Responsibly”

Please take a look at the chart below, the data is quite revealing and it also indicates why CEO’s are raking in huge amounts of money at the expense of the average American worker.

Conclusion

The debate on executive compensation extends beyond numbers, touching on the values that underpin our economic systems. Striking a balance between rewarding leadership and promoting broader corporate success is a crucial challenge.

A sustainable economic growth model requires considering all stakeholders’ interests, aligning executive compensation with long-term performance, promoting transparency and accountability, and addressing social inequalities due to wealth concentration.

Policies that reward executives based on sustainable performance metrics can encourage long-term value creation. Transparency and accountability in executive pay can foster trust and promote inclusivity. Addressing social inequalities requires a broader perspective on wealth distribution, considering the impact of executive compensation on all stakeholders.

Balancing rewarding leadership and promoting broader corporate success requires a collective effort involving ongoing dialogue among stakeholders, including executives, shareholders, policymakers, and the public. This collective effort can help shape a more just and sustainable economic growth model.

Beyond Basics: Engaging Stories Await

Mastering the Art of Retirement: How to Start Saving for Retirement at 45 with Grace and Style

Investor Sentiment in the Stock Market: Maximizing Its Use

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Financial Freedom Reverse Mortgage: A Sophisticated Strategy for a Comfortable Retirement

Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

Maximizing Gains: Mastering Market Sentiment Indicators

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams

Sophisticated Strategies for US Dollar Index Investing: Elevate Your Forex Game

How much has the stock market dropped in 2023?

Visionary Views: How to Achieve Financial Freedom Before 40

A Major Problem with ESOPs is That Employees Can Lose Big

The problem is Fractional Reserve Banking-we don’t need the Gold standard

One way to deal with faulty distribution of wealth would be to tax the excessive “golden parachute” compensation of company executives at 95% rate. But this would be very difficult to achieve. Defining what is excessive would be tricky, but when we consider which party would be totally against such a thing we know it would definitely be the Republicans. They would scream “socialism” until their voices could be heard on the far side of the moon.