Media Manipulation; The new order of the day

Manipulation is the order of the day, and this trend will continue to gather traction; it will only end when the masses revolt. The masses are notorious for responding very slowly, so we can assume that by the time they snap out of their comas, the markets will be trading at unimaginable levels. We expect corporate debt to trade at levels that will make today’s insane levels appear sane one day.

Against this backdrop you have only one option; every major pullback/correction has to be viewed as a buying opportunity. The markets will continue to be manipulated probably until the end of time, so until the trend changes, every strong pullback has to be viewed as a buying opportunity.

The Economic recovery is not real but who cares right

If the recovery were real, interest rates would not be held low for so long, and the Fed would need to support the stock market. After it stopped the corporate world stepped in via the illegal usage of Stock Buybacks. Now instead of trying to improve the bottom line, they focus on simply buying back more shares and in doing so artificially boosting the EPS. It’s a perfect scam, no work and big pay; and as interest rates are low, the incentive to borrow large sums of money to do these dirty deeds is larger than ever. Hence expect stock buybacks to surge to levels that will appear insane one day.

Media Manipulation; EPS is not rising, however, Share Buybacks are

Low rates have forced people to speculate so imagine what effect Negative interest rates will have on the populace and the corporate world. To the corporate world, it will be a clear signal that they should continue raiding the cookie box. Buyback more shares, boost EPS, get larger bonuses, and do the same thing over and over again, until the cycle ends and then send the bill to the masses. The bottom always drops out, but it’s the average Joe that is left holding the can. Nothing has changed, and nothing will change going forward

Share buybacks are dangerous when abused as is the case now

“Anytime when you’re relying solely on one thing to happen to keep the market going is a dangerous situation,” said Andrew Hopkins, director of equity research at Wilmington Trust Co., which oversees about $70 billion. “Over time, you come to the realization, ‘Look, these companies can’t grow. Borrowing money to buy back stocks is going to come to an end.”’

“Corporate buybacks are the sole demand for corporate equities in this market,” David Kostin, the chief U.S. equity strategist at Goldman Sachs Group Inc., said in Feb. 23 Bloomberg Television interview. “It’s been a very challenging market this year regarding some of the macro rotations, concerns about China and oil, which have encouraged fund managers to reduce their exposure.” Full story

This is a very neat trick the corporate world uses to maintain the illusion that EPS is growing. All they need to do is buyback a record sum of their shares and then magically create the illusion that EPS is growing, even when in some cases it is not.

The Crowd Psychology perspective

The trend is up regarding share buybacks, and as Central bankers worldwide are gravitating towards negative rates, it is fairly safe to assume that this trend will continue for quite some time. The masses are not revolting against this dishonest behaviour and until they do, the dollar amount committed to share buybacks will continue to surge.

Nothing short of rising rates will put a damper on share buybacks, and there is absolutely no chance in hell of rates rising, not when the entire world is embracing negative rates. The second option is for Congress to pass new laws restricting companies from blatantly repurchasing their shares with the sole intention of raising the EPS. The odds are better than some alien life form will contact us then of Congress passing such a law.

Suggested Game strategy

The corporate world has gone a massive share buyback binge. This binge is not showing any signs of letting up. It allows corporations to borrow money for next to nothing. They then use these funds to buy back massive amounts of shares and in doing boost the EPS (Earnings per share). Negative interest rates will be akin to trying to put out a raging fire with gasoline. Negative rates will provide rocket fuel to the share buyback programs. Corporate debt will soar to insane levels. If you think today’s levels are insane, you are in for a rude awakening as debt levels will soar beyond anyone’s imagination.

The debt will soar to record levels

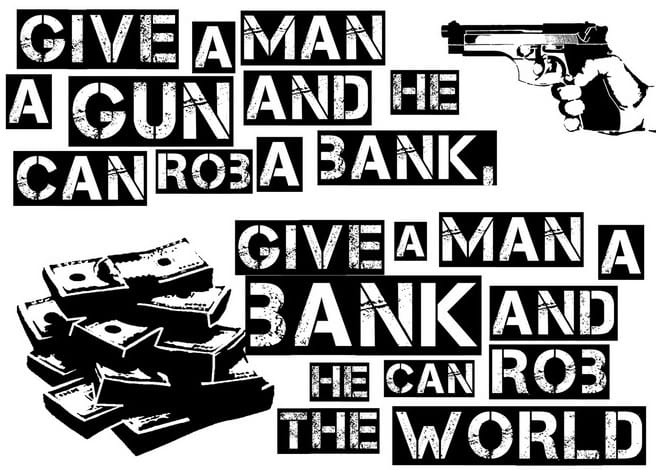

We live in a world of extreme greed and our government seems to favour corporation fraud as not one major banker has gone to jail for triggering the financial crisis of 2008. In this environment, you need to do that which seems insane from a logical point of view. Thus, all strong corrections should be viewed as buying opportunities. From a mass psychology perspective, this is still the most hated bull market in history and until the masses embrace, it is destined to run a lot higher than most envision.

Lastly, we would suggest having a core position in Gold; at some point in time Gold will start to react strongly to this massive form of currency debasement. Currencies are being destroyed on a global basis at a level never seen before. This will not end well, but as we have pointed out many times before, being right does not equate to market success.

One has to look at the time factor, and most individuals do not have the staying power to bet against the Fed. Wall Street is full of tombstones of good men who were right but could not stay solvent long enough to benefit from their insights. Hence, we would not bet the house on Gold and nor should you. No matter how good an investment appears to be, one should never put all of one’s eggs in one basket.

It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. Henry Ford

Other Articles Of Interest:

China dumping worthless dollars & buying Gold bullion (9 April)

Wall Street Mafia Utilize Psychological War Fare to Con the masses (7 April)

Yuan surges past Canadian dollar for Global Payments (6 April)

China’s growing wealth makes China very good long term investment (6 April)

Some economic woes but no hard landing for China (5 April)

Fraud Crisis; U.S firms fudging their numbers like no tomorrow (4 April)

I avoid the problem of low interest rates by staying far away from fixed income holdings. Instead, I invest in stocks that mostly pay good dividends. No, that isn’t a guaranteed winning strategy. Nothing in the investment world comes with guarantees. But this way of investing has worked well for me, for years.

Bob that is a sound strategy. Nothing is guaranteed but then again if you take no risk there is no gain. Even getting up in the morning and taking a walk entails risk, you could get hit by car or a truck. Congrats on your success

why did you delete it on Medium.com ? and who is the author?