Erratic Behaviour Meaning

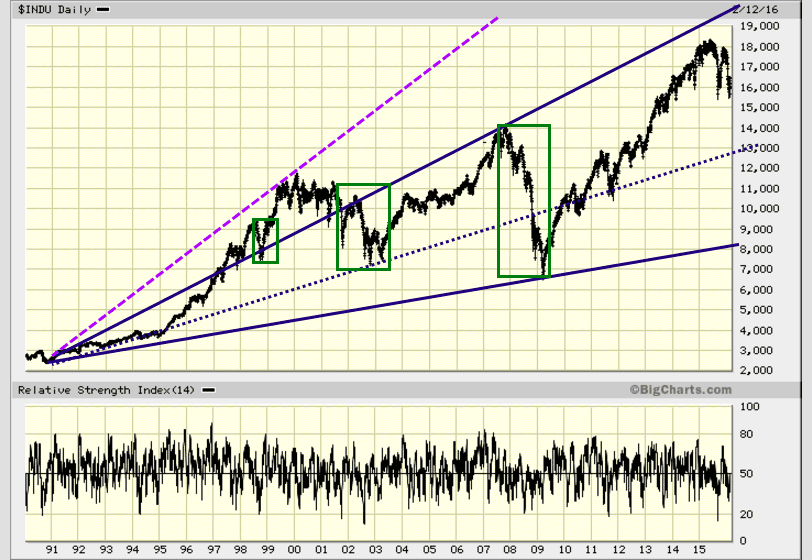

To see the above behaviour in action, all one needs to do is look at how the masses react to news when it comes to investing. Fear is in the air, and the masses have just moved to the border of the Hysteria zone. The trend is still up on the NASDAQ and the Dow, so the outlook remains bullish. As volatility levels are very high, view very strong pullbacks as buying opportunities. A test of the August lows is likely, with a possible overshoot to the 14,800-15,000 ranges to destroy the last of the ardent bulls. The RSI has generated a nice series of positive divergence signals too.

Must Read:Interest rate wars-Fed stuck between a hard place & Grenade

Erratic Behaviour Meaning; Look No Further Than The Stock Market

Market volume is increasing on up days and decreasing on down days; this indicates that the smart money is buying while the dumb money is selling at or close to the bottom. All our proprietary sentiment indicators are trading in the extreme ranges, indicating that panic is in the air and opportunity is waiting to give you a big hug if you will welcome into your domain. Do not become one with the crowd; crowd psychology states that you should be buying when the crowd is selling and vice versa.

The SPX already traded below its Aug lows and in doing so triggered a rather strong positive divergence signal. Hence, the necessity of the Dow testing its lows has been negated to some degree. The ideal set up calls for the Dow to trade to or below its Aug lows. Make a list of strong stocks and use pullbacks to add to your position or open new positions.

Market Update Feb 2019

This bull market is unlike any other; before 2009, one could have relied on extensive technical studies to more or less call the top of a market give or take a few months; after 2009, the game plan changed and 99% of these traders/experts failed to factor this into the equation. Technical analysis as a standalone tool would not work as well as did before 2009 and in many cases would lead to a faulty conclusion. Long story short, there are still too many people pessimistic (experts, your average Joes and everything in between) and until they start to embrace this market, most pullbacks ranging from mild to wild will falsely be mistaken for the big one.

The results speak for themselves; the majority of our holdings were in the red during the pullback, but now they are in the black, proving that one should buy when there is blood flowing in the streets. It is a catchy and easy phrase to spit out but very hard to implement, because when push comes to shove, the masses will opt for being shoved. Permabear; It takes A Special Kind Of Stupid To Be One

Other articles of Interest:

India vs. China; Which Market is better (Feb 24)

Crisis investing: stock market crashes represent opportunity & not disaster (Feb 23)

Central banks declare war on Citizens (Feb 23)