Crude Oil Market Crash

Top analysts on Wall Street were all calling for higher oil prices before the markets suddenly tanked. The idiotic Peak oil camp was not far behind them, stating that we were running out of oil. What happened to the peak oil Nonsensical theory that said oil supplies were running low? Instead of oil production peaking, we seem to be awash with oil. And the Peak Oil experts have vanished into the woodwork.

Just as the oil market collapsed when everybody proclaimed higher prices, the oil will probably stabilize sometime in 2016, as everyone expects it to keep crashing.

As it has broken through several levels of support, it will need to trend sideways for an extended period before it has any hope of breaking out.

The Technical Picture of Crude Oil price in 2016

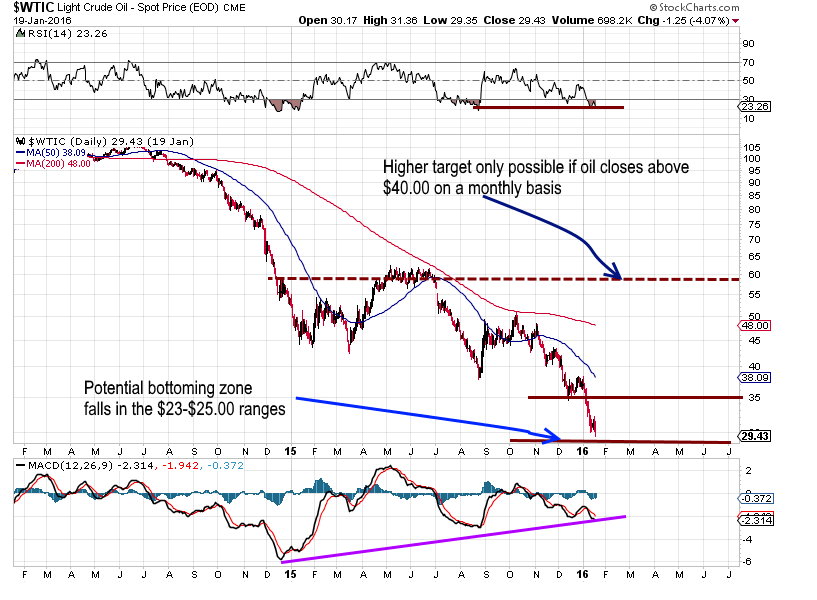

Oil has closed below the psychological level of $30 on a weekly basis; this could drive oil down to $20.00. The more likely groups fall in the $23-$25 range. As long as oil does not close below $23.00 on a weekly basis, the oil will start putting in a slow bottoming formation.

Once oil puts In the bottom and for this to occur, fat cannot close below 23 on a weekly basis. Otherwise, all bets are off. Oil must be put in a slow channel formation; prices will most likely be contained to the $24.00-$36.00 range. And only a monthly close above $40 will widen the trading range. Oil’s trading range will then shift to the $36.00-$58.00 range, with the possibility of overshooting to $65.00.

Once a bottom is in, do not expect miracles from oil, It will trade in a tight range of $24.00-$36.00 for some time. Only a monthly close above $40 will signal that the trading range will shift to a slightly higher zone of $36.00-$58.00, with a possible overshoot to $65.00.

Other articles of interest:

6 Rules to making money in the Markets Using Mass Psychology (Jan 20)

The U.S Economy in Crisis: Obama’s illusory economic recovery (Jan 19)

The Dow Jones Industrials & the economic recovery that never was (Jan 18)

The Dow Jones destined to trade much higher in 2016 (Jan 15)

Oil market crashes but Oil tanker market raking in profits (Jan 09)

Financial Insights: Cutting Through the Noise